The single currency managed to trade positivity amid the holiday season. It was due to the US reports, the House Price Index showed that home prices climbed 6.3% from October 2022 to October 2023. This was below the forecast of 6.5%. This means that housing prices will not have an impact on inflation. Even if the growth rate accelerated, as predicted, it would have little effect on overall inflation. Considering the fact that inflation in the United States is already lower compared to Europe, American traders concluded that the Federal Reserve will start lowering interest rates earlier than the European Central Bank. This became the reason why the euro strengthened.

Today, the European markets are open albeit a shortened work day. However, the economic calendar is completely empty. Therefore, there's a good chance that the single currency will continue to stay in the range of 1.1000-1.1050.

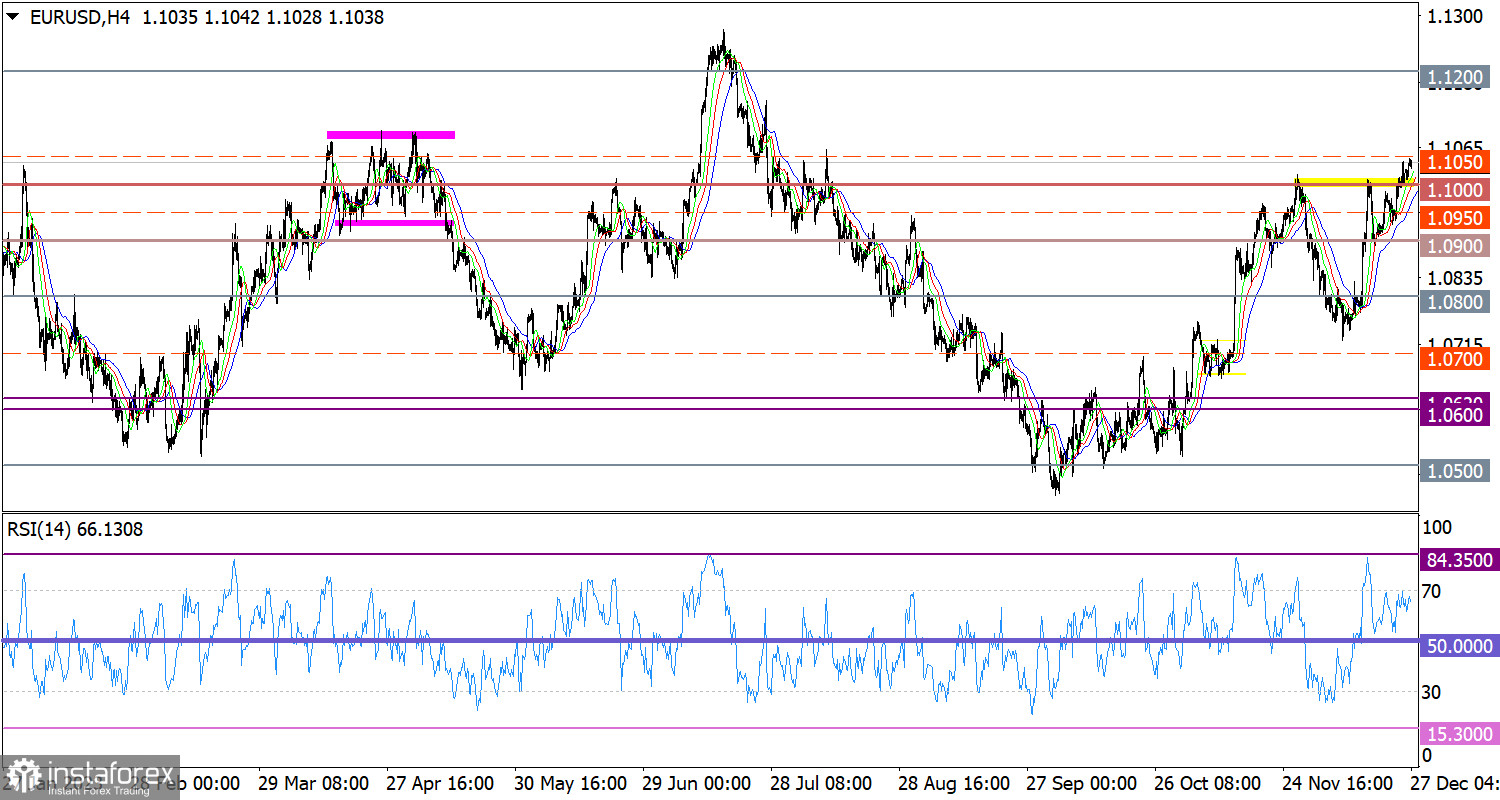

The EUR/USD pair not only surpassed the level of 1.1000, but also managed to extend the current upward cycle. However, due to non-working days in Europe, market volatility was low, leading to insignificant price changes.

On the 4-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, indicating a bullish bias.

On the same timeframe, the Alligator's MAs are headed upwards, corresponding to an uptrend.

Outlook

We expect the volume of long positions to rise once the price settles above 1.1050 during the day. This movement will indicate the possibility of further upward movement, and the euro could even rise towards the local high in the medium-term period. The alternative scenario considers the price fluctuating in the range of 1.1000/1.1050.

The complex indicator analysis suggests an uptrend in the short-term, medium-term and intraday periods.