Talks that the Bank of Japan will exit its negative interest rate policy in the first half of 2024 have helped the Japanese yen significantly strengthen in the last two months of 2023.

Market participants are not deterred by assurances from the leadership of the Bank of Japan that monetary policy should remain soft.

Following the December meeting, the Japanese Central Bank kept the interest rate and the target yield for 10-year Japanese government bonds at the previous level, -0.1% and 0%, respectively (if this indicator exceeds the upper limit of the range at 1.0%, the BoJ will increase the volume of purchases of all types of securities). The accompanying statement said that the economy is likely to continue recovering at a moderate pace, and core consumer inflation will gradually rise.

At a press conference after the meeting, Bank of Japan Governor Kazuo Ueda stated that the Central Bank leadership will not hesitate to take additional easing measures if necessary. "We are still not in a situation to predict sustainable, stable inflation with sufficient confidence," said Ueda.

Recall that in January 2023, the annual Consumer Price Index (CPI) peaked at 4.2%, but then decreased to 2.9% in November. If inflation in Japan continues to decline or remains low, the hopes of yen buyers for a rollback of the ultra-soft credit and monetary policy of the Japanese Central Bank will melt away. However, if the Fed does not reduce interest rates as expected in March, and this term is shifted closer to the end of 2024, then the resumption of the growth of the USD/JPY pair becomes practically inevitable.

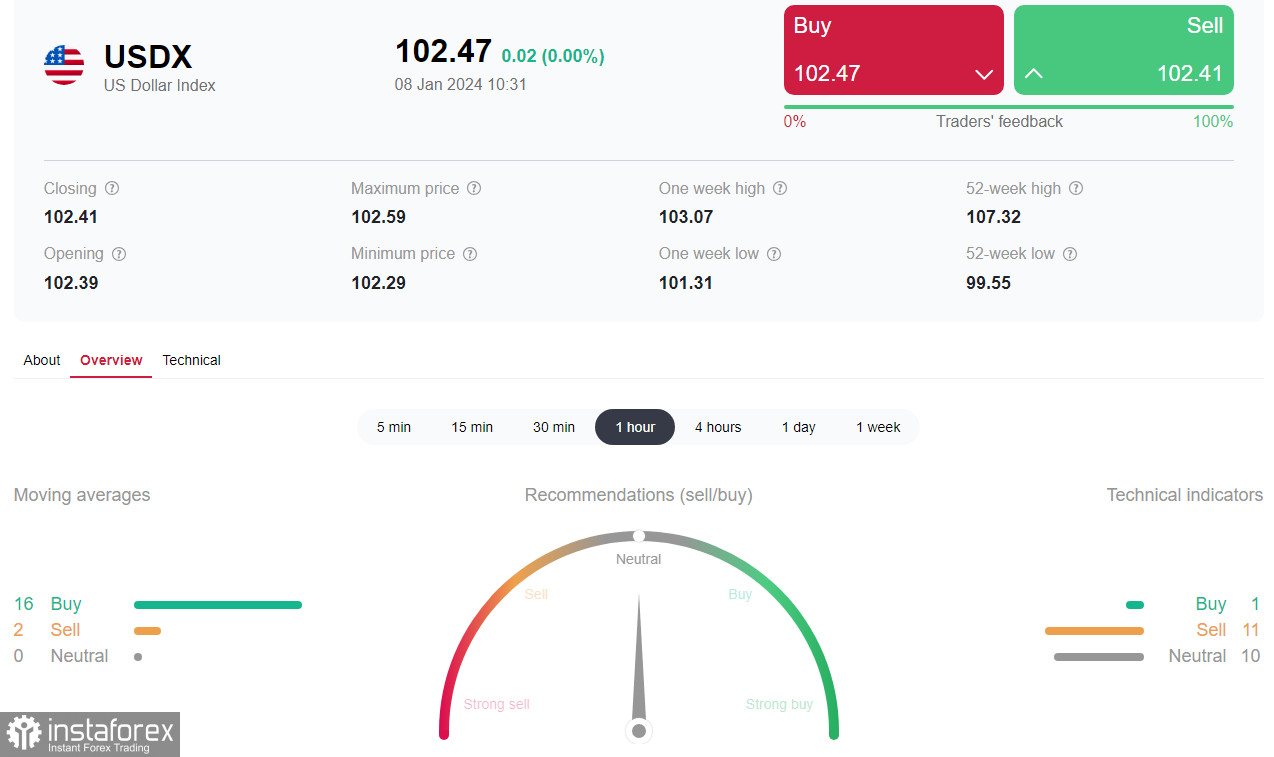

By the way, the first trading week of this year demonstrated how quickly the situation with the weakening of the dollar can change: it strengthened sharply and continued to rise until the publication on Friday (at 15:00 GMT) of the December business activity index for the services sector from the Institute for Supply Management, which did not meet expectations at 52.6 and fell to the mark of 50.6 from November's 52.7.

Market participants also tempered their strengthened positive sentiment towards the dollar after the strong data from the U.S. Department of Labor's report, published on Friday (employment growth in December was 216,000, above the forecast of 170,000, and the unemployment rate remained at the previous level of 3.7% against the forecast of a rise to 3.8%), were tarnished by revised downward NFP values for November and October.

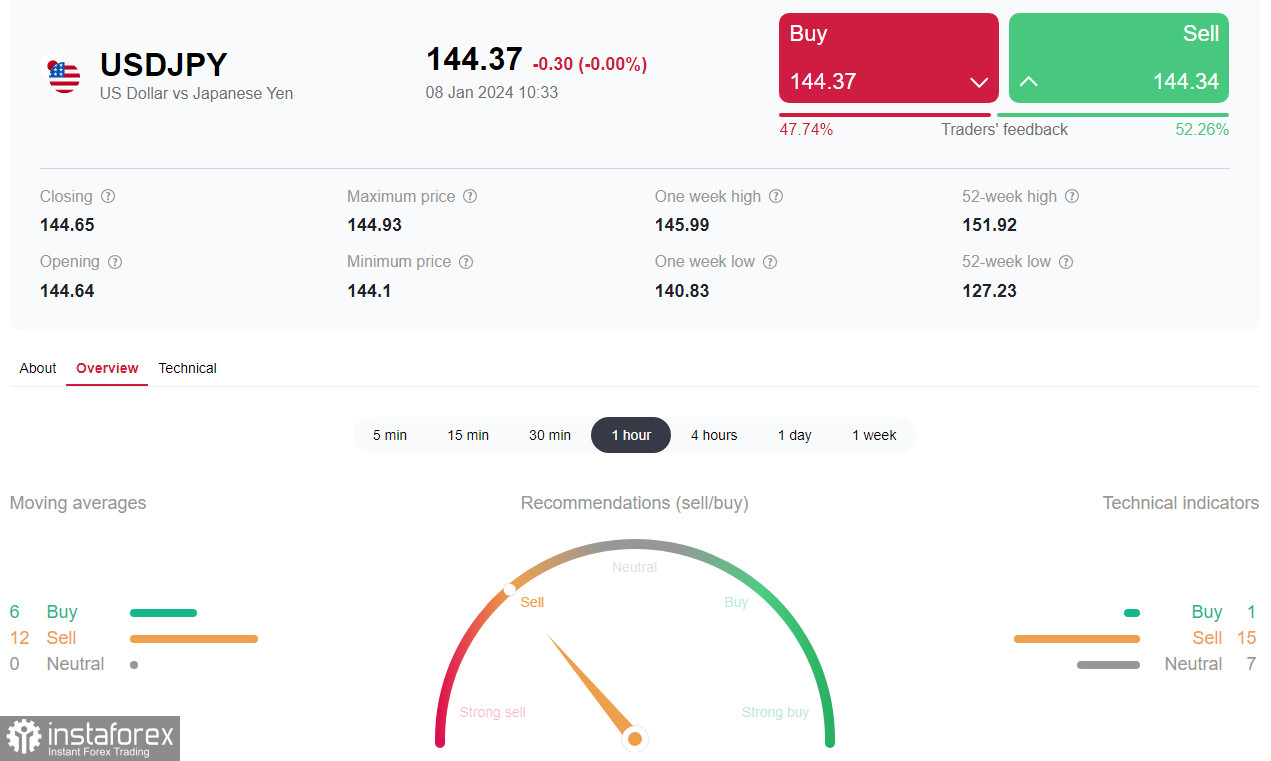

As a result, the dollar failed to capitalize on its success, and at the beginning of the new week, the USD/JPY pair is again declining. As of this writing, it was trading near the 144.40 mark, 20 points below Friday's closing price.

Closer to the end of the week, volatility in the dollar quotes will sharply increase again on Thursday upon the release of inflation data in the U.S. at 13:30 (GMT), and on Friday for the producer price indices (at 13:30).

If the data indicate an increase in inflation in the U.S., then after Friday's Labor Department report, a resumption of dollar growth should be expected, including in the USD/JPY pair.

However, volatility in the pair will increase as early as today, when at 23:30 (GMT), the Japanese Bureau of Statistics will publish December consumer price data for the Tokyo region.

Since Tokyo is the most populous city in Japan, economists consider this data, which is published a month earlier than the national Consumer Price Index, the most important indicator of consumer inflation. Consumer prices account for a large part of overall inflation, the assessment of which is very important for evaluating currency prospects (an increase in consumer inflation forces the country's Central Bank to tighten monetary policy, which usually, under normal economic conditions, positively reflects on the value of the national currency).

If the data turns out to be worse than the forecast and previous values, the yen will most likely decrease sharply but temporarily.

Previous values (year-on-year):

Tokyo CPI Index: +2.6%, +3.3%, +2.8%, +2.9%, +3.2%, +3.2%, +3.2%, +3.5%, +3.3%, +3.4%, +4.4% (in January 2023),

Tokyo CPI Index (excluding food and energy): +3.6%, +3.8%, +4.0%, +4.0%, +4.0%, +3.8%, +3.9%, +3.8%, +3.4%, +3.1%, +3.0% (in January 2023).

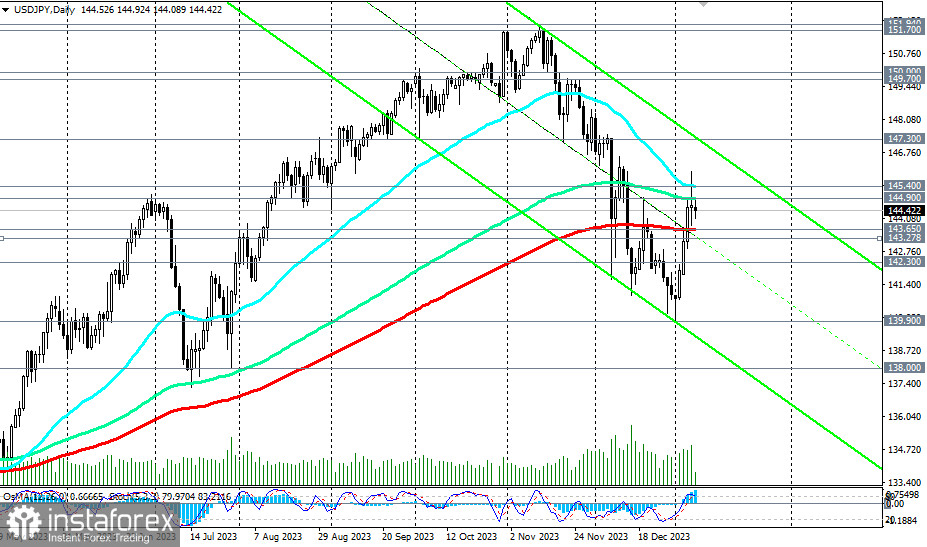

From a technical point of view, USD/JPY, after breaking through the key resistance level of 143.65 last Thursday, is attempting to return to the medium-term bullish market while remaining in the zone of the long-term bullish market. Here, a confirmed break of the important resistance level of 144.90 can be a signal to build up long positions.