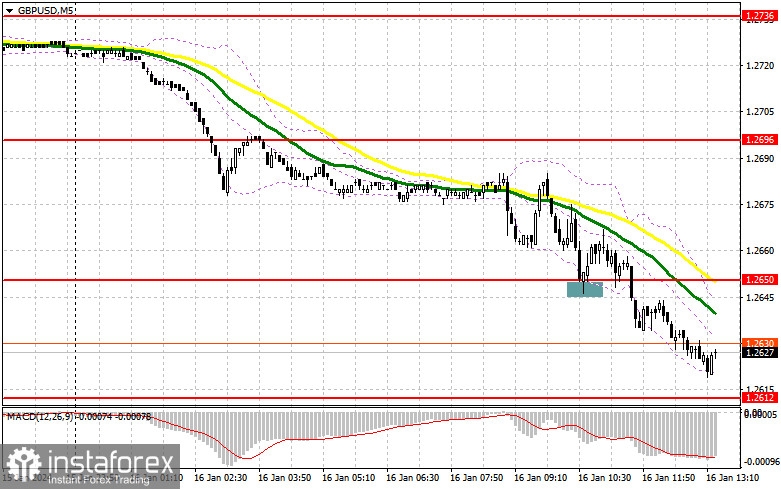

In my morning forecast, I drew attention to the 1.2650 level and planned to base market entry decisions on it. Let's look at the 5-minute chart and analyze what happened there. A decline and the formation of a false breakout around 1.2650 occurred, and the pound even rebounded upwards by 15 points. However, relying heavily on this signal was not advisable since the released labor market data for the UK indicated a further decline in the currency pair. Unfortunately, I couldn't enter the market after the breakout at 1.2650 because I didn't wait for a retest of this level. The technical picture remained unchanged for the second half of the day.

To open long positions on GBP/USD:

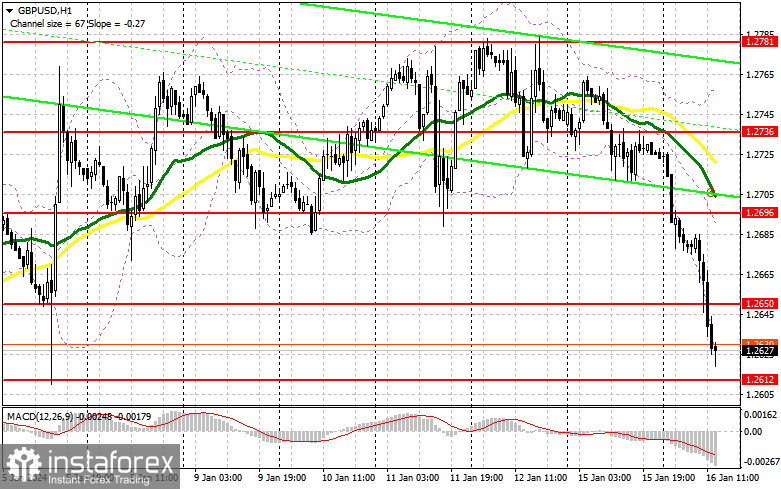

A sharp slowdown in average wage growth in the UK undermined the Bank of England's stable position regarding interest rates, leading to a significant drop in the pound in the first half of the day. Adding to this the reduction in new job vacancies at the end of last year, it becomes clear that buying the pound soon is not advisable. In the second half of the day, in addition to the US data, there will be a speech by the Governor of the Bank of England, Andrew Bailey. Let's see what he says about this, as it could significantly impact the pound and potentially even lead to an increase. A dovish tone from Bailey will result in a drop in the pair, which I plan to take advantage of around the annual minimum of 1.2612. The formation of a false breakout there will provide an entry point for long positions with the expectation of a rise to around 1.2650, the new intraday resistance that acted as support earlier in the morning. A breakthrough and consolidation above this level will restore demand for the pound and pave the way to 1.2696, where I expect sellers to be more active. The ultimate target will be around 1.2736, where I intend to take profits. In the scenario of a decline in GBP/USD and the absence of bullish activity at 1.2612, pressure on the pound will persist. In that case, I will postpone purchases until the next support level at 1.2584. I plan to buy GBP/USD immediately on a rebound only from 1.2558 with the goal of a 30-35 point intraday correction.

To open short positions on GBP/USD:

Sellers control the market, but it would be good to see their reaction to the test of the nearest resistance at 1.2650. If they hold this level and a false breakout confirms it, I expect short positions with a retest of the annual minimum of around 1.2612. A breakthrough and retest from below upwards of this range will deal a more serious blow to the bullish positions, sending the market into a new bearish trend and opening the path to 1.2584. The ultimate target will be around 1.2558, where I plan to take profits. In the event of GBP/USD rising due to the hawkish stance of the Governor of the Bank of England and the absence of activity at 1.2650 in the second half of the day, buyers will regain initiative. In such a case, I will postpone selling until a false breakout occurs at 1.2696. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.2736, but only in anticipation of a pair's correction downwards by 30-35 points.

Indicator Signals:

Moving Averages:

Trading is taking place below the 30 and 50-day moving averages, indicating a further decline in the pair.

Note: The period and prices of the moving averages are determined by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In the case of a decline, the lower boundary of the indicator, around 1.2640, will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

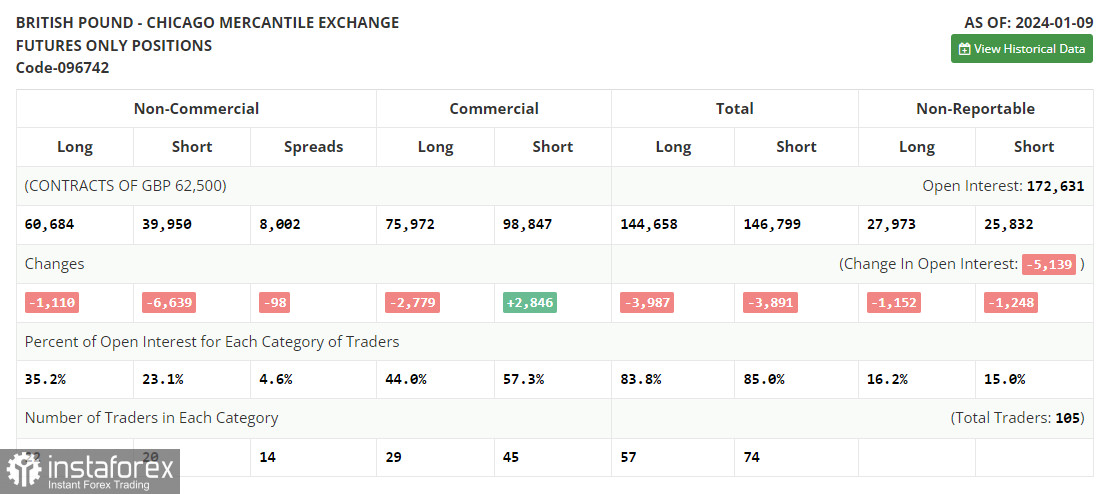

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.