Significant economic reports were published at the start of the U.S. trading session on Thursday, which serve as a kind of "harbingers." The German inflation report often correlates with the eurozone inflation report (which will be released on Friday), and the ADP report sometimes (although not always) correlates with Non-Farm Payrolls (which will also be published on Friday). In other words, these reports are, in some sense, a "preview" of Friday's events.

As a result of these two reports, the EUR/USD pair initially edged down but then it managed to recover, settling in the middle of the 9-figure range. In other words, the pair generally remained in its previous positions, showing a small reaction to fairly important reports. Why?

The reason is that the ADP report was in the "green" and this worked in favor of the greenback, while the German inflation report supported the euro. In such contradictory conditions, it's challenging to take a "downward" or "upward" side, so traders made a good decision, adopting a wait-and-see approach.

According to the Automatic Data Processing report, the number of jobs in the non-farm sector in the United States increased by 164,000 in December, while the forecast was at 120,000. This is the strongest result since August 2023. On one hand, this is good news for the greenback. However, there are a few "buts" here. First, ADP reports do not always correlate with official data. For instance, last month, the agency reported an increase of 101,000, while November's Non-Farm Payrolls came in at 199,000. Second, "164,000" is relatively modest on its own: for two consecutive months, Non-Farm Payrolls have failed to reach the 200,000 mark. By the way, according to the general forecasts, 168,000 jobs were officially created in December. So, the ADP result almost coincided with the expected official result. If Non-Farm Payrolls come out at this level on Friday, they won't make much of an impact – December will be the third consecutive month that shows a figure below the 200,000 target.

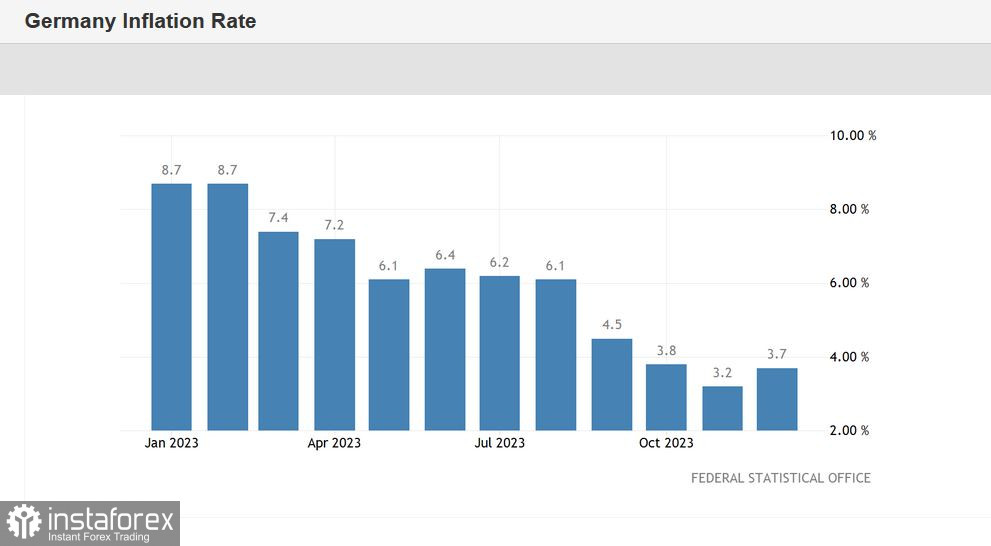

As for the German inflation data, the situation was more straightforward. German figures often (almost always) correlate with the overall European figures, reflecting the general trend. Therefore, the latest result is good news for the euro and, consequently, for EUR/USD buyers.

According to the report, the Consumer Price Index (CPI) in Germany rose to 3.7% on an annual basis, as many experts had predicted. But what's important here is that the indicator had been consistently declining for the last three months (reaching 3.2% in November), and in December, it accelerated again. The Harmonized Index of Consumer Prices (which the European Central Bank prefers to use for measuring inflation), not only accelerated but was also in the "green" – this component of the report rose to 3.8% against an expected increase to 3.7%. And here, a similar picture emerges: the indicator had been declining for the last four months, but in December, it started to gain momentum again.

If we talk about the structure of the latest report, it is worth noting the rise in prices for food and non-alcoholic beverages – in December, they increased in Germany by 4.5% on an annual basis. Services became more expensive by 3.2%, and energy prices rose by 4.1%, following a 4.5% decline in November.

What does all this mean? First of all, it suggests that the European report on Friday could pleasantly surprise EUR/USD buyers. Especially since preliminary forecasts indicate a potential increase in overall inflation in the eurozone. According to most experts, the CPI in December will rise to 3.0% after falling to 2.4% in November. In that case, the indicator will demonstrate an upward trend for the first time after seven consecutive months of decline. The Core CPI is expected to decrease to 3.4%. If it unexpectedly surges (after a 4-month decline), EUR/USD buyers will have a strong argument to strengthen their positions.

Therefore, Thursday's reports, published in the US and Germany, suggest that Non-Farm Payrolls will likely come in at the forecast level, and the eurozone inflation report will probably be in the "green." Of course, we cannot say this with absolute certainty, but the messages mentioned above indicate the realization of such a scenario.

The reaction of EUR/USD traders is consistent with this. On one hand, traders are cautious, and on the other hand, they prefer long positions.

It is noteworthy that the bears were unable to break through the support level at 1.0910 (the middle line of the Bollinger Bands indicator on the daily chart) on Wednesday. After testing this target, the bears took profits, allowing the pair's bulls to move back towards the middle of the 9th figure. This once again indicates that bearish pressure is unreliable. The nearest target for the upward movement is the level at 1.1010 – which is the Tenkan-sen line on the 1D chart. The next target is 1.1080 (the upper line of the Bollinger Bands on the weekly chart).