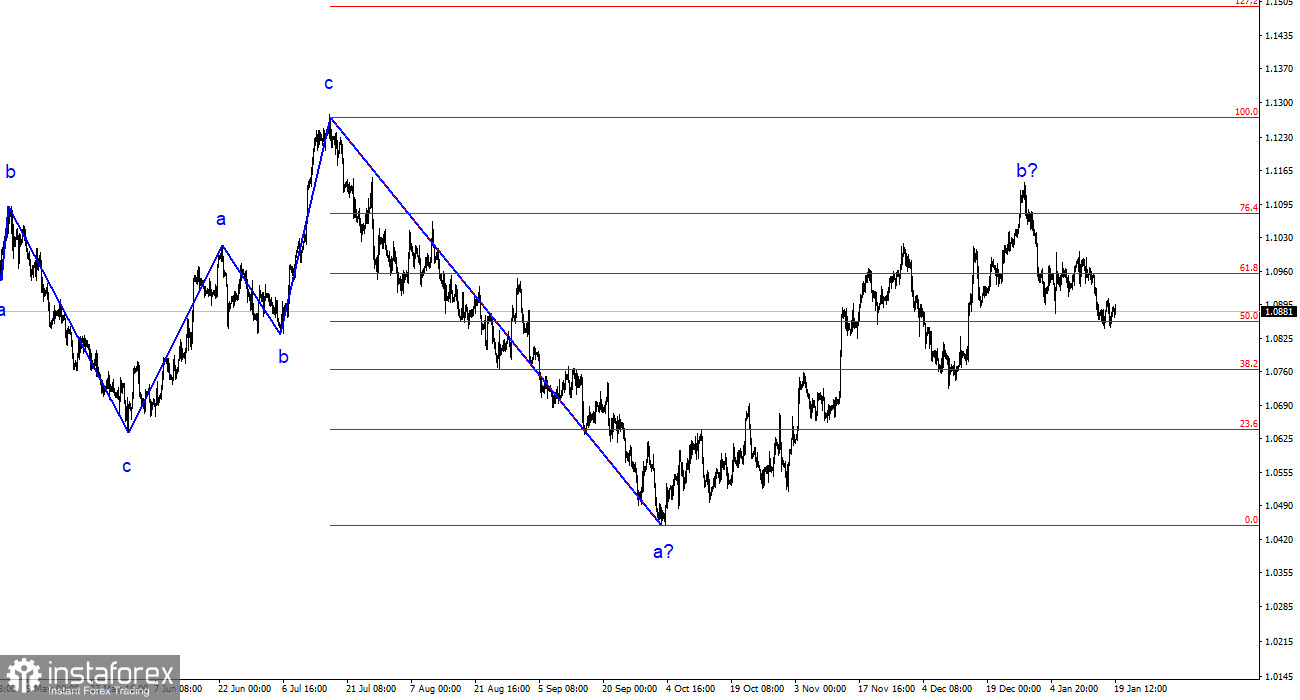

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. Over the past year, we have only seen three-wave structures that constantly alternate with each other. Currently, the construction of another three-wave pattern, a downward one, is continuing. The presumed wave 1 has been completed, but wave 2 or b has been complicated three or four times, and there are no guarantees that it won't get more complicated again.

Although the news background cannot be considered "supportive of the European currency," the market always finds new reasons to increase demand for the pair. In my opinion, such a situation is not normal. Even if the upward trend segment is resumed, its internal structure will become completely unreadable.

The internal wave count of the presumed wave 2 or b has changed. Since the last downward wave turned out to be disproportionately large, I now interpret it as wave b. If this is indeed the case, wave 3 or c is currently being formed, and the entire wave 2 or b is presumably completed. The current retreat from the highs looks convincing.

The market will continue to be cautious

The euro/dollar pair's exchange rate increased by 10 basis points on Friday. As I regularly say, the day has not yet ended, so we may still see a strong movement. The American session has not yet begun, and the most interesting movements usually occur there. However, the whole current week has been rather boring. We saw a good, interesting movement only on Tuesday when the pair fell by 80 basis points. All other days passed without a clear advantage for buyers or sellers. In my view, the market is approaching the opening of new deals very cautiously, as it does not understand what to expect from the ECB and the Federal Reserve in the first half of 2024.

Today, there were no interesting reports in the European Union, but overall, this week saw the release of the Consumer Price Index and two statements by Christine Lagarde. It would seem that these events are sufficient for active market trading. However, the final assessment of the inflation report did not differ from the first one, and Christine Lagarde made only one important statement related to monetary policy. The ECB President specifically stated on Tuesday that the rate may start to decline "closer to the summer."

In reality, Lagarde stated that "closer to the summer, the ECB will have all the necessary information to make conclusions about inflation dynamics and possible interest rate cuts," but the market "saw" a promise to lower rates at the end of spring. Previously, it was expected that the easing policy would not start until the summer or even the autumn. Demand for the European currency declined after this statement, but this process did not last long.

General Conclusions

Based on the analysis conducted, I conclude that the construction of a downward wave pattern continues. Wave 2 or b has taken on a completed form, so I expect the continuation of building an impulsive downward wave 3 or c with a significant decrease in the pair. An unsuccessful attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci retracement, indicated the market's readiness for sales a month ago. I am currently considering selling.

On a larger wave scale, it can be seen that the construction of corrective wave 2 or b continues, which in length is already more than 61.8% Fibonacci from the first wave. As I mentioned before, this is not critical, and the scenario of building wave 3 or c with a decline in the pair below the 1.4 level is still valid.