The EUR/USD currency pair did not trade on Monday, just like all other currency pairs and instruments. The market was closed to celebrate Christmas, but the situation remained mostly the same with its opening on Tuesday. If you open the charts now and look at them, it's quite challenging to determine whether the market is open or if the weekend is continuing. The price is standing still, and there are no signs that the current week will unfold differently.

However, the pair is not merely standing still; it is 10 points away from its last local maximum, reached just last week. In other words, the pair rose for several weeks and then stopped. This would be strange market behavior if not for the same notorious holidays. Trader activity has dropped almost to zero simply because the traders themselves left the market. If there are no participants in the market, what kind of movements can be expected?

However, it's more complex than one would like. We understand there is a temptation to close the terminal and leave early to celebrate the New Year, but movements in the market are still possible. When there are few participants in the market, it creates the danger of sharp spikes in movements, as any large deal can significantly impact the balance of supply and demand. Therefore, we draw the following conclusion: with an 80% probability, we will not see strong movements and a significant euro or dollar rise this week. However, surprises are always possible.

The euro welcomes the New Year in a good mood. As for the prospects of the European and American currencies, opinions among experts are currently very diverse. Many believe the recent decoupling of rhetoric between the Fed and the ECB is the main reason for the dollar's fall. If so, the US currency could continue declining, which would look like growth on the charts. However, how much longer will this factor influence the pair's movement (or, more precisely, the dollar's fall)? Neither the ECB nor the Fed have even started to soften monetary policy, and the market is behaving like the Fed's rate has dropped to zero. Moreover, does the Fed's rate remain 1% higher than the ECB's rate, or does that not matter? Furthermore, the ECB's rate next year will decrease, just like the Fed's rate. Moreover, both central banks will lower the rate again to minimum values.

Thus, from this perspective, there is no expectation of significant differences in the monetary policies of the ECB and the Fed. But for some reason, the market reacts as if it's only about the Fed lowering its rate. This situation is illogical, as we have mentioned many times before. The market is reluctant to purchase the dollar while strongly inclined to acquire the euro. And possible changes in monetary policy in 2024 are just a reason for buying the pair, not the basis.

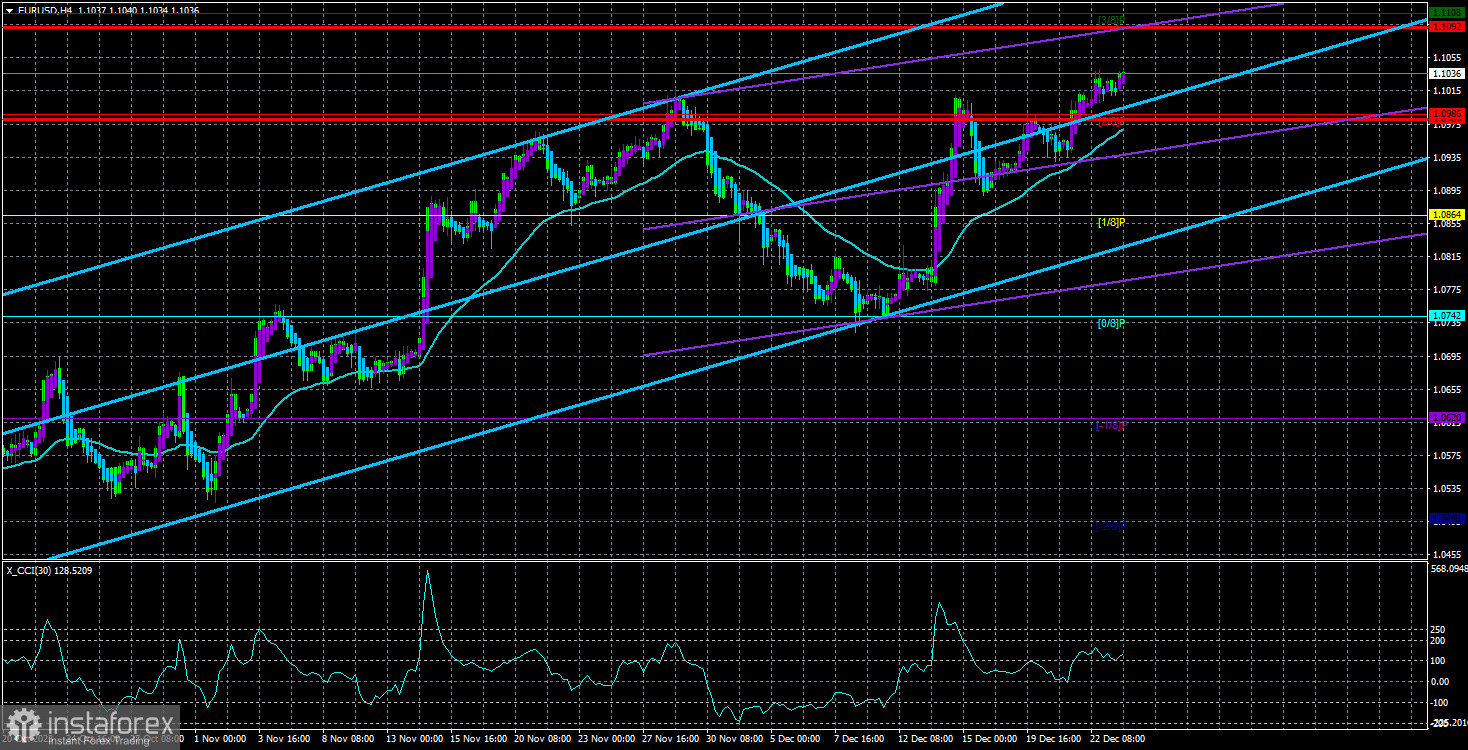

From all this, the following picture emerges. From a technical point of view, the pair's rise is logical, as almost all indicators point upward. Except for the notorious CCI, which has already entered the overbought zone four times. But from a fundamental and macroeconomic point of view, explaining the current rise of the pair is still very difficult. We have already said that explaining any movement after the fact is straightforward, which most "experts" regularly do. If the dollar were rising now, everyone would be talking about a higher Fed rate, equal changes in the ECB and Fed monetary policies in 2024, and the status of a "reserve currency."

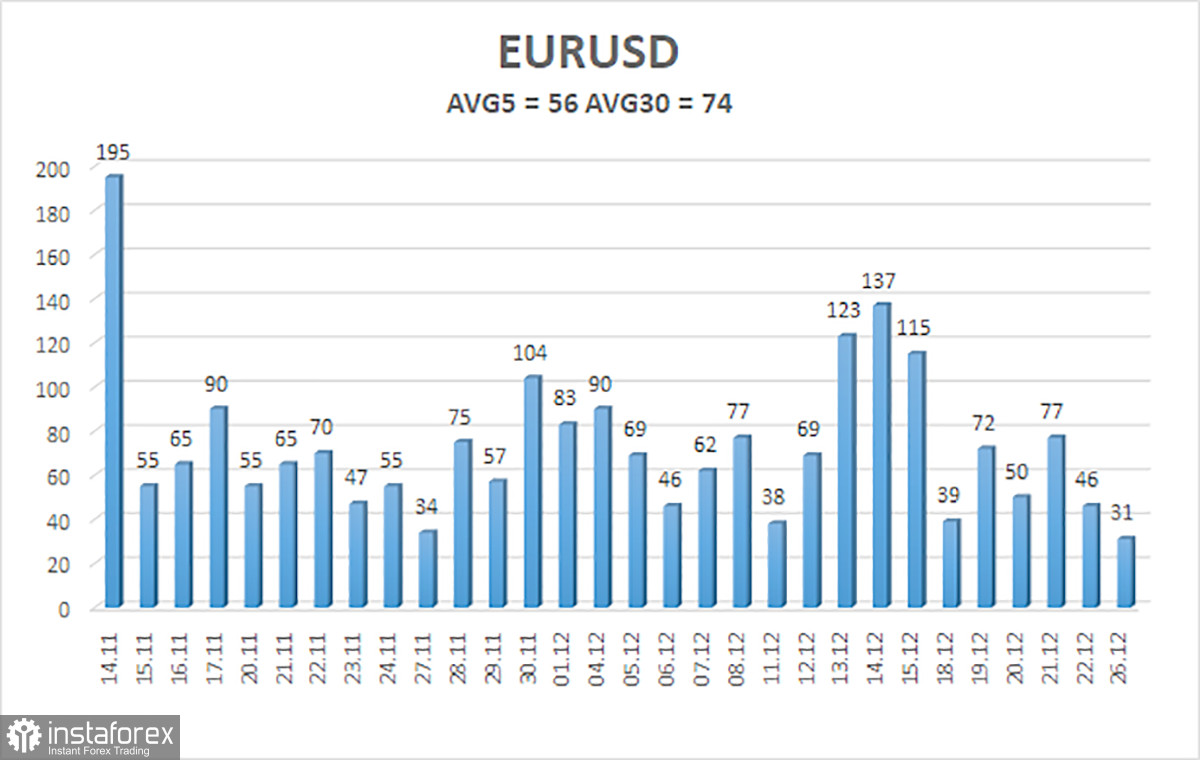

The average volatility of the EUR/USD currency pair for the last five trading days as of December 27 is 56 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0980 and 1.1092 on Wednesday. A downward reversal of the Heiken Ashi indicator will indicate a new phase of corrective movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair remains above the moving average line, but we still see no reason for further growth. The price has surpassed the psychological level of $1.10, so the upward trend persists, and the euro may continue its movement to the north. The overbought condition of the CCI indicator still indicates an excessively high euro cost. Short positions can be considered when consolidating below the moving average towards 1.0864.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both point in the same direction, the trend is currently strong.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day based on current volatility indicators.

CCI indicator – its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an imminent reversal of the trend in the opposite direction.