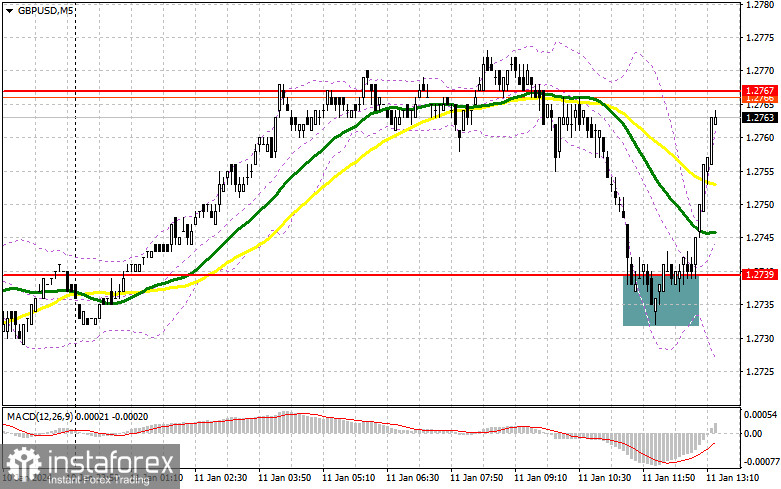

In my morning forecast, I pointed out the level of 1.2739 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout at this level led to an excellent entry point for buying the pound, resulting in a rise of more than 30 points in the pair. The technical picture remained unchanged for the second half of the day.

To open long positions on GBP/USD, the following is required:

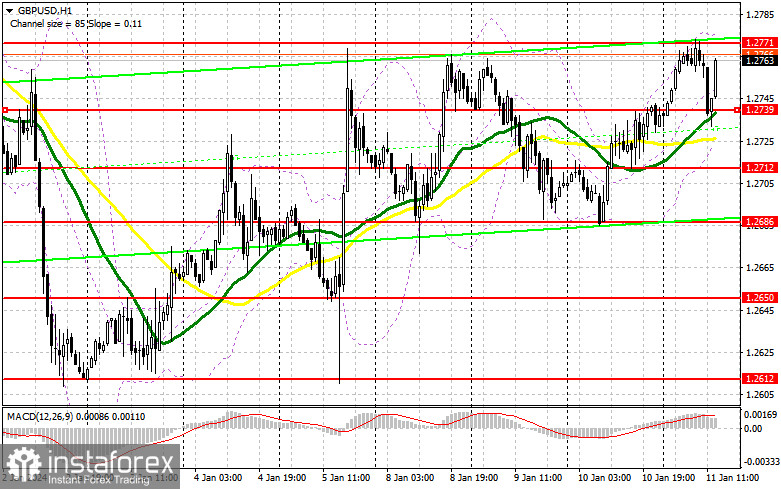

We have US inflation data ahead of us, and only a very sharp slowdown in price growth will trigger further strengthening of the British pound, which is what I will be counting on. If prices return to growth by the end of the year, we can forget about rate cuts from the Federal Reserve in March. This must also be considered when making buying decisions, as the pair could decline significantly. I prefer to act on buying only after a decline and the formation of a false breakout near the support at 1.2739, similar to what I discussed earlier. This will provide another entry point for long positions in the continuation of the bull market, from where we can reach 1.2771 – a new intraday resistance level. A breakout and consolidation above this level, against very mild inflation in the US, will strengthen demand for the pound and pave the way to 1.2798, where I expect to see more active selling. The ultimate target will be the 1.2823 area, where I plan to make a profit. In the scenario of GBP/USD declining and no activity from the bulls at 1.2739, where we also have the moving averages, pressure on the pound will return. In that case, I will postpone purchases until the next support at 1.2712. I plan to buy GBP/USD immediately on the rebound only from 1.2686, targeting a pair correction of 30-35 points intraday.

To open short positions on GBP/USD, the following is required:

Sellers attempted but failed to break below 1.2739. Now, it's necessary to seriously consider how to protect the weekly maximum of 1.2771, which has been tested for strength multiple times. Only the formation of a false breakout there after the release of inflation statistics will provide a suitable entry point for short positions with the prospect of a decline to the support at 1.2739, which has performed excellently today. A breakout and a bottom-up retest of this range, which has already worked once today, so it's quite realistic, will deliver a more serious blow to the bull's positions, opening the path to 1.2712. The ultimate target will be the 1.2686 area, where I plan to make a profit. In the scenario of GBP/USD rising and no activity at 1.2771, it is more likely that buyers will regain the initiative. In that case, I will postpone selling until a false breakout at the 1.2798 level. If there is no downward movement, I will sell GBP/USD immediately on the rebound from 1.2823, but only in anticipation of a pair correction down by 30-35 points intraday.

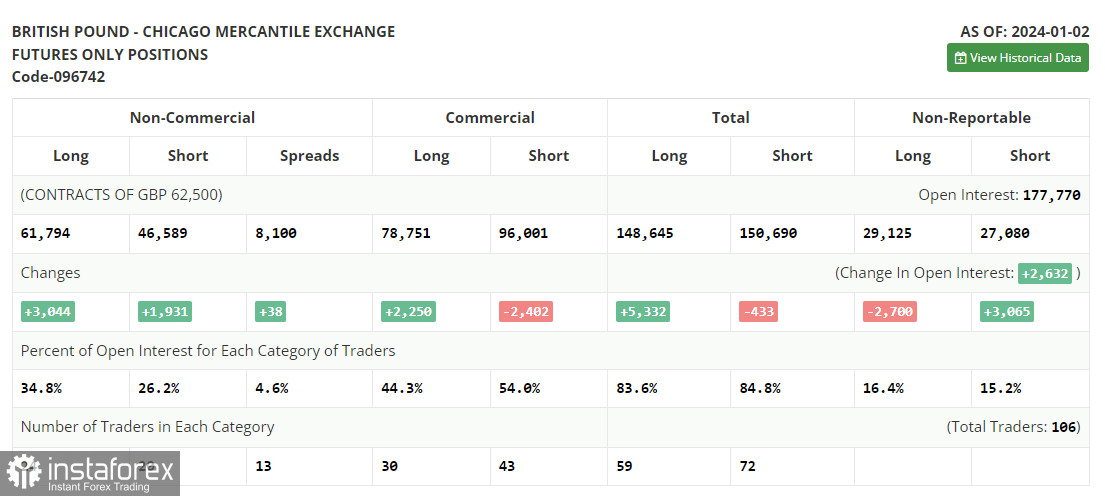

In the COT report (Commitment of Traders) for January 2nd, both long and short positions increased. There is still demand for the pound, as the recent decision of the Bank of England to leave interest rates unchanged is based on the continued fight against high inflation, along with statements from Bank of England Governor Andrew Bailey that rates will remain high for an extended period – all of this runs counter to the expected policy of the Federal Reserve in the US, where the regulator plans to lower interest rates, citing good progress in combating inflation. This leads to a weakening of the dollar against the British pound in the medium term. If the fresh data on price growth in the US, expected soon, again pleases central bank officials, we can expect another rise in GBP/USD. The latest COT report noted that long non-commercial positions increased by 3,044 to 61,794, while short non-commercial positions increased by only 1,931 to 46,589. As a result, the spread between long and short positions increased by 38.

Indicator Signals:

Moving Averages:

Trading is taking place above the 30 and 50-day moving averages, indicating an attempt by the pound to continue rising.

Note: The author considers the period and prices of moving averages on the hourly H1 chart, which differ from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator at around 1.2725 will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' long and short positions.