What is more important for EUR/USD: the difference in interest rates between the Fed and the ECB or global risk appetite? In fact, these processes are interconnected. Both the large-scale demand for stocks and the expectations of a decrease in borrowing costs in Europe and the USA were provoked by the Fed's dovish pivot in December. If it weren't for Jerome Powell's discussions on monetary expansion, the euro would hardly have jumped so high. However, as is well known, those who fly high fall hard.

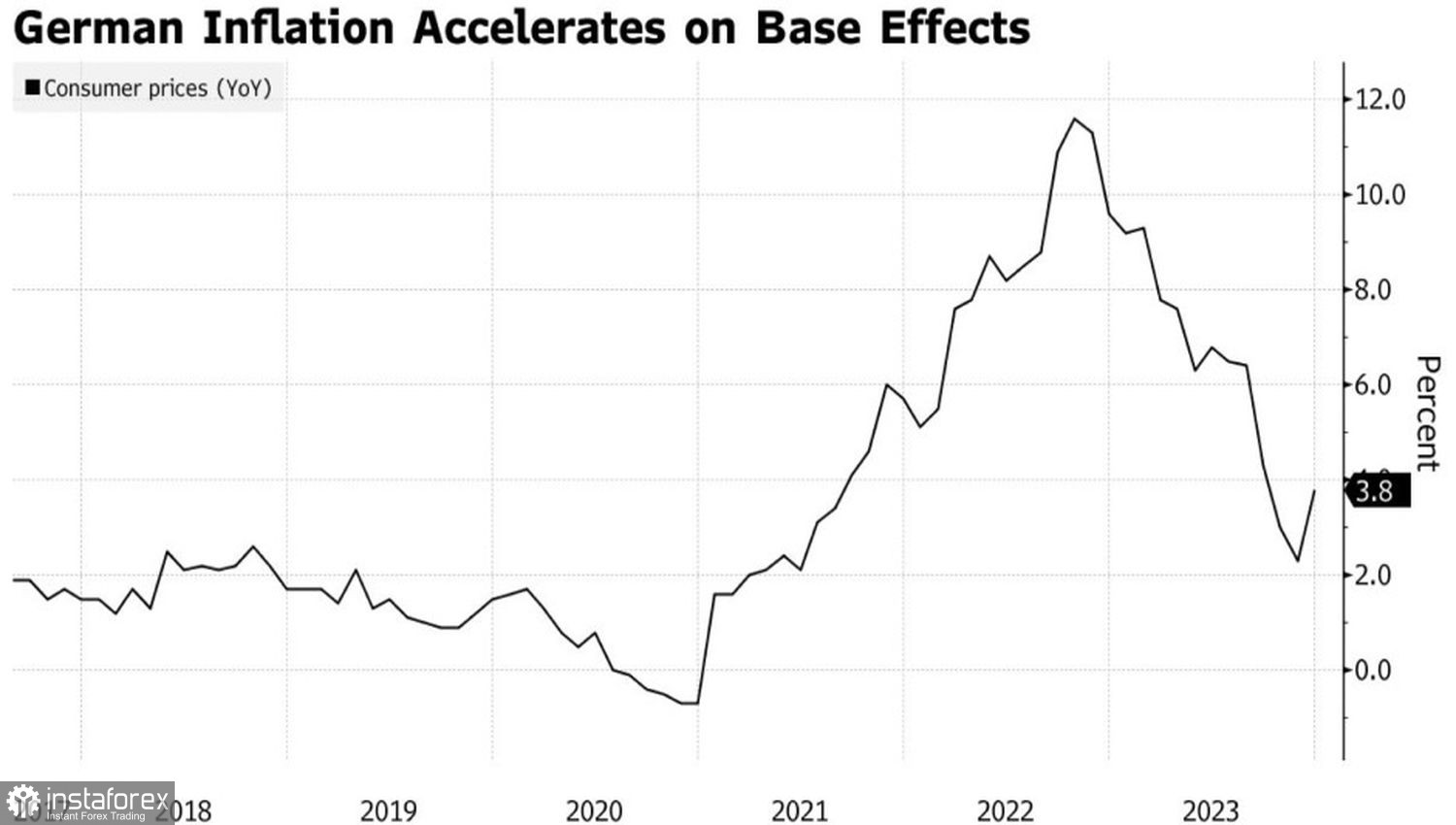

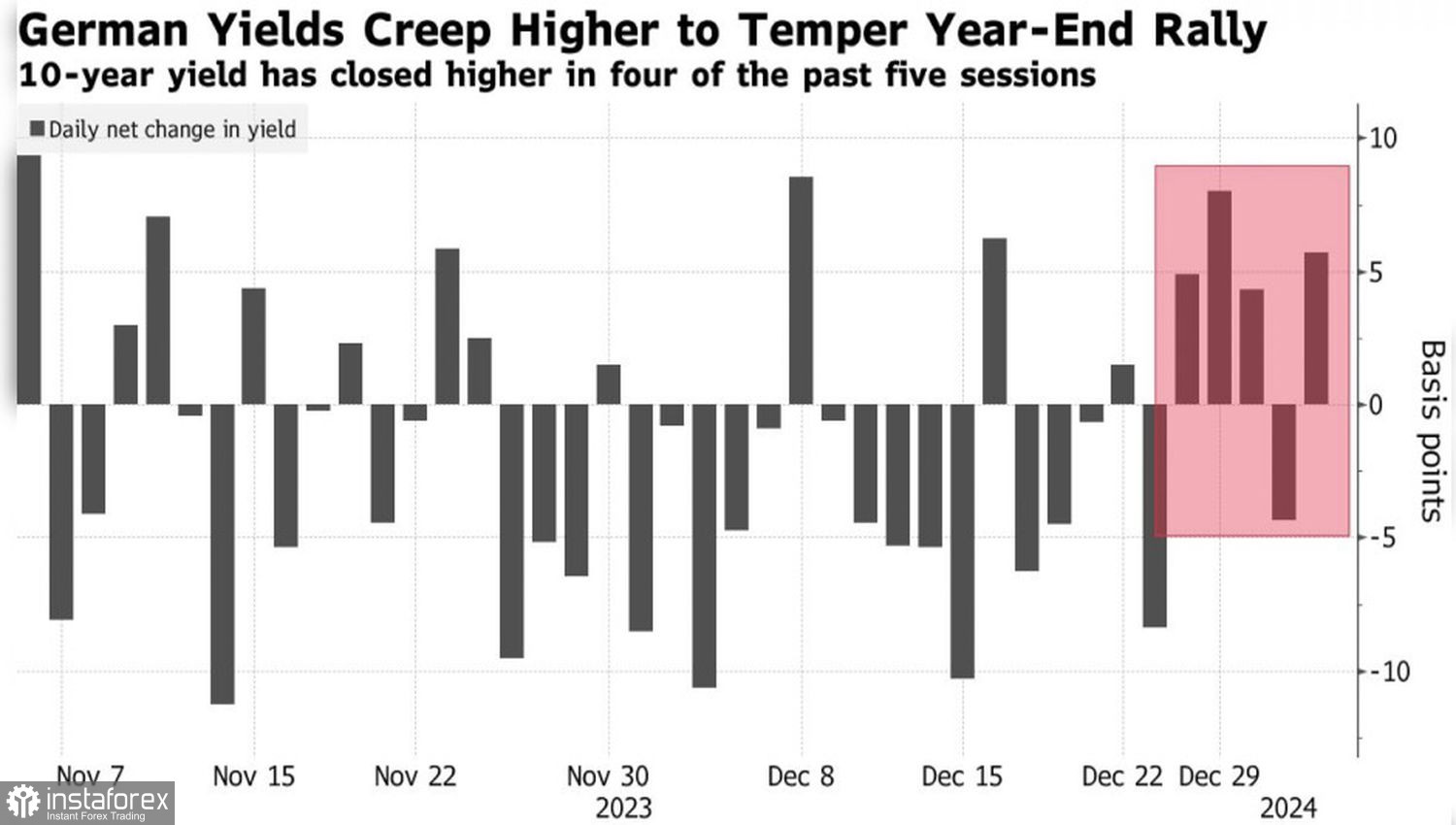

The EUR/USD's downward correction was as swift as the rally of the main currency pair in the fourth quarter. Markets are undergoing a reassessment of views, and not only in the States. For example, the slower growth of German inflation from 2.3% to 3.8% in December than Bloomberg experts forecasted reduced the anticipated scale of the ECB's deposit rate cut in 2024 from 166 basis points to 156 bps, raised the yield on German bonds, and allowed euro bulls to attack the important level of 1.097. The first attempt was unsuccessful.

Dynamics of German Inflation

In fact, the market's reassessment of views is global in nature. And if the U.S. dollar suffered the most from the expectations of rate cuts by the world's leading central banks led by the Fed at the end of 2023, it is the dollar that should now reap the most benefits. That is exactly what is happening. According to ING, due to the worsening of global risk appetite, the chances of EUR/USD falling to 1.08 are higher than returning to 1.1.

However, the likelihood of pleasantly surprising is greater when nothing is expected of you than when a lot is expected. In this regard, investors' hopes for a soft landing of the U.S. economy and their pessimism regarding the future of the eurozone might play a cruel joke on the EUR/USD bears. If the U.S. GDP slows down and its European counterpart recovers, the divergence in economic growth will favor the EUR/USD bulls. Especially since, unlike the Fed, the ECB does not intend to make a dovish pivot. The head of the Bundesbank, Joachim Nagel, warned investors against such thoughts, stating that in the past this ended badly.

Dynamics of German Bond Yields

In this regard, the revision of Eurozone business activity statistics for December upwards is good news for the euro. However, the dynamics of the main currency pair will depend not only on the economy and monetary policy of central banks but also on global risk appetite. In this respect, the stabilization of U.S. stock indices is a reason to buy EUR/USD, and their fall is a reason to sell the euro against the U.S. dollar. The U.S. labor market report for December will soon give a hint for the S&P 500.

Technically, on the daily chart of EUR/USD, after the realization of the Anti-Turtles pattern and the pair's fall below two out of three moving averages, the bulls attempted a counterattack but were stopped by the pivot level of 1.097. Its successful re-assault will signal the opening of long positions. However, as long as the main currency pair trades below, it is advisable to stick to a selling strategy.