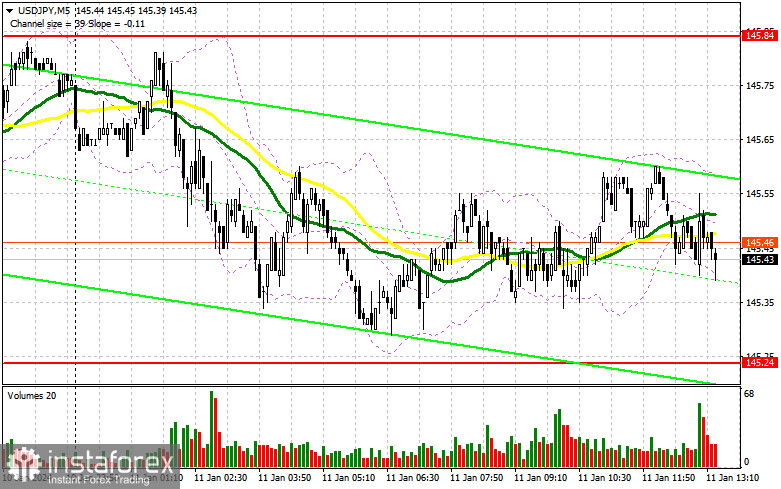

In my morning forecast, I emphasized the level of 145.24 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The lack of full trader activity led to very low volatility in the yen during the first half of the day, preventing us from reaching the designated levels and obtaining suitable entry points into the market. The technical picture remained unchanged for the second half of the day.

To open long positions on USD/JPY, the following is required:

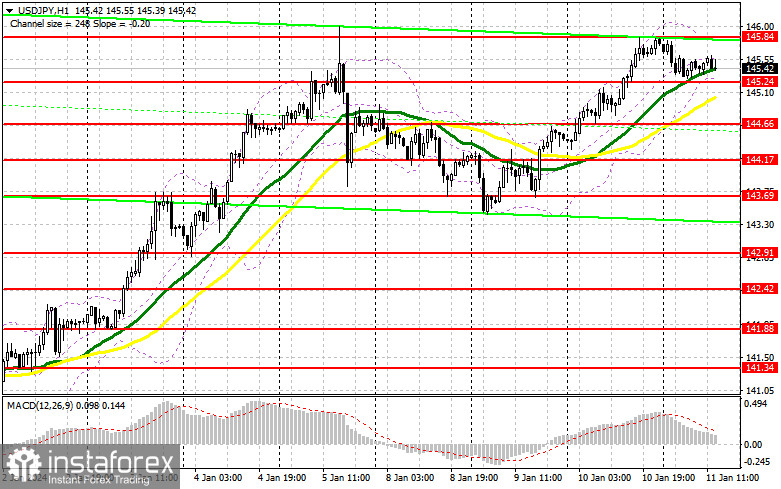

If US inflation suddenly surges at the end of the year, it is evident that the Japanese yen will continue to fall, and the dollar will return to a bullish market, strengthening the USD/JPY pair. If the data pleasantly surprises everyone and inflation decreases, the pressure on the yen will decrease, leading to a downward correction in the pair, which I will try to capitalize on in such a market. I will act by the morning scenario: a decline in USD/JPY to the support area at 145.24 and a false breakout there will provide an entry point for buying with an upward move to around 145.84. A breakout and a retest from top to bottom of this range will lead to another good option for increasing long positions, pushing USD/JPY to around 146.51. The ultimate target will be the 147.22 area, where I plan to make a profit. In the scenario of the pair declining and a lack of activity at 145.24 from buyers in the second half of the day after weak inflation, pressure on the dollar will return, leading to a good downward correction in the pair. In such a case, I will try to enter the market around 144.86. But only a false breakout there will signal the opening of long positions. I plan to buy USD/JPY immediately on the rebound only from the minimum around 144.17, targeting a pair correction of 30-35 points intraday.

To open short positions on USD/JPY, the following is required:

Sellers can only hope for a sharp decrease in inflation at the end of last year, which is quite possible. However, extreme caution must be taken against such a bullish market. Only an unsuccessful consolidation at 145.84 after releasing a series of statistics will provide an opportunity for a slight downward correction to around 145.24, where the moving averages are located, favoring buyers. However, the main movement will depend on how sellers deal with this level. A breakout and a retest from bottom to top at 145.24 will deal a more serious blow to the bull's positions, removing stop orders and opening the path to 144.66. The ultimate target will be the 144.171 area, where I plan to make a profit. The bull market will continue to develop in the scenario of further USD/JPY growth and a lack of activity at 145.84 during the American session. In such a case, postponing selling until testing the next resistance at 146.51 is best. If there is no downward movement, I will sell USD/JPY immediately on the rebound from 147.22, but only in anticipation of a pair correction down by 30-35 points intraday.

Indicator Signals:

Moving Averages:

Trading is taking place above the 30 and 50-day moving averages, indicating a potential rise in the pair.

Note: The author considers the period and prices of moving averages on the hourly H1 chart, which differ from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator at around 145.24 will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

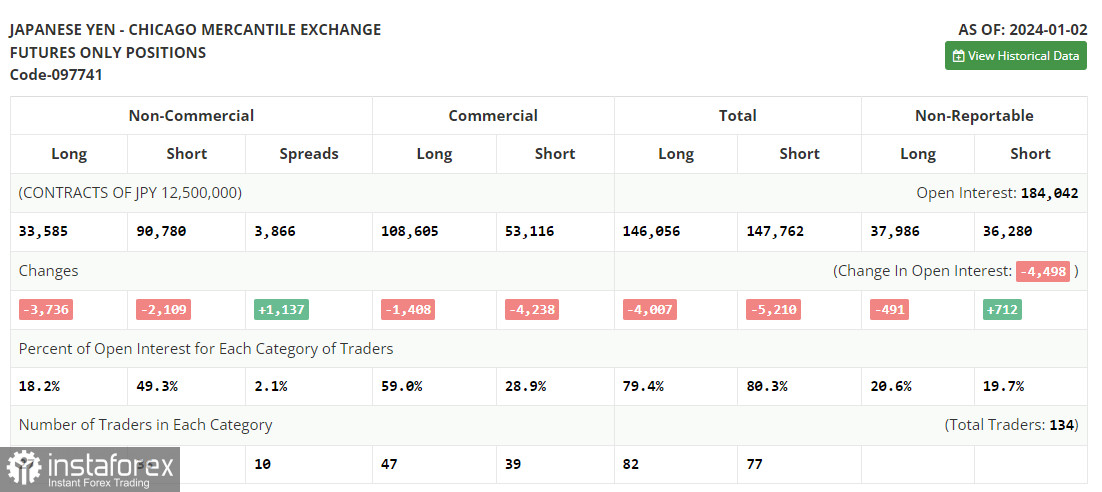

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between long and short positions of non-commercial traders.