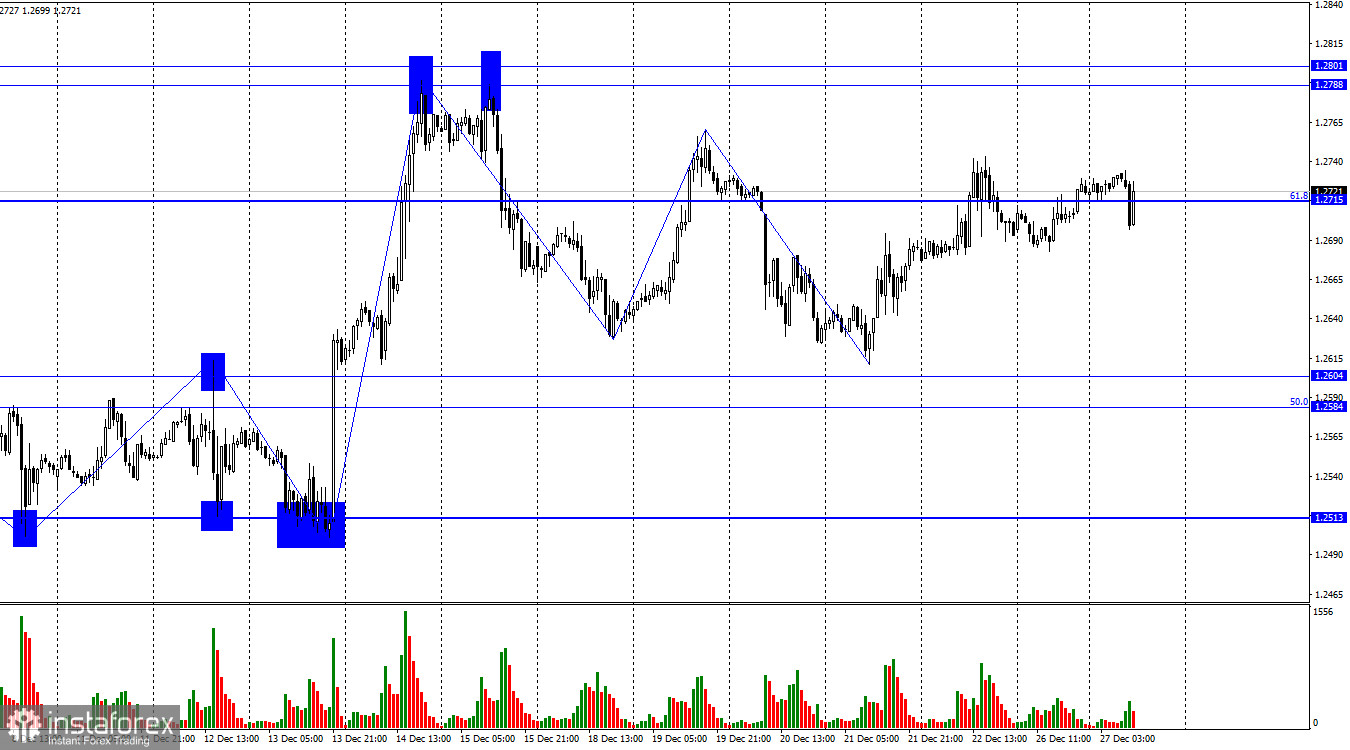

On the hourly chart, the GBP/USD pair has risen to the corrective level of 61.8% (1.2715) and reversed around it in favor of the US dollar. Thus, the decline may continue towards the support zone of 1.2584–1.2604 this week. However, there is a high probability of transitioning to horizontal movement since there is no news, and bullish traders do not want to take an example from their counterparts in the EUR/USD pair. Therefore, I do not expect a strong decline or rise this week.

The wave situation remains quite ambiguous. Trends change too often and become shorter. The last "bullish" trend is one wave. The last downward wave barely broke the lows of the previous wave. Thus, the trend has now changed to "bearish," but a breakout of the peak from December 19 will indicate a reversal of the trend to "bullish." At the same time, until this happens, a downward wave may be forming with targets below the previous low (1.2611).

Throughout the current week, there will be a uniform picture without news or important events. Remember that it is not worth counting even on speeches by politicians, bankers, and officials, as almost all of them have gone on Christmas and New Year holidays. Thus, until the end of the year, we will observe only weak, probably horizontal movements.

Yesterday showed us that the EUR/USD pair is ready to grow despite everything, while the GBP/USD pair is not. Thus, horizontal movement this week is the most likely scenario.

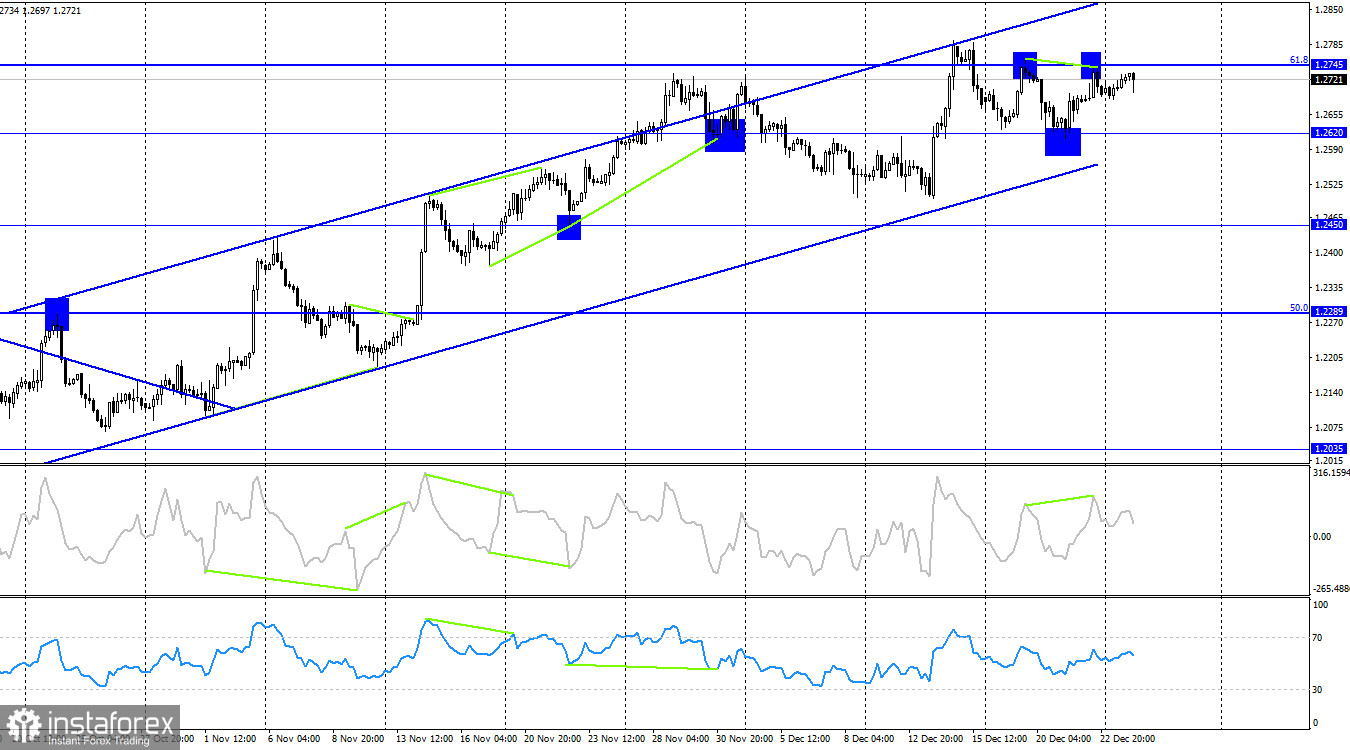

On the 4-hour chart, the pair has risen to the Fibonacci level of 61.8% (1.2745) and bounced off it. Thus, a reversal in favor of the US dollar has occurred, and the decline toward the level of 1.2620 has begun, which is close to the lower line of the ascending trend corridor. The "bullish" trend persists, so I do not expect a significant decline below the level of 1.2620 soon. The "bearish" divergence on the CCI indicator also supports strengthening the dollar.

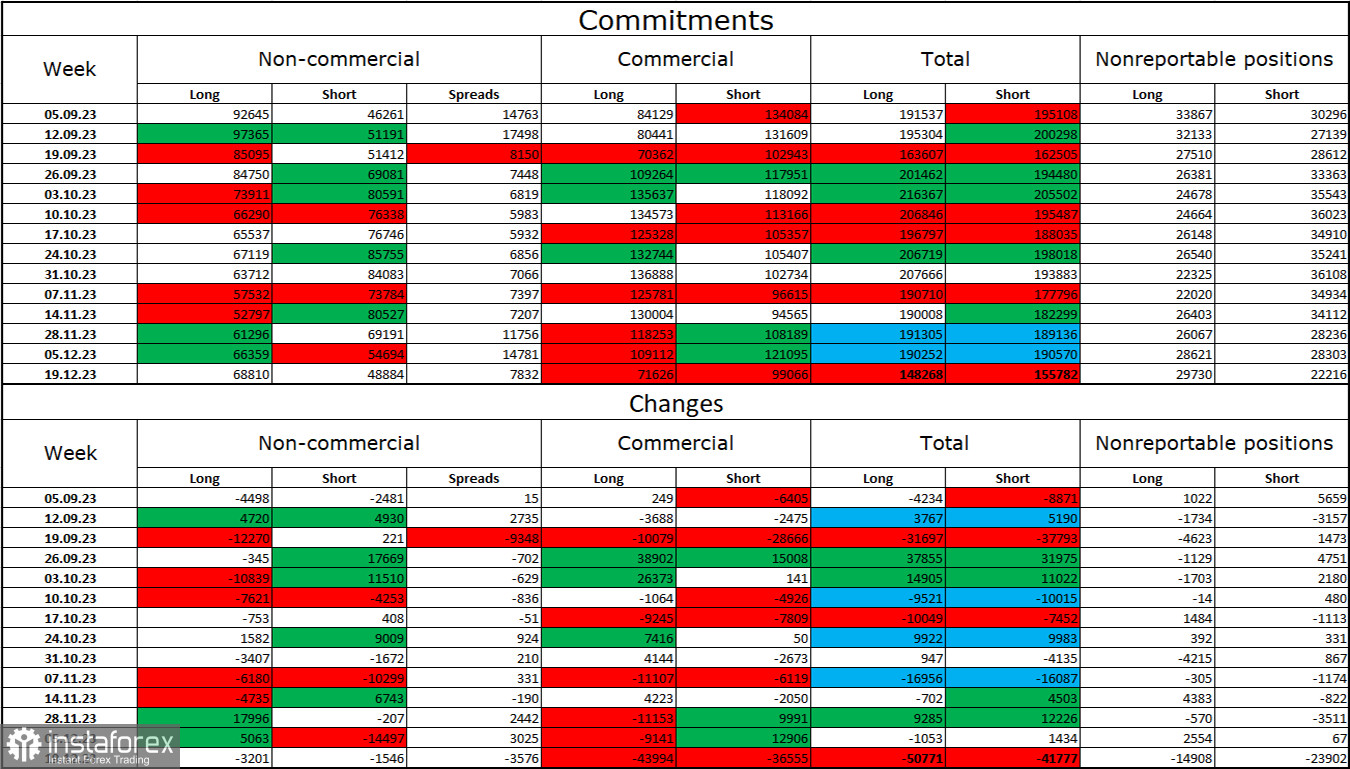

Commitments of Traders (COT) report:

The mood of the "non-commercial" trader category for the last reporting week has practically not changed. The number of long contracts in the hands of speculators decreased by 3201 units, and the number of short contracts decreased by 1546 units. The overall sentiment of major players changed to "bearish" several months ago, but at present, bulls have the advantage again. The gap between long and short contracts is increasing in favor of bulls: 68 thousand against 48 thousand. Excellent prospects for continuing the decline persist for the pound. I do not expect a significant rise in the pound soon. Over time, bulls will continue to get rid of buy positions as the long-term information background favors the dollar. The growth we have seen in the last two months is corrective.

News calendar for the USA and the UK:

On Tuesday, the economic events calendar contains a few interesting entries. The impact of the information background on the market sentiment will be absent today.

GBP/USD forecast and trader advice:

Purchases of the Briton were possible last week around the level of 1.2604, but there was no clear rebound, and consequently, the signal was not formed. Today, options for selling from the level of 1.2715 on the hourly chart with a target of 1.2584–1.2604 can be considered, but movements are currently very weak and can be horizontal, unlike the EUR/USD pair.