EUR/USD

Higher Timeframes

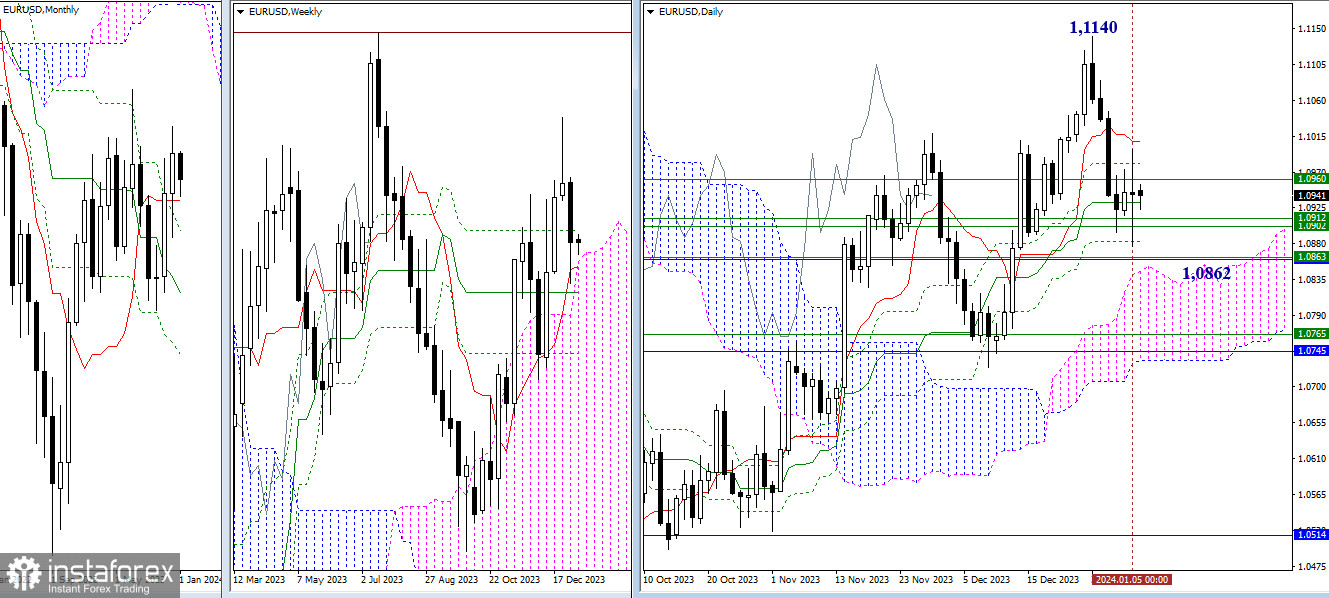

The last week of the previous year provided a bearish sentiment for the start of 2024. As a result, the pair quickly returned to the zone of influence and attraction of daily (1.1008 – 1.0981 – 1.0932 – 1.0883) and weekly (1.0960 – 1.0912 – 1.0902) support levels. The current situation for further strengthening of bearish sentiments is complicated by the fact that beyond the indicated supports, the euro will encounter a confluence of strong levels around 1.0862 (monthly short-term trend + weekly medium-term trend). For bullish players, the initial task in the current conditions is to free themselves from the attraction of the current interaction levels and update the December high (1.1140).

H4 – H1

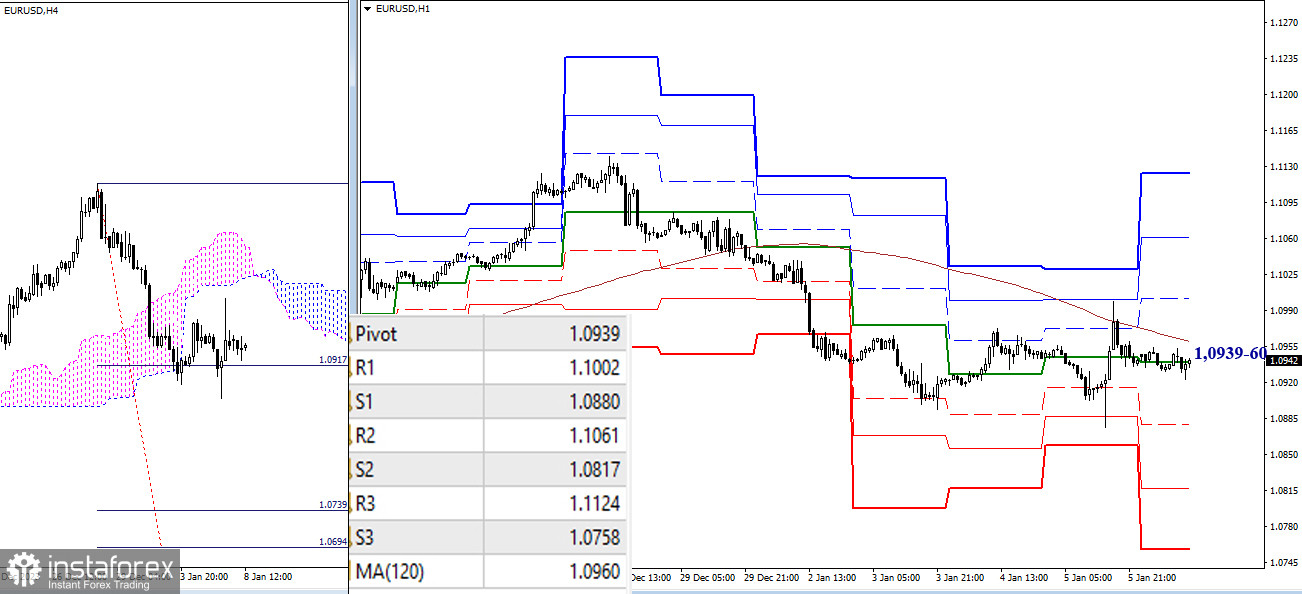

On the lower timeframes, there is currently uncertainty. The pair is in the zone of an upward correction and is preparing to overcome the key resistance of the weekly long-term trend (1.0960). A break and consolidation above will shift the main advantage to the bulls. The intraday bullish targets, in this case, will be the classic pivot points (1.1002 – 1.1061 – 1.1124). If the bears maintain their position below the key levels of the lower timeframes 1.0960 – 1.0939 (central pivot point of the day + weekly long-term trend), then with new activity, they can exit the correction zone and continue the downward trend. Support levels of the classic pivot points inside the day today can be noted at 1.0880 – 1.0817 – 1.0758.

***

GBP/USD

Higher Timeframes

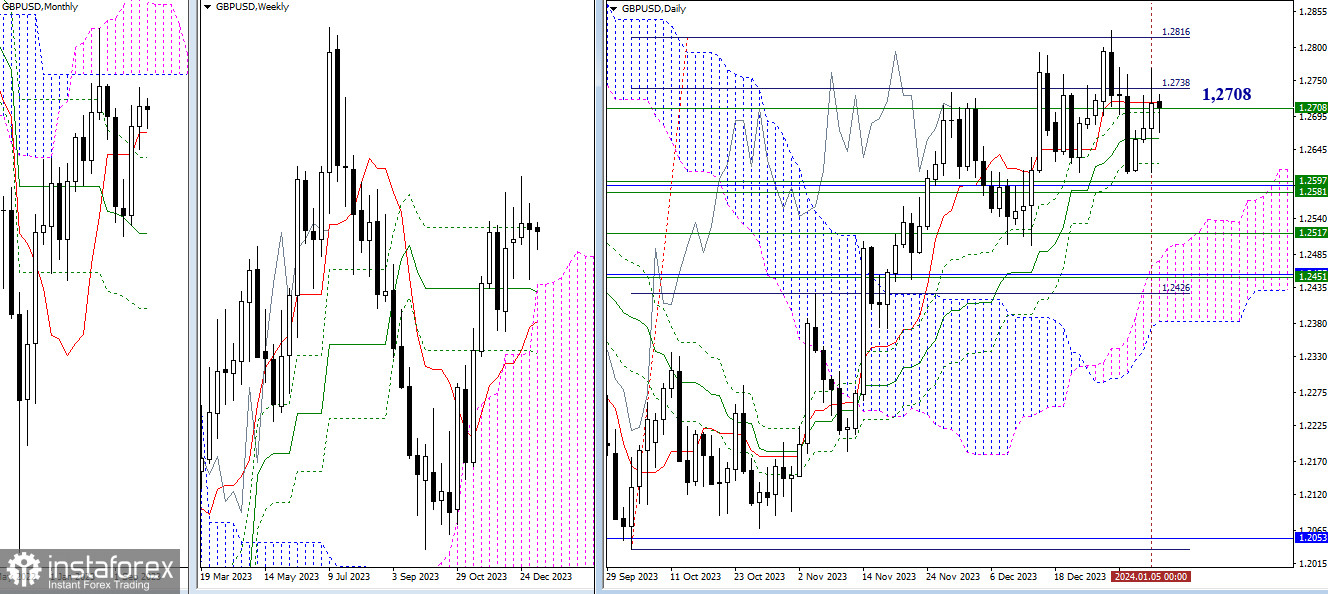

At the end of last year, the target for breaking through the daily Ichimoku cloud (1.2816) was reached. After the completion, the bulls took a pause, and as a result, they almost reached the strengthened supports around 1.2581-97 (monthly short-term trend + weekly levels), nevertheless, the pound returned to the zone of attraction and influence of the accumulation of levels of the daily Ichimoku cross headed by the weekly level 1.2708. With the return of bullish activity and updating of December's high (1.2826), a rise and testing of the lower boundary of the monthly cloud (1.2893) can be expected.

H4 – H1

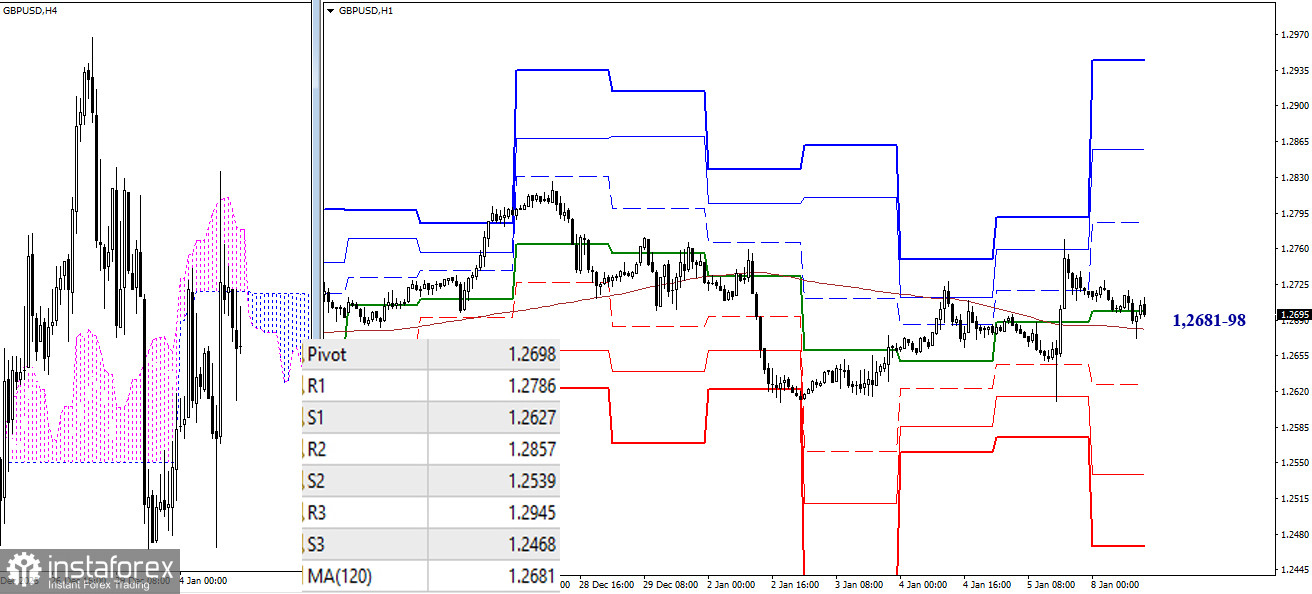

On the lower timeframes, the advantage, at the moment, remains on the side of the bulls, as the pair is operating above the weekly long-term trend (1.2681). With bullish activity, the intraday targets will be the classic pivot points, located today at 1.2786 – 1.2857 – 1.2945. A break and reversal of the trend can give the main advantage to the bears, then the focus will shift to the supports of the classic pivot points, which can now be noted at 1.2627 – 1.2539 – 1.2468.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)