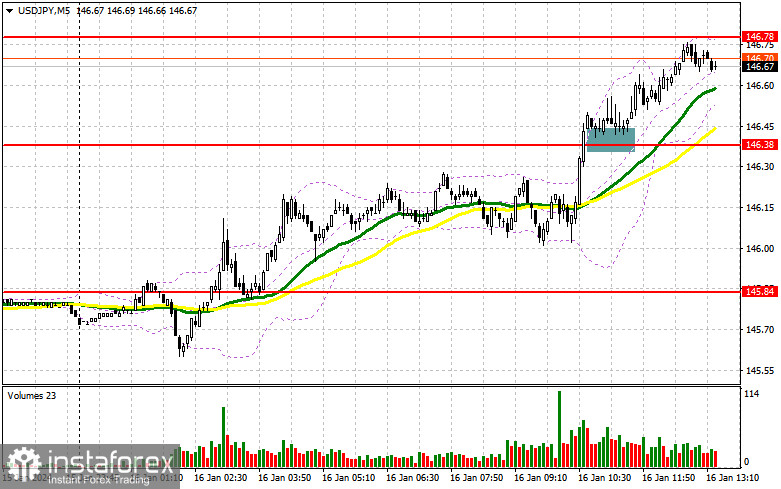

In my morning forecast, I drew attention to the level of 146.38 and planned to base market entry decisions on it. Let's look at the 5-minute chart and analyze what happened there. The breakthrough of 146.38 did occur, but we were just 2 points short of a retest. Since we had been above 146.38 for quite some time, I decided to continue buying the dollar against the yen, following the bullish market development I mentioned in my morning forecast. As a result, the pair moved up by about 40 points. The technical picture remained unchanged for the second half of the day.

To open long positions on USD/JPY:

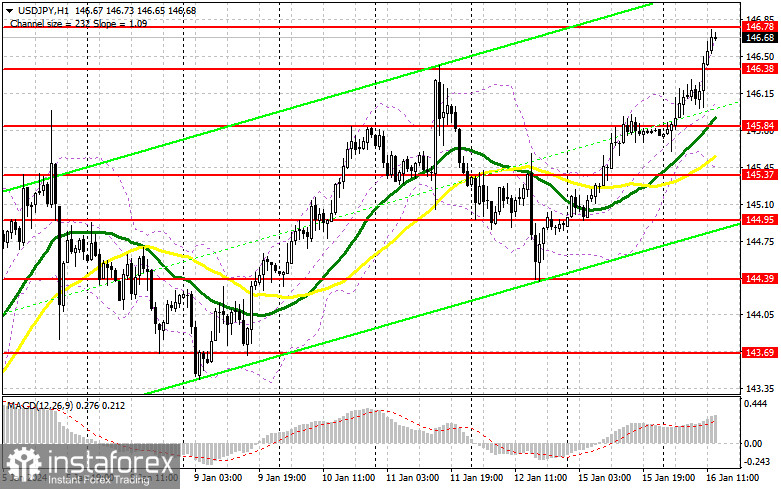

The situation with the yen remains rather dismal, but credit should be given to the US dollar, which is gradually gaining strength against riskier assets. The pair's further direction will depend on the Empire Manufacturing data to a lesser extent and Christopher Waller's speech, a member of the FOMC, to a greater extent. A tough stance by policymakers to combat inflation will lead to a new rise in USD/JPY. Will we see a correction to around 146.38 by that time to re-enter the market? It is possible, and I plan to take advantage of that. A false breakout at this level will provide an entry point for buying with an upward move to around 146.78, where we currently stand. A breakthrough and retest from above to below this range will lead to another good opportunity for increasing long positions, pushing USD/JPY to around 147.22, a new monthly high. The ultimate target will be around 147.82, where I intend to take profits. In the scenario of a pair's decline and the absence of activity at 146.38 from buyers in the second half of the day, pressure on the dollar will return, leading to a significant downward correction. In that case, I will enter the market around 145.84, where the moving averages, which favor buyers, are slightly above. Only a false breakout there will signal opening long positions. I plan to buy USD/JPY immediately on a rebound only from the minimum level around 145.37, with a 30-35 point intraday correction target.

To open short positions on USD/JPY:

Sellers can only hope for the defense of the nearest resistance at 146.78 and a dovish tone from Federal Reserve representatives, without which hopes for a correction will be completely lost. An unsuccessful consolidation at 146.78 against such a bullish market will provide an entry point for selling with a small decline. The target will be the area around 146.38. A breakthrough and retest from below to above this range will deal a more serious blow to the bullish positions, leading to stop-loss triggers and opening the path to 145.84. The ultimate target will be around 145.37, where I plan to take profits. The bullish market development will likely continue in the scenario of further USD/JPY growth and the absence of activity at 146.78 during the American session. In that case, postponing selling against the trend until testing the next resistance at 147.22 is best. If there is no downward movement, I will sell USD/JPY immediately on a rebound from 147.82, but only in anticipation of a pair's correction downwards by 30-35 points.

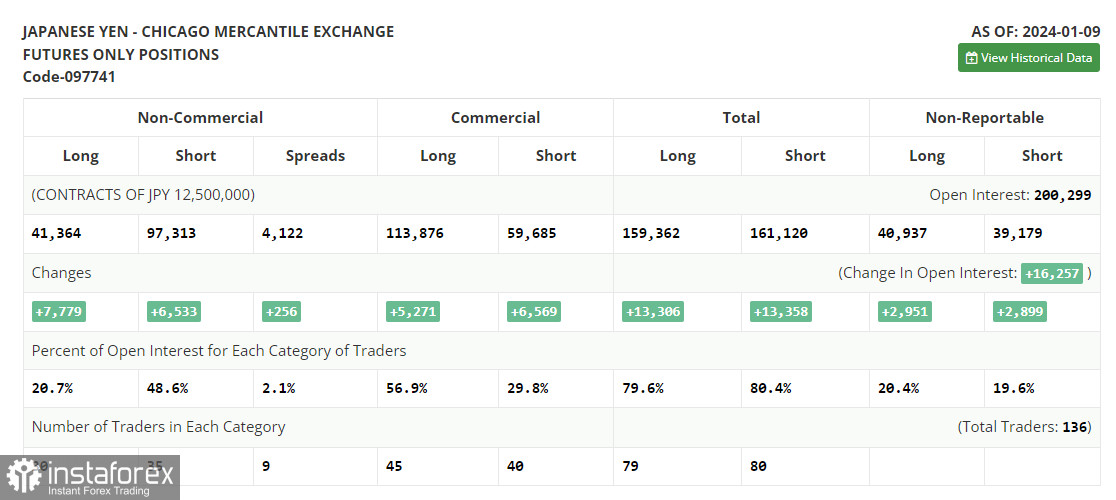

In the COT report for January 9th, there was an increase in both long and short positions. Traders are gradually recovering from the recent earthquake in Japan. Still, the fundamental data released recently must be more encouraging, so the Japanese yen quickly loses ground against the US dollar. The Bank of Japan's plans to abandon the policy of negative interest rates at the beginning of this year failed. On top of that, the Federal Reserve, with inflation growth, helps the dollar to stay afloat in the current conditions. Ahead of us, there is an important report on price growth in Japan, and it will be the determining factor for the current bullish market in USD/JPY. The latest COT report stated that long non-commercial positions increased by 7,779 to 41,364, while short non-commercial positions jumped by 6,533 to 97,313. As a result, the spread between long and short positions increased by 256.

Indicator Signals:

Moving Averages:

Trading is conducted above the 30 and 50-day moving averages, indicating further growth in the pair.

Note: The period and prices of the moving averages are determined by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In the case of a decline, the lower boundary of the indicator, around 145.37, will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.