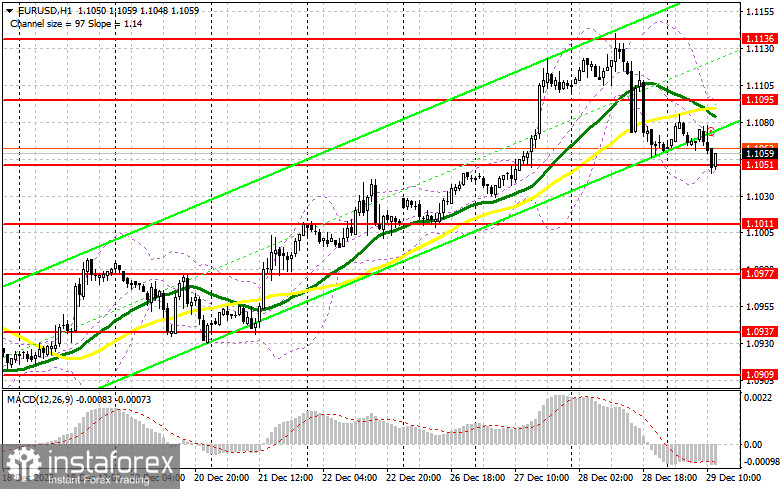

In my morning forecast, I drew attention to the level of 1.1051 and planned to make decisions regarding market entry based on it. Let's look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout around 1.1051 led to a good entry opportunity for buying the euro. When writing this article, the pair has increased by about 13 points. The technical picture for the second half of the day remains unchanged.

To open long positions on EUR/USD, the following conditions are required:

Ahead of us, there is data on the Chicago PMI index, where a slowdown in activity is expected. This could maintain pressure on the dollar, allowing the morning signal to play out. As long as trading remains above 1.1051, it's possible to bet on the rise of the euro. If the pair drops in the second half of the day, I will act according to the morning scenario, which involves another false breakout formation around the support level of 1.1051. This would allow entry into the market to continue the bullish trend with a target around 1.1095, where moving averages are located, favoring sellers. Breaking through and establishing above or below this range will provide a chance for buying with further upward trend development and the prospect of reaching 1.1136, this month's maximum. The ultimate target is the new yearly high of 1.1188, where I will take profit. In the event of a decline in EUR/USD and the absence of activity around 1.1051 in the second half of the day (as this level has already been tested once today), we can expect a larger downward movement. In this case, I plan to enter the market only after a false breakout is formed around 1.1011. I will open long positions on the bounce from 1.0977 with a target of a 30-35 point upward correction within the day.

To open short positions on EUR/USD, the following conditions are required:

Sellers could not do anything with 1.1051, so now all attention is focused on defending 1.1095. The formation of a false breakout there would indicate the presence of sellers in the market, which should lead to a retest of the 1.1051 level. After breaking and establishing below this range, along with a retest from below to above, I expect to receive another sell signal targeting 1.1011. Testing this level will trap the pair in a sideways channel until the end of the year. The ultimate target is 1.0977, where I will take profit. If EUR/USD moves upward in the second half of the day due to the absence of statistics and bears at 1.1095, the bullish market trend will continue. I will postpone selling until the next resistance test at 1.1136 in this scenario. I will consider selling there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a bounce from 1.1188 with a 30-35 point downward correction target.

Indicator Signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating a possible decline in the euro.

Note: The author considers the period and prices of moving averages on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.1051, will serve as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence – measures the relationship between two moving averages of the asset's price). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (a volatility indicator consisting of three lines, an upper, middle, and lower band). Period 20.

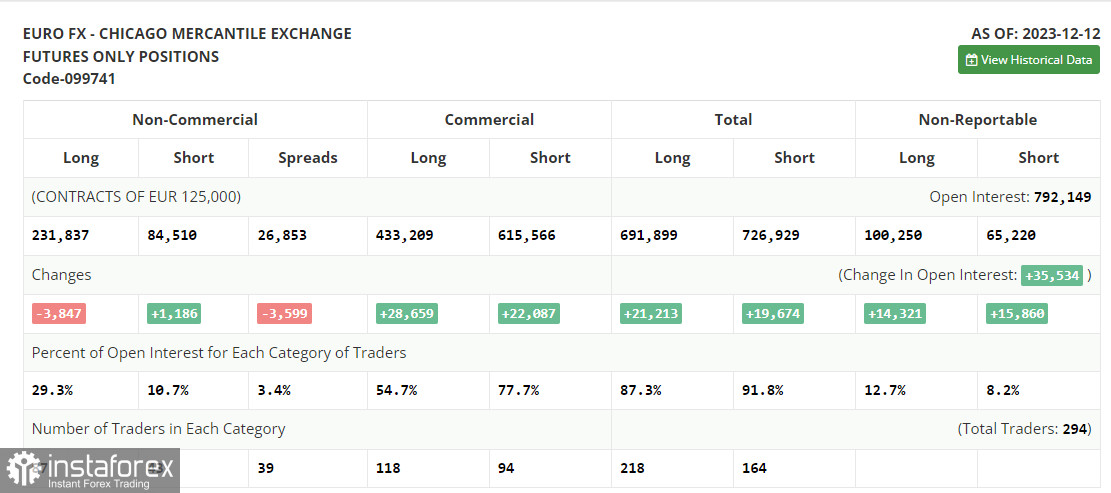

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.