Last week, we witnessed the first FOMC meeting of the year. Back then there was no intrigue surrounding this: interest rates could not change, but Federal Reserve Chair Jerome Powell could give some hints about the timing of future monetary easing. Since the beginning of the year, the market believed that rates would start to fall in March. However, closer to the Fed meeting, market expectations began to shift towards at least May. Powell did not give a single sign that suggests policy easing at the next meeting and, on the contrary, stated that before lowering rates, it is necessary to ensure that inflation reaches the target level in the future.

How did this information affect the demand for the US currency? So far, the impact was quite weak. The US dollar edged up after the FOMC meeting, but the next day, the greenback was falling for no apparent reasons. The dollar rose again the following day (Friday), but this was due to strong US reports. Therefore, I cannot say that the dollar benefited as much from the FOMC meeting.

At the same time, Bank of America analysts changed their forecast for 2024. Earlier, they expected (like everyone else) the first cut in March, but after the FOMC meeting, they changed it to June. The BofA believes that the Fed may raise rates at a later period, but stronger. I believe there will be no "stronger" move, as FOMC members have repeatedly mentioned that they expect the Fed to gradually ease monetary policy.

BofA analysts also believe that there is very little time left until the May meeting, and inflation reports will not show any new dynamics for the Fed to decide on the first rate cut in May. They said that the central bank likes to make adjustments in policy after new quarterly economic forecasts. In other words, the Fed wants to first update its inflation and other economic indicators forecasts before it starts lowering rates. BofA also believes that the end of the QT program will be announced at the May meeting.

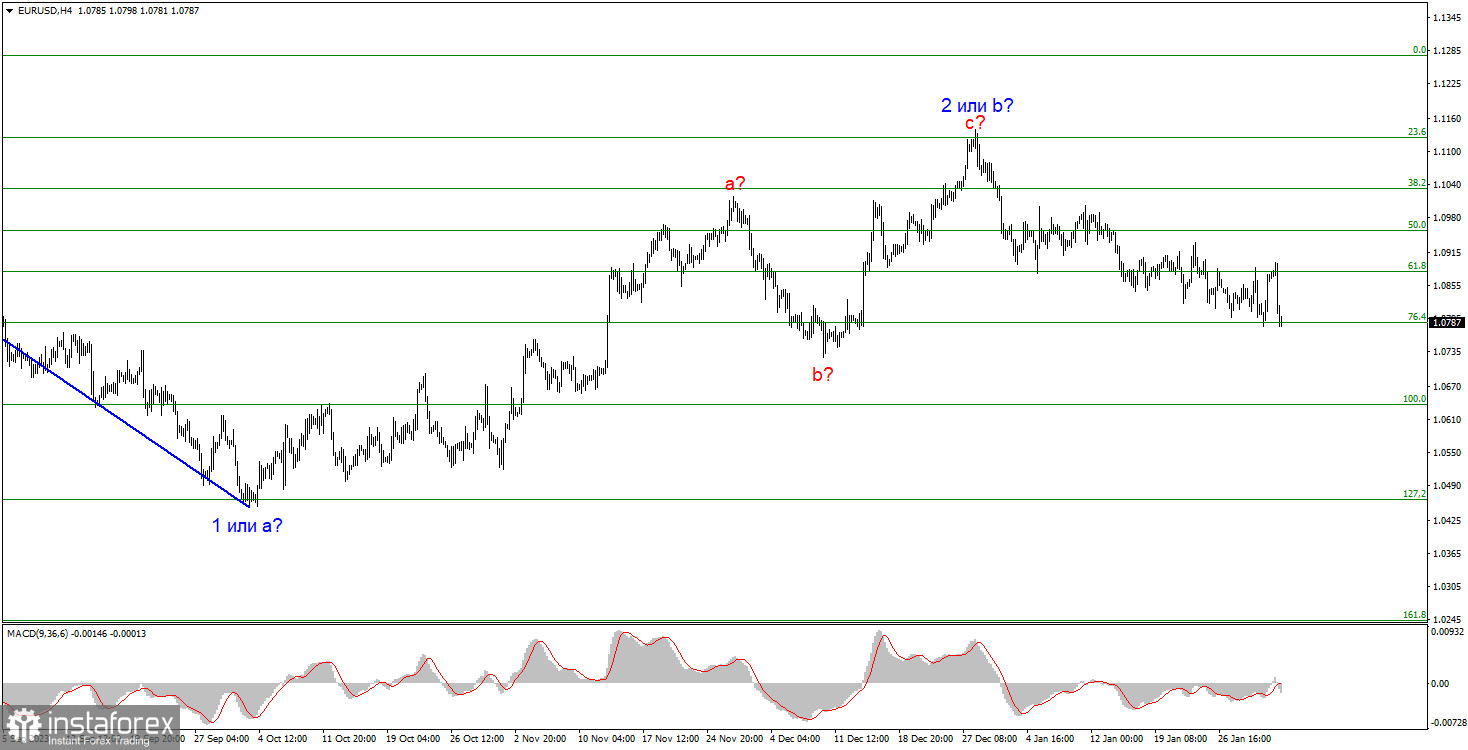

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

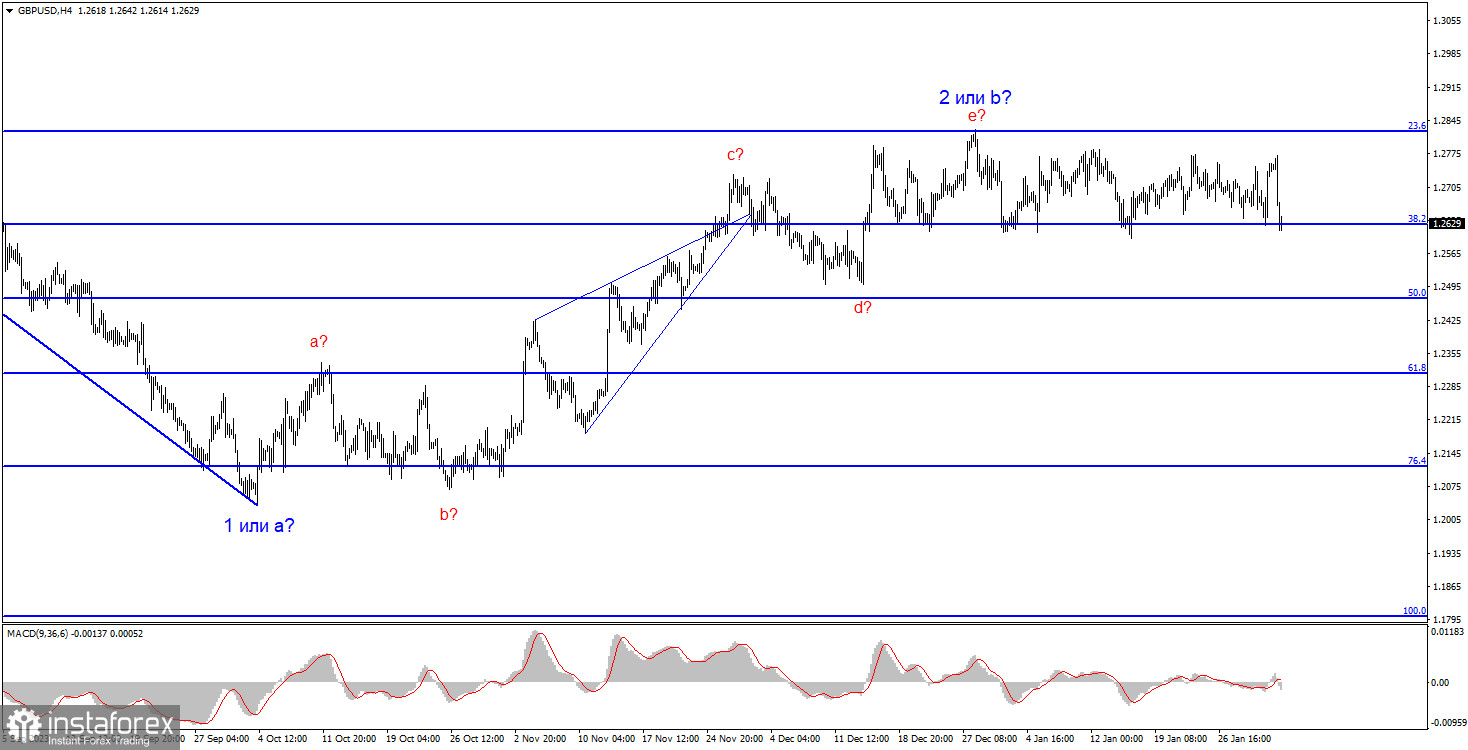

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing horizontal movement, I wouldn't rush to short positions at this time. I would wait for a successful attempt to break through the 1.2627 level in order to grow more confident about the instrument's decline.