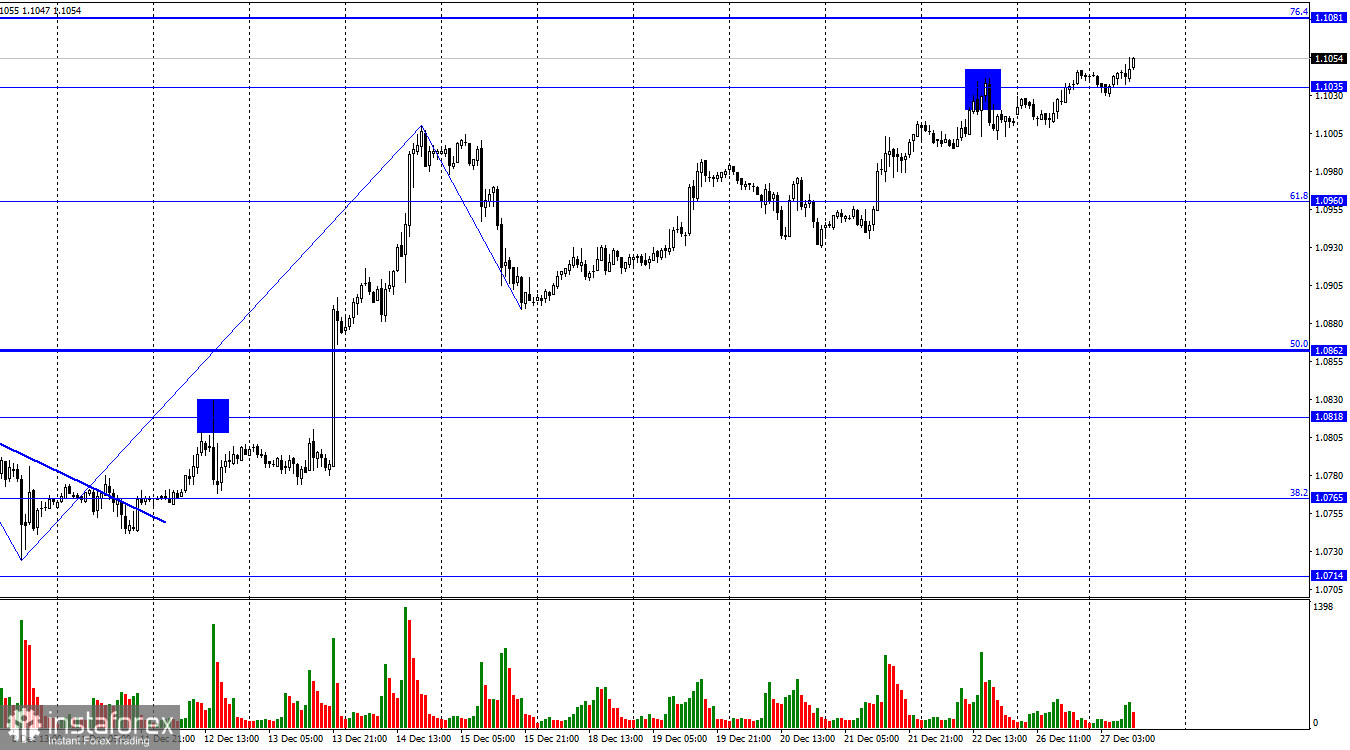

The EUR/USD pair has consolidated above the level of 1.1035. Thus, the upward process may be continued toward the next corrective level of 76.4% (1.1081). A rebound of quotes from this level will favor the US dollar and lead to some decline in the euro. Closing the pair's rate above the level of 1.1081 increases the probability of further growth towards the next level of 1.1172. The "bullish" trend persists despite the holidays.

The wave situation remains clear. The last downward wave was too weak to consider the "bullish" trend as completed. The last upward wave broke the peak of the previous wave, so the "bullish" trend is still intact, and there is no sign of its completion. A breakout of the last low (from December 15) is needed for such a sign to appear. Considering the holiday status of the current week, trader activity will not be high. It may take quite some time for the pair to fall by 170 points.

The Forex market opened on Tuesday morning.

The EUR/USD pair continued to rise despite no news, and most of the market has gone on vacation. Nevertheless, the remaining bullish traders push the pair further upward, taking advantage of bearish passivity. There are no clear grounds or reasons for the current growth of the euro. The movement is driven by the stronger position of the bulls, which does not necessarily require an information background. At this rate, the pair may reach 1.1172 before the New Year.

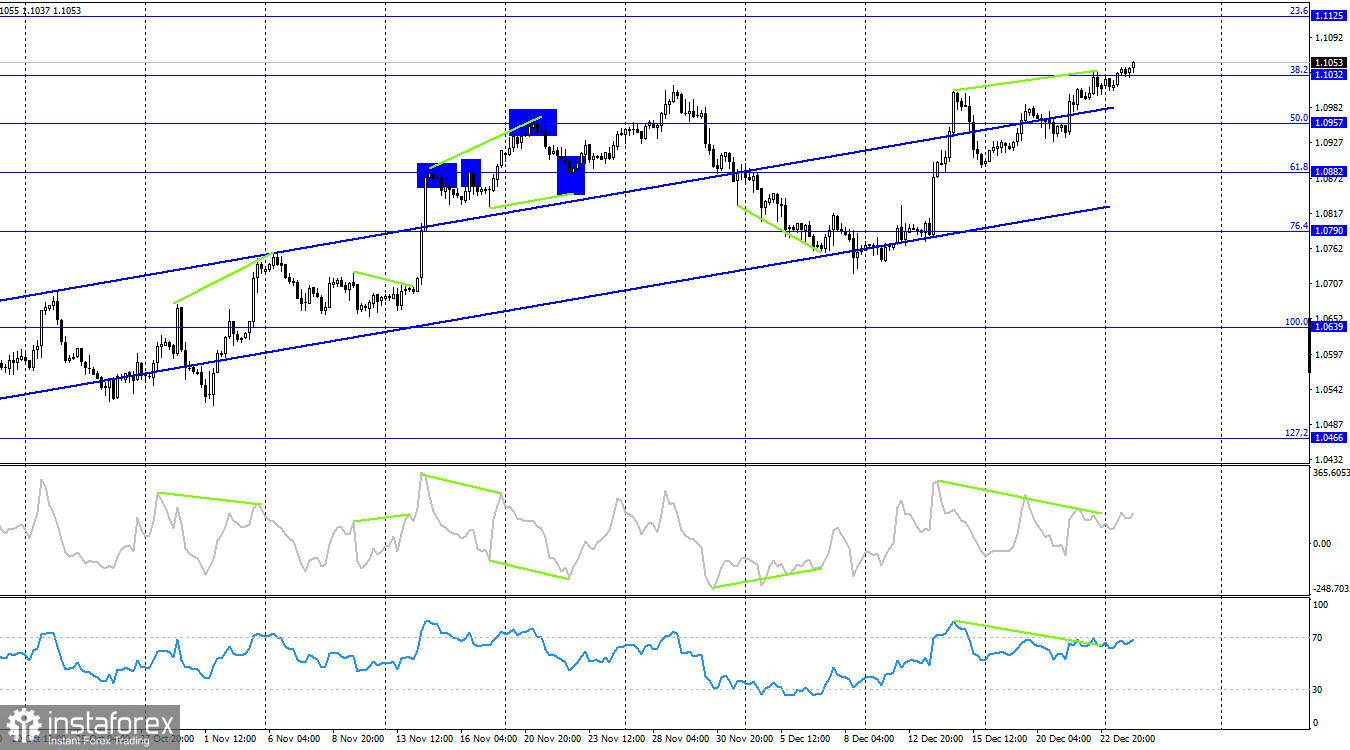

On the 4-hour chart, the pair has consolidated above the 38.2% (1.1032) level despite the strong "bearish" divergence in the CCI and RSI indicators. Thus, the upward process can continue toward the next Fibonacci level of 23.6% (1.1125). Fixing quotes below the level of 1.1032 will allow for a reversal in favor of the US currency and some decline. However, the ascending trend corridor continues to characterize the current market sentiment as "bullish." I do not expect a significant decline in the European currency soon.

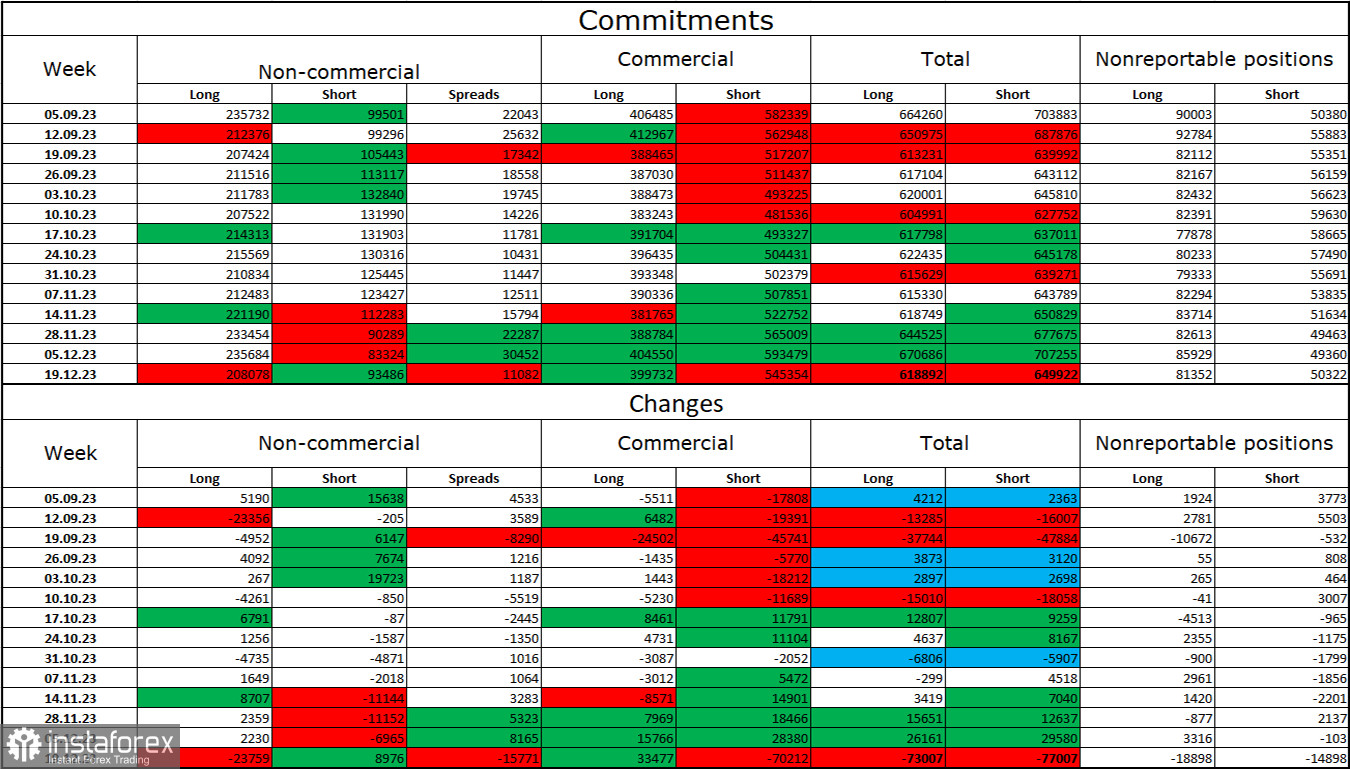

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 23,759 long contracts and opened 8,976 short contracts. The sentiment of major traders remains "bullish" and is weakening again. The total number of long contracts speculators hold is now 208,000, and short contracts are only 93,000. Despite the significant difference, the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong background of information to maintain the "bullish" trend. I don't see such a background now. Professional traders may resume closing Long positions soon; as we can see, they started this process last week. The current figures allow for a resumption of the decline in the euro in the coming months.

News calendar for the USA and the Eurozone:

On December 27, the economic events calendar does not contain any entries. The impact of the information background on traders' sentiment will be absent today.

EUR/USD forecast and trader advice:

Sales of the pair are possible today on a rebound from the level of 1.1081 on the hourly chart. Targets are 1.1035 and 1.0960. Closing above the level of 1.1035 on the hourly chart allowed buying the pair yesterday with targets of 1.1081 and 1.1172. It should be remembered that movements may be very weak, but the European currency continues to rise. Why not take advantage of this?