The Bank of England meeting ended on Thursday, which many were eagerly awaiting. The markets were not expecting the British central bank to soften its hawkish mood since inflation remains persistently high. At the same time, analysts assumed that there would be some dovish hints. In my opinion, this is exactly what happened, but some experts found a place for hawkishness where there is none.

Some investors believe that the BoE has taken a hawkish position since only one member of the Monetary Policy Committee voted for a rate cut. BoE Governor Andrew Bailey preferred to keep the rate at the current level, as inflation is at 4%, and the central bank needs to be confident in reducing it by half. Some analysts also believe that the BoE chose inflation over the economy. If so, the BoE will be guided by the Consumer Price Index rather than the state of the economy, which leaves much to be desired. In this case, even if the economy enters a recession (although it has been teetering on the brink of decline for six quarters), the central bank will still maintain the rate due to its main task – to return inflation to the 2% target.

These two theses are easily refuted by facts and common sense. At the last meeting, three of its members voted for a rate hike. In the recent meeting, two MPC members continued to vote for a rate increase, while one voted for a rate cut. The difference is clear, and it suggests that the central bank is softening its sentiment. The fact that the central bank has chosen the latter between the economy and inflation is not news at all, as over the past one and a half to two years, all of the BoE's actions have been aimed at combating high inflation. In addition, the phrase about the possible need for additional tightening was removed from the final statement on monetary policy, and Bailey said that the rate will not be lowered in the near future. At the same time, if five out of nine officials vote for a rate cut, the policy will be eased, even if Bailey is against it. One such vote has already been cast.

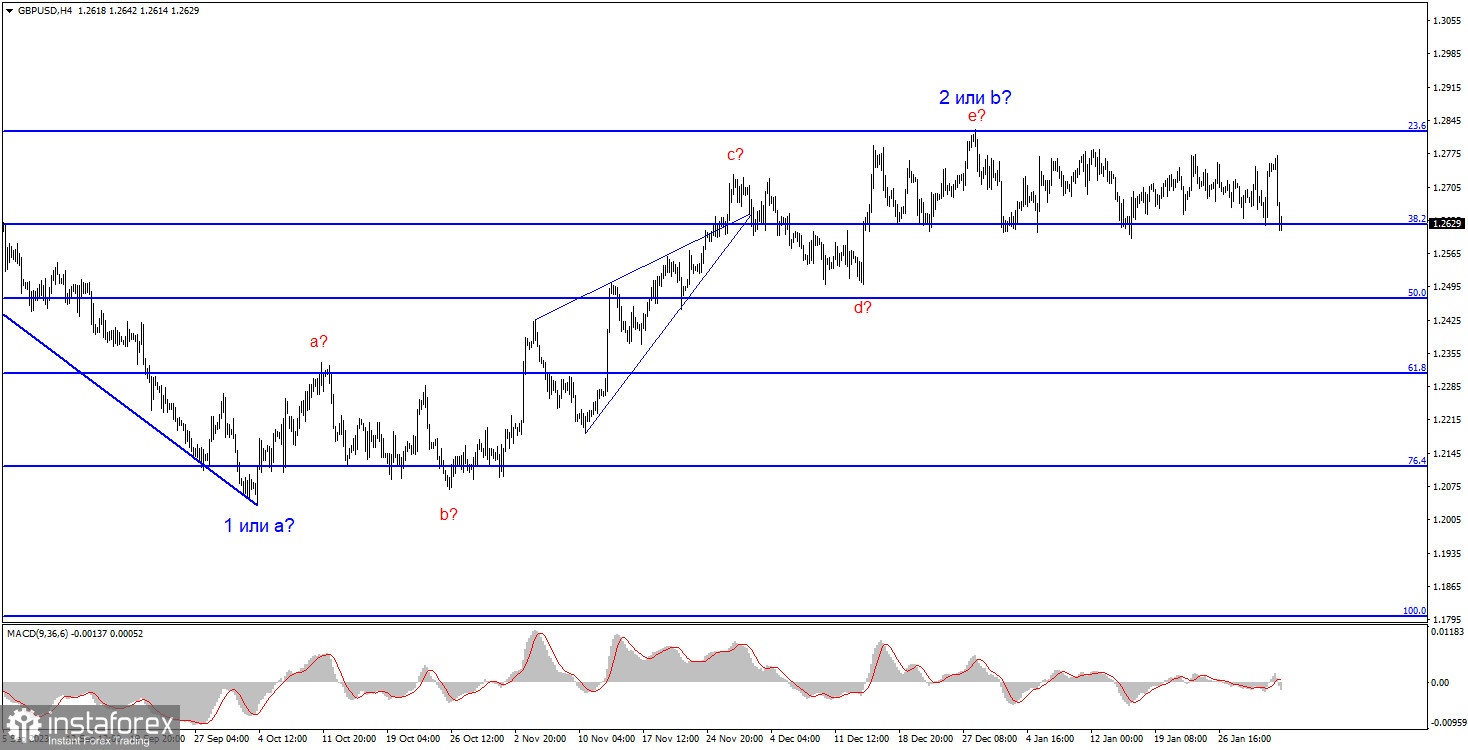

Based on everything I mentioned above, I consider the outcomes of the meeting to be dovish. The sideways trend persists for the British pound and GBP/USD is currently making its seventh attempt to break through the level of 1.2627, which corresponds to 38.2% Fibonacci retracement.

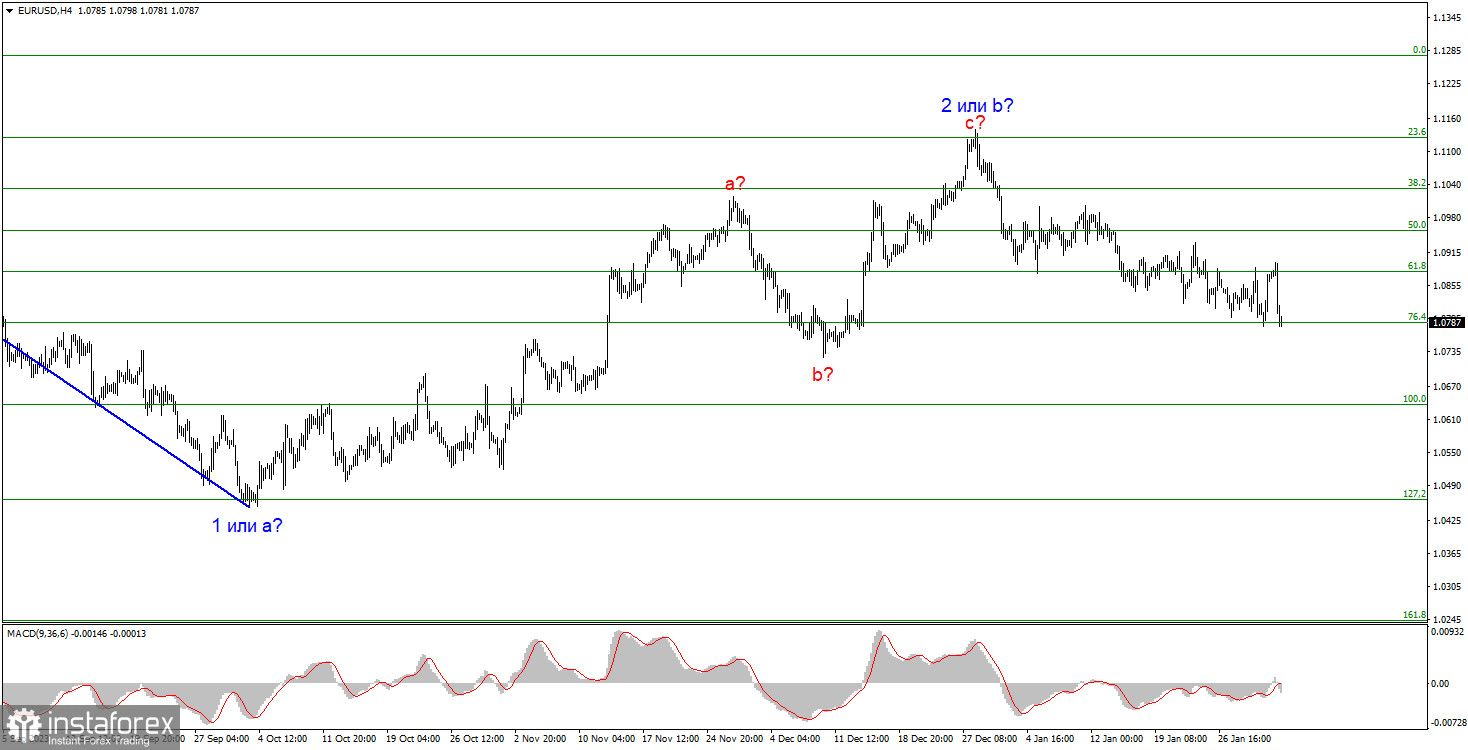

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets around the level of 1.0462, which corresponds to 127.2% Fibonacci.

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing horizontal movement, I wouldn't rush with short positions at this time. I would wait for a successful attempt to break through the 1.2627 level in order to grow more confident about the instrument's decline.