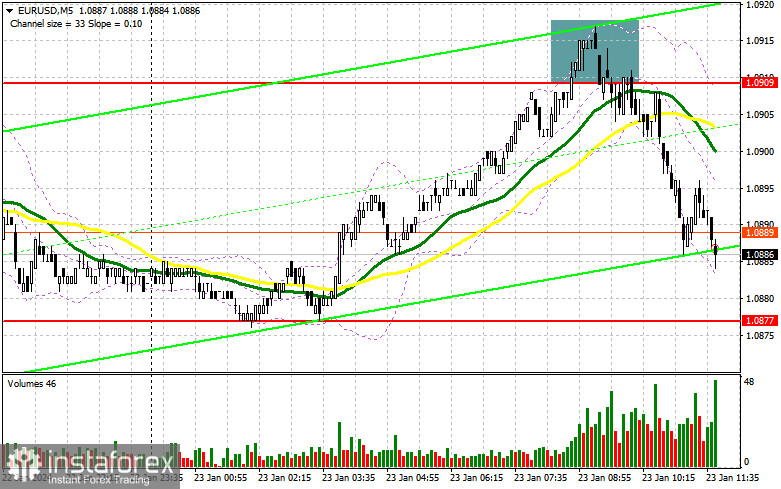

In my morning forecast, I pointed out the level of 1.0909 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout around 1.0909 provided an excellent entry point for selling from the upper boundary of the sideways channel, resulting in a 25-point downward movement. The technical picture remained unchanged for the second half of the day.

For opening long positions on EUR/USD, the following conditions are required:

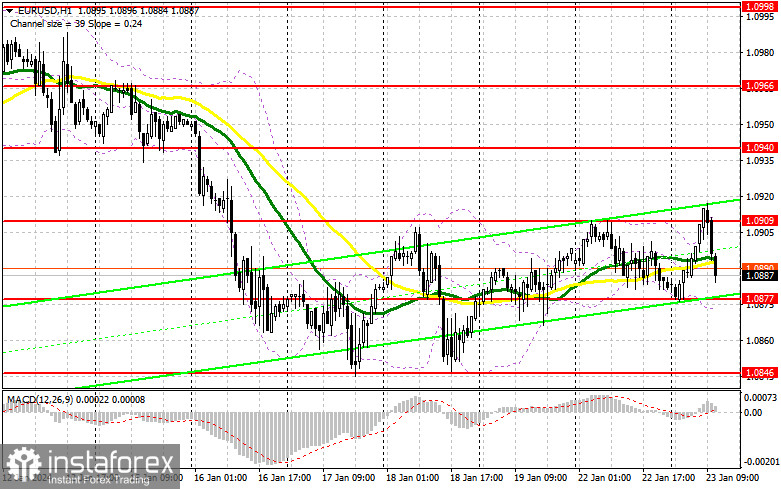

The absence of Eurozone statistics kept trading within a sideways channel, significantly affecting intraday volatility, which leaves much to be desired today. Ahead of us, there is only the Richmond Fed Manufacturing Index, which is unlikely to lead to significant market changes or disturbances. Since buyers failed to break above 1.0909 again, it is better to focus on protecting the nearest support at 1.0877, where the pair is currently heading. Only a false breakout at this level would be a suitable entry point for anticipating another upward movement towards 1.0909, where sellers have been active again today. Breaking and confirming above or below this range would set suitable conditions for buying or selling, with the potential for an upward correction and a target of 1.0940. The ultimate target would be 1.0966, where I would take profit. If there is a decline in EUR/USD and no activity around 1.0877 in the second half of the day, pressure on the pair will increase. In this case, I plan to enter the market only after a false breakout of around 1.0846. I recommend opening long positions upon a bounce from 1.0817 with the target of a 30-35 point intraday upward correction.

For opening short positions on EUR/USD, the following conditions are required:

Bears also maintain the chance of the euro's decline, as was well established earlier in the day. In the event of another upward move in the pair, a suitable entry point would be the formation of a false breakout around 1.0909, indicating the presence of sellers in the market and the potential for a new downward movement towards 1.0877. However, it is worth understanding that 1.0909 has been tested several times, so I advise you to take your time with decisions based solely on this level. Missing the 1.0877 level would add to the problems for buyers. After breaking and confirming below 1.0877 and a retest from below to above, I expect to receive another selling signal with an exit at 1.0846. The ultimate target would be the minimum at 1.0817, where I would take profit. In case of an upward movement of EUR/USD in the second half of the day and no bearish presence at 1.0909, demand for EUR/USD will increase, leading to a larger upward correction. In that case, I would postpone selling until testing the next resistance at 1.0940. I would also consider selling there, but only after a failed consolidation. I plan to open short positions immediately upon a bounce from 1.0966 with the target of a 30-35 point downward correction.

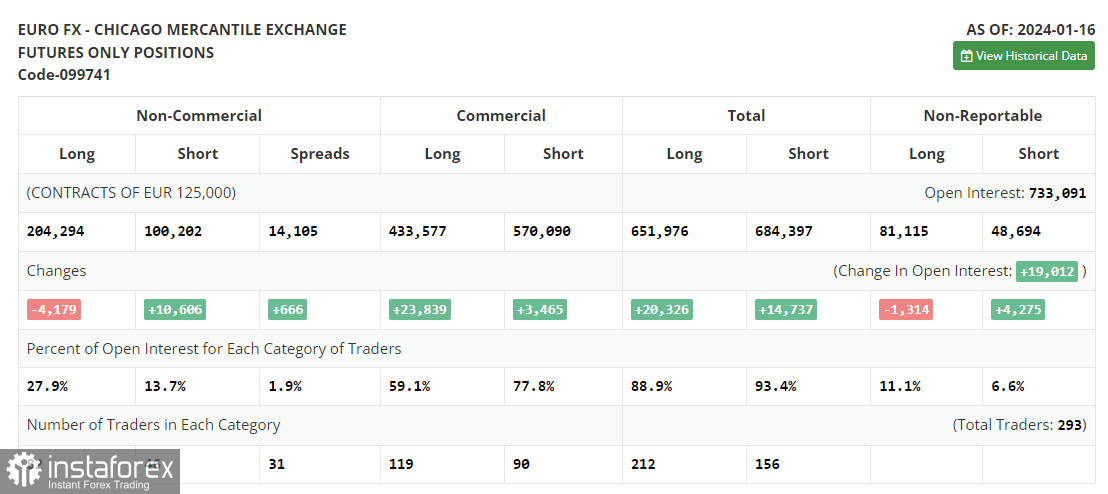

In the COT (Commitment of Traders) report for January 16th, there was a reduction in long positions and an increase in short positions, indicating a shift in favor of the US dollar. A strong labor market and the high probability of another inflationary spike in the US early this year are maintaining the chances of a tough policy by the Federal Reserve. The further the timing of the first rate cut in the US shifts, the stronger the dollar will become against the European currency. In the near future, the European Central Bank will hold a meeting, during which the regulator is expected to keep rates unchanged and continue to combat inflation, which should keep the euro's position in line with the US dollar, maintaining trading within the channel. In the COT report, it is noted that long non-commercial positions decreased by 4,179 to a level of 204,294, while short non-commercial positions increased by 10,606 to a level of 100,202. As a result, the spread between long and short positions increased by 666.

Indicator Signals:

Moving Averages:

Trading is conducted around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author analyzes the moving averages' period and prices on the hourly chart (H1) and differs from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator at around 1.0877 will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.