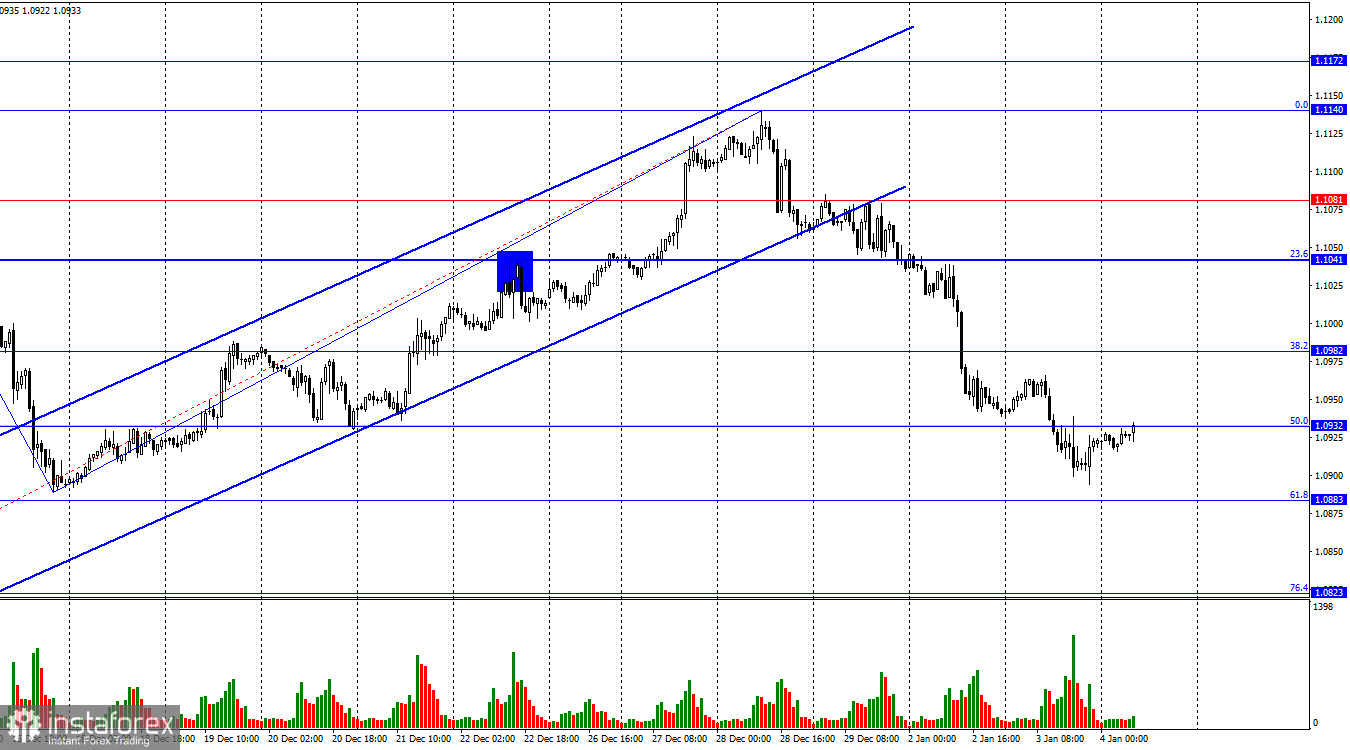

EUR/USD fell below the 50.0% retracement level of 1.0932, provoking a decline towards the 61.8% retracement level of 1.0883. Although a consolidation above the level of 1.0932 will work in favor of euro, leading to some growth towards the 38.2% retracement level of 1.0982, the bearish mood may persist, especially after a movement below the upward channel.

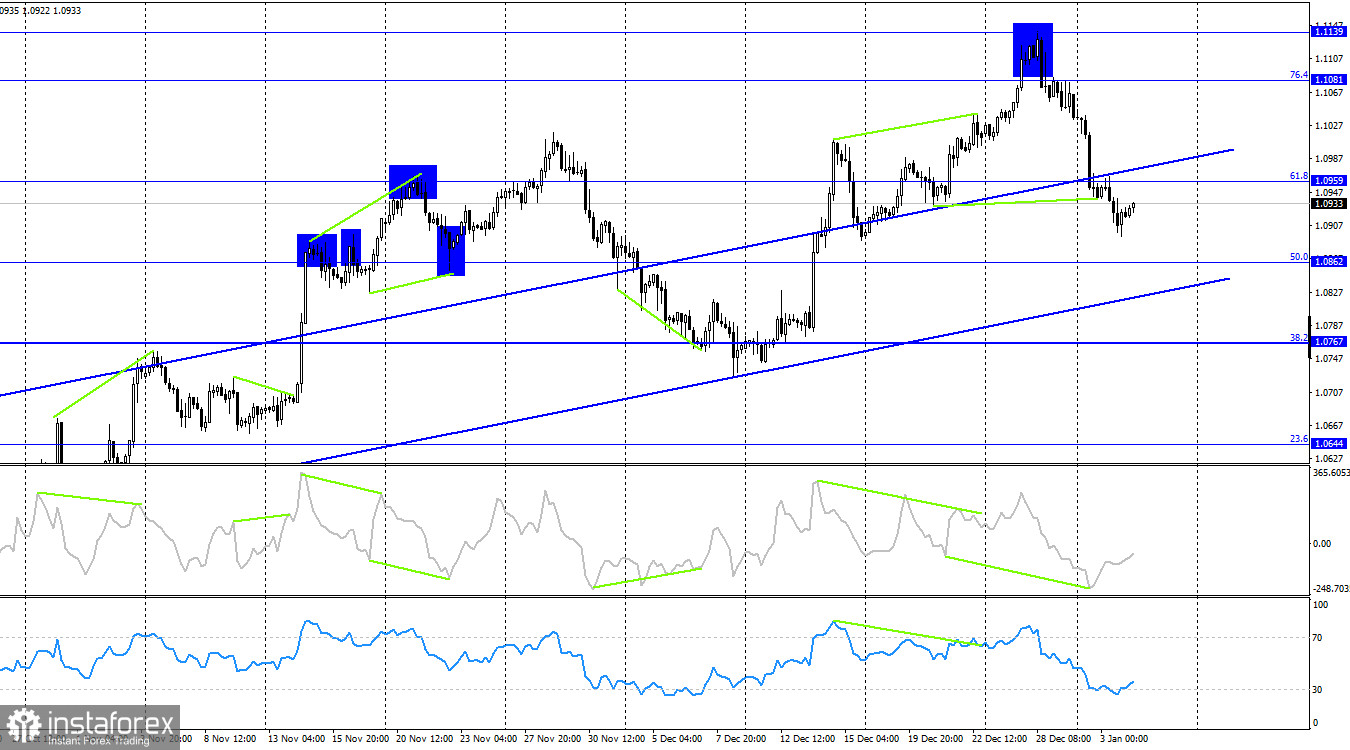

The situation with the waves became more interesting. The last downward wave ended exactly at the location where the previous downward wave ended, around the level of 1.0890. Based on this, and despite the pair's recent 250-pip decline, the current trend will continue. Only if the new upward wave turns out to be weak and does not break the peak from December 28 will traders get the first sign of the end of the bullish trend. However, before this happens, the pair may rise by 250 pips and may build a series of upward waves.

As for economic data, the ISM Manufacturing PMI for December rose from 46.7 to 47.4, while the number of JOLTS job openings in November hit 8.79 million, lower than the expected 8.85 million. One report turned out a little better, the other a little worse, but market players did not give preference to either, so dollar did not derive particular benefit from the statistics.

Euro fell below the 61.8% retracement level of 1.0959 on the 4-hour chart, so the decline may continue in the direction of the 50.0% retracement level of 1.0862. However, this will not change the bullish sentiment, as a strong fall will occur only after a consolidation below the price channel.

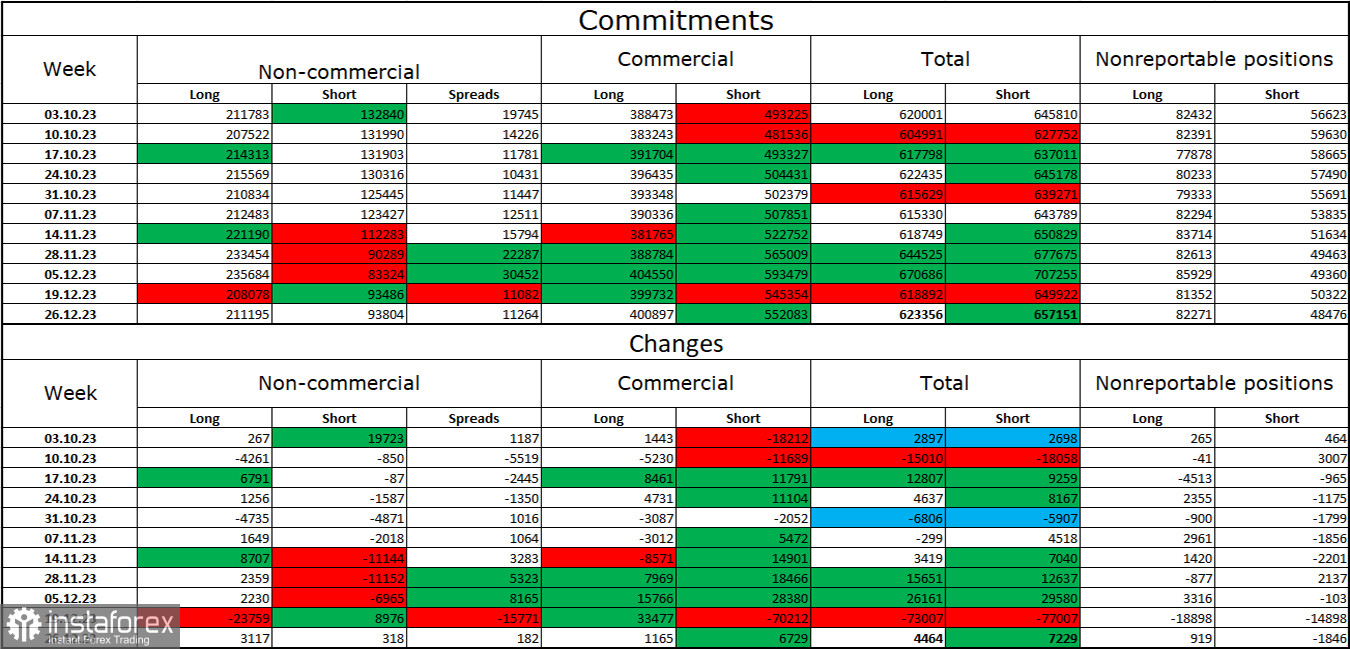

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 3,117 long contracts and 318 short contracts. The total number became 211,000 for long contracts and 94,000 for short contracts. Despite the huge difference, the situation may change in favor of the bears, as bulls have dominated the market for too long, and now they need a strong news background to maintain the trend. Professional traders may close long positions soon, and the current figures allow for a resumption of euro's decline in the coming months.

News calendar for the US and Europe:

EU - German Services PMI (08-55 UTC)

EU - Services PMI (09-00 UTC).

EU - German Consumer Price Index (13-00 UTC).

US - ADP Employment Change (13-15 UTC).

US - Initial Jobless Claims (13-30 UTC).

US - Services PMI (14-45 UTC).

The economic calendar contains several important entries, among which the ADP report stands out. The impact of the news on market sentiment today will be medium in strength.

EUR/USD forecast and tips for traders:

Sell-offs occurred in the pair after a consolidation below the price channel on the hourly chart. The quote headed towards the target level of 1.0883. A rebound from the level of 1.0932 will lead to a further decline to 1.0883 and 1.0823, while a rise above the level of 1.0932 on the hourly chart could provoke an increase to 1.0982 and 1.1041.