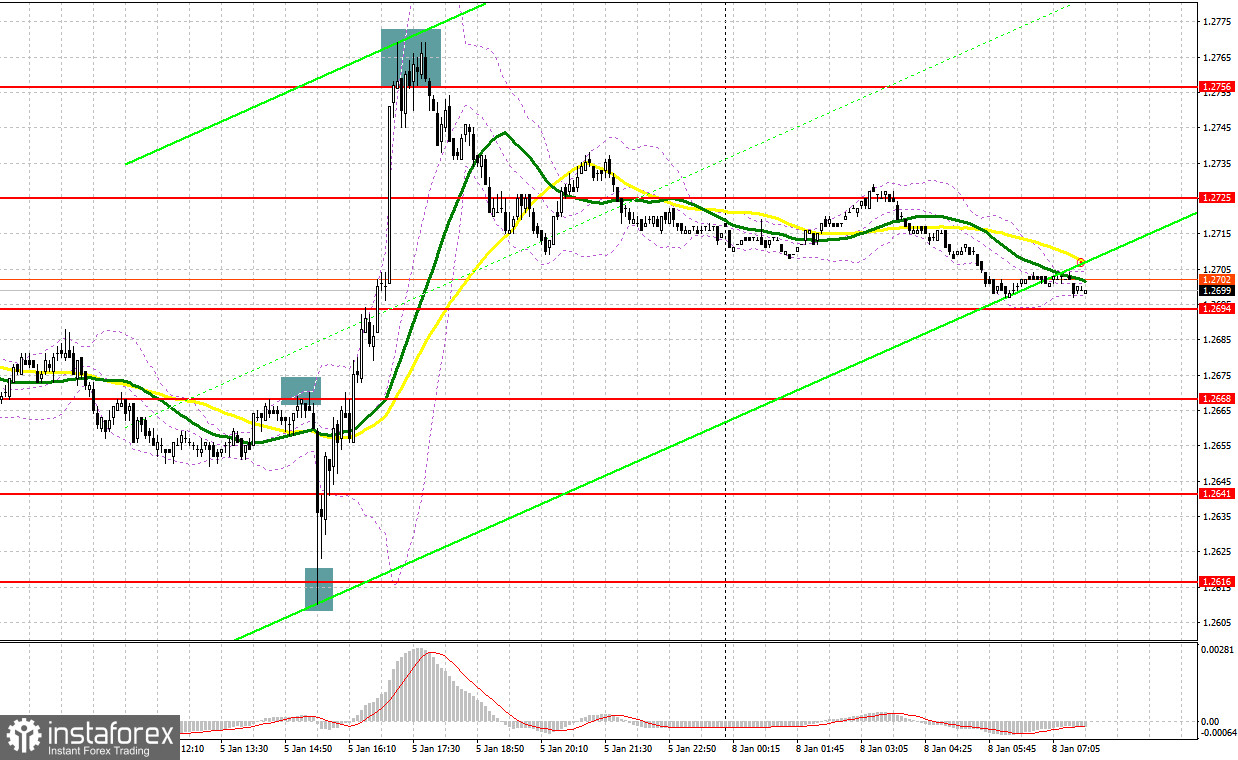

Last Friday, the pair formed some great entry signals. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2655 as a possible entry point. The price fell to 1.2655, but a false breakout was not formed. In the afternoon, safeguarding 1.2668 generated a sell signal, which sent the pair down by more than 50 pips. Buying on the rebound from 1.2616 after the US labor market data made it possible for trader to gain about 50 pips more profit.

For long positions on GBP/USD:

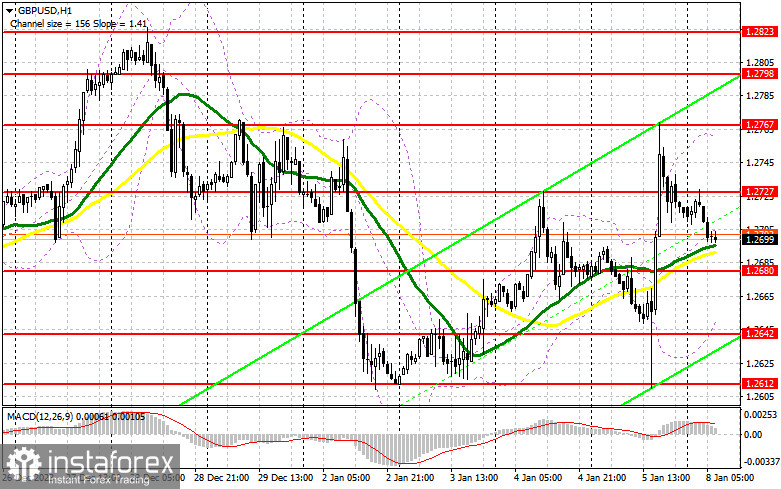

The strong labor market has only served as a temporary reason to sell the pound, which big buyers have taken advantage of. Building up long positions near the weekly low resulted in new longs, triggered by the excessively weak report on activity in the US services sector. Today, we can expect the bulls to be active in the absence of UK data. If GBP/USD fails in the first half of the day, the bulls will have to be active in the area of support at 1.2680. Just above this level, we have the moving averages that favor the bulls. A false breakout there will provide an excellent entry point for long positions in continuation of the bullish market, which is now under great threat. It will also help to bring GBP/USD back to the 1.2727 resistance area established at the end of Asian trading. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2767. The farthest target will be the area of 1.2798 high, where I will take profits. If the pair falls and there is no buying activity at 1.2680 in the first half of the day, trading will return to the sideways channel. In this case, I will postpone buying until the test of 1.2642. Only a false breakout there will signal opening long positions. I plan to buy GBP/USD immediately on a rebound from last week's low of 1.2612, aiming for an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Despite the sharp surge in volatility, the bulls still have the advantage, but this doesn't necessarily mean that the bears have lost complete control of the situation. Forming a false breakout in the area of 1.2727, in the absence of economic reports, will indicate the presence of large bears in the market, which can produce a sell signal and may push the price to the area of 1.2680, which is also in line with the bullish moving averages. A breakout and an upward retest of this range will deal a more serious blow to the bulls' positions, leading to the removal of stop orders and pave the way to 1.2642.The furthest target will be the area of 1.2612 - last week's low, where I will take profits. If GBP/USD rises and there is no activity at 1.2727 at the beginning of the week, traders will continue to build a bullish market. In this case, I would delay short positions until a false breakout at 1.2767. If there is no downward movement there, I will sell GBP/USD immediately on a bounce right from 1.2798, considering a downward correction of 30-35 pips.

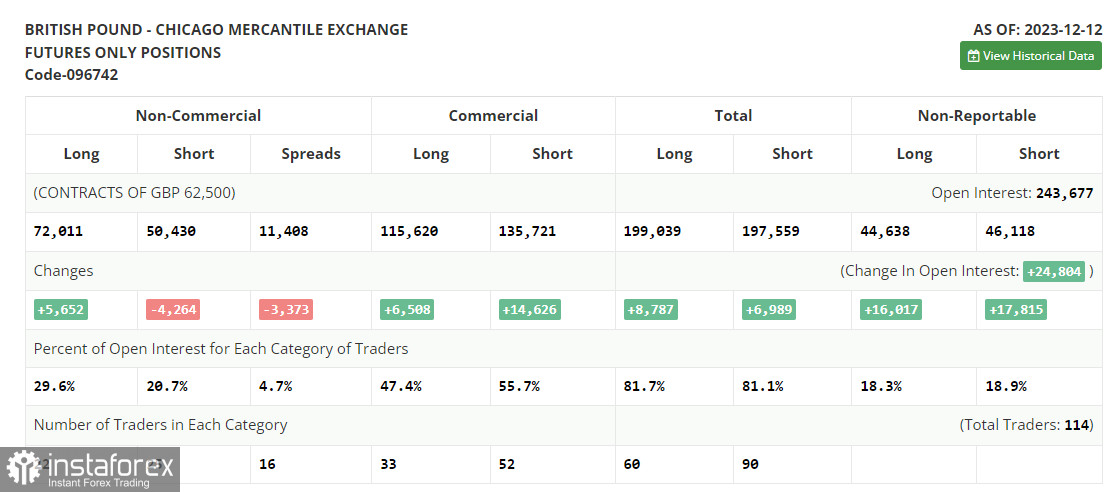

COT report:

The Commitment of Traders (COT) report for December 12 showed an increase in long positions and a decline in short ones. Obviously, there is still demand for the pound, as the Bank of England's recent decision to leave interest rates unchanged as it continues its fight to curb inflation, as well as statements by BoE Governor Andrew Bailey that rates will remain high for an extended period, has revitalized the pound. As a result, the British currency strengthened against the U.S. dollar. Another thing is how the UK economy, which has been struggling lately, will react to all this. A batch of UK and US inflation data will be released soon, and if prices rise, we can bet on the pair's further growth. The latest COT report indicates that non-commercial long positions rose by 5,652 to 72,011, while non-commercial short positions were down by 4,264 to 50,430. As a result, the spread between long and short positions decreased by 3,373.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates that the buyers are returning to the market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower border near 1.2665 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.