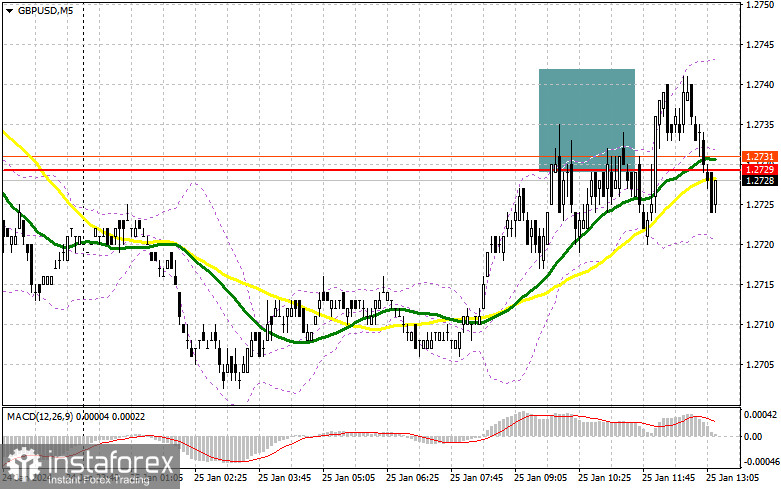

In my morning forecast, I emphasized the level of 1.2728 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout provided a good selling entry point for the pair; however, as you can see on the chart, the drop did not materialize. The technical picture was slightly revised in the second half of the day.

To open long positions on GBP/USD, the following conditions are required:

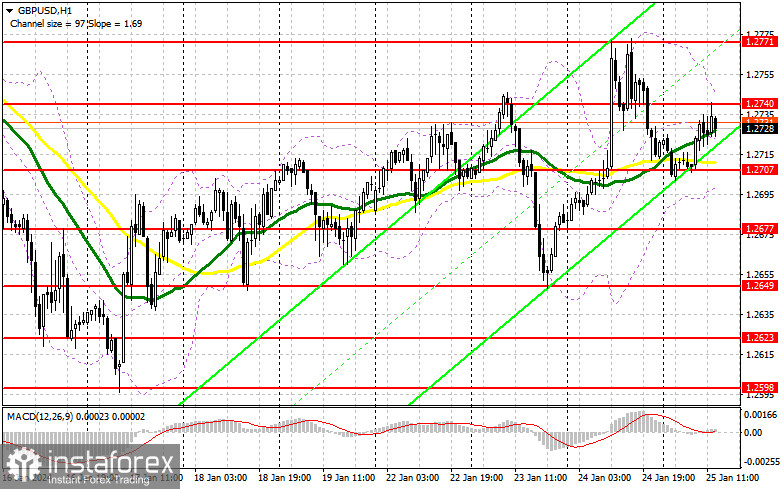

Now, the focus needs to be on the US data, which can significantly impact the pair's further growth. With strong US GDP figures for the 4th quarter of 2023, selling pressure will return to the pair. Additionally, a decrease in initial jobless claims and an increase in new home sales in the primary market will lead to even more GBP/USD sell-offs. In this case, I will act on a false breakout near the new support level at 1.2707, just above the moving averages, favoring buyers. Only this will provide an entry point for long positions to continue the bullish trend with the target of reaching 1.2740 - a new resistance level formed during the first half of the day. A breakthrough and consolidation above this range will strengthen demand for the pound and open the way to 1.2771. The ultimate target will be at 1.2797, where I plan to make a profit. In the scenario of the pair's decline and the absence of bullish activity at 1.2707, buyers will lose their initiative, and pressure on the pound will increase. In such a case, I will postpone purchases until testing 1.2677. Only a false breakout will confirm the correct entry point into the market. I plan to buy GBP/USD immediately on a rebound from 1.2649 with the aim of a 30-35 point correction within the day.

To open short positions on GBP/USD, the following conditions are required:

Sellers have so far achieved their goal and limited the pair's further growth. Now, only strong US statistics can help them. In the second half of the day, I will act on the rise, but only after forming a false breakout around the resistance level of 1.2740, similar to what I discussed earlier. Only this will confirm the presence of major sellers in the market and provide a selling entry point with the goal of a more significant decline toward the support level of 1.2707. A breakthrough and a retest from below to above this range will deal a more serious blow to the bullish positions, intensifying pressure on the pair and opening the path to 1.2677. The ultimate target will be in the 1.2649 area, where I plan to make a profit. In the scenario of further growth of GBP/USD and the absence of activity at 1.2740 in the second half of the day, which will only happen in the case of very weak US GDP data, buyers will continue to hold the initiative, counting on a move towards the annual maximum. In such a case, I will postpone selling until there is a false breakout at 1.2771. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.2797, but only in anticipation of a pair correction down by 30-35 points.

Indicator Signals:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating further pound growth.

Note: The author analyzes the moving averages' period and prices on the hourly chart (H1) and differs from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decline, the lower boundary of the indicator at around 1.2700 will act as support.

Description of Indicators:

- Moving Average (a tool that determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (a tool that determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

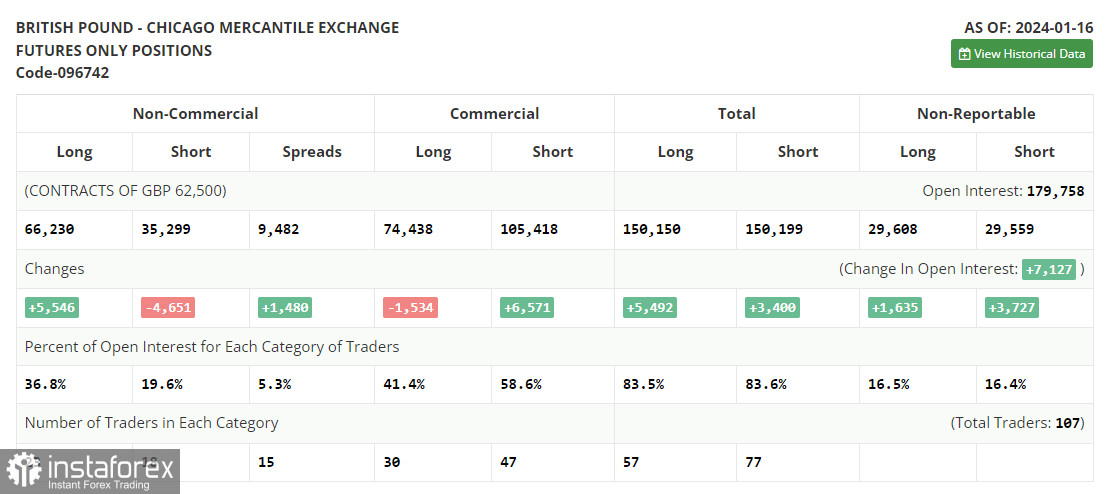

- Non-commercial traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between short and long non-commercial positions.