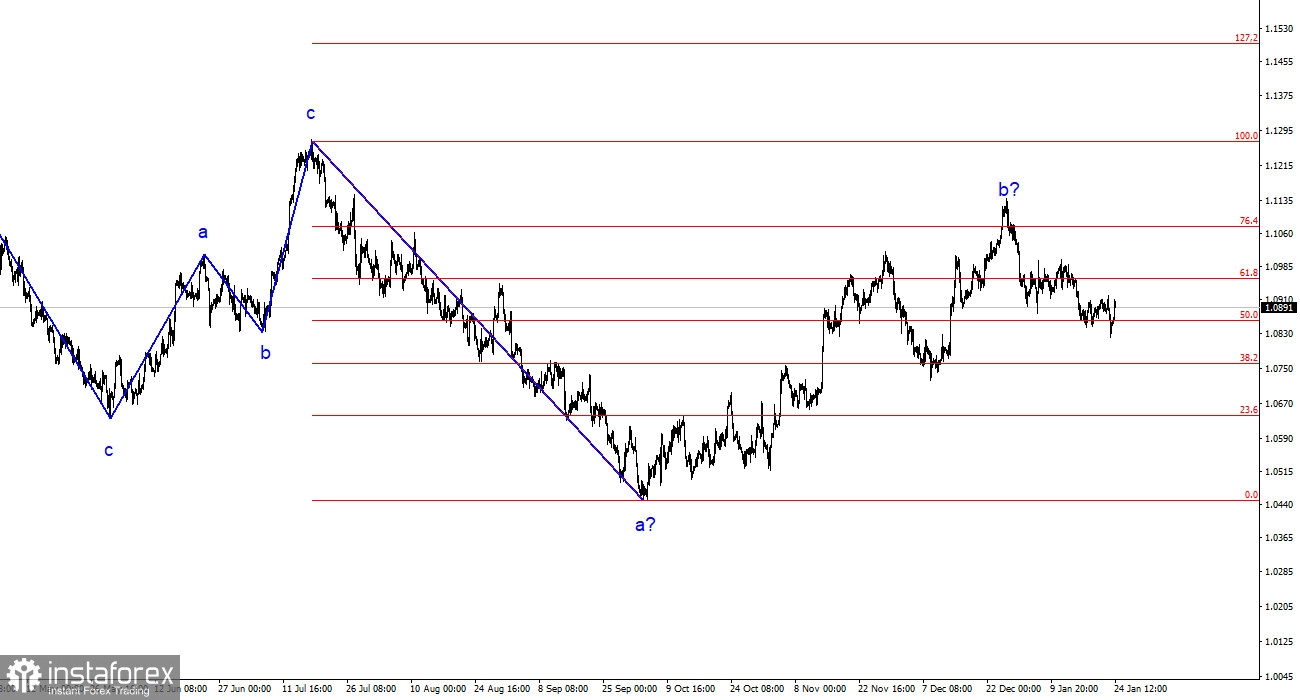

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. In the past year, we have seen only three wave structures that constantly alternate with each other. The construction of another three-wave structure is ongoing, and it is bearish. The presumed wave 1 has been completed, but wave 2 or b has complicated itself three or four times, and there are no guarantees that it won't complicate further.

Although the news background cannot be considered "supportive of the European currency," the market finds new reasons to increase demand for the pair each time. This situation is not normal. Even if the upward trend segment is resumed, its internal structure will become unreadable.

The internal wave analysis of the presumed wave 2 or b has changed. Since the last bearish wave turned out to be disproportionately large, I now interpret it as wave b. If this is the case, wave 3 or c is currently being formed, and the entire wave 2 or b is presumably completed. The current retreat from the highs looks convincing.

The euro fell and rose within a day. During Wednesday's session, the euro/dollar pair increased by 40 basis points. However, at the moment, it is impossible to say whether the dollar has risen or fallen by the end of Wednesday. The day is not over yet, and the American session has just begun. The most significant movements usually occur during the American session. Yesterday, I mentioned that there was no logical explanation for the decline of the European currency. The market, in general, logically reduces the demand for the EU currency, as the wave analysis and the overall news background support the fall of the euro and the rise of the dollar. However, there was no reason to reduce the demand for the euro yesterday.

However, the upcoming ECB meeting, which may turn "dovish," and the updated expectations for the Fed's rates in 2024 support the demand for the US dollar. Nevertheless, the American currency is growing, which is a good sign. Today, business activity indices were released in the European Union. The indicator rose by 2.2 points in the manufacturing sector to 46.6, but in the services sector, it fell from 48.8 to 48.4 points. The European currency responded to these data with an increase, but most of the way up from yesterday's lows was covered before this statistics release.

In Germany, business activity indices showed the same trend. The index rose in the manufacturing sector and fell in the services sector. The market began to rebound from the decline yesterday, and the business activity indices were more neutral than supportive of the euro. Both the rise and fall of the pair had no impact on the wave pattern. The construction of the presumed wave 3 or c continues.

General Conclusions:

Based on the analysis conducted, the construction of a bearish wave set continues. Wave 2 or b has taken on a completed form, so in the near future, I expect the continuation of the construction of an impulsive downward wave 3 or c with a significant decrease in the pair. The unsuccessful attempt to break through the level of 1.1125, corresponding to 23.6% Fibonacci, indicated the market's readiness for sales a month ago. I am only considering selling with targets near the calculated level of 1.0462, corresponding to 127.2% Fibonacci.

On a larger wave scale, it can be seen that the construction of corrective wave 2 or b is ongoing, which, in length, is already more than 61.8% Fibonacci from the first wave. As I have already mentioned, this is not critical, and the scenario of building wave 3 or c with a decline in the pair below the 1.04 level still remains valid.