Trend analysis

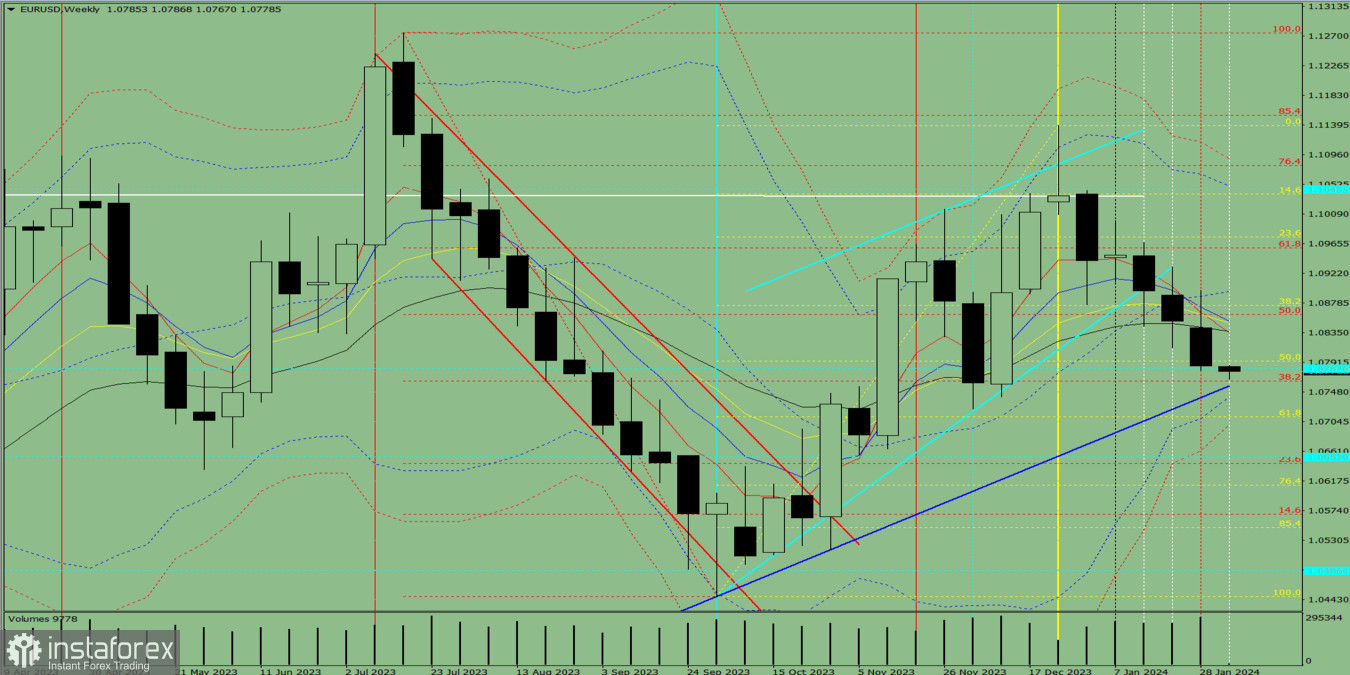

EUR/USD may continue moving downward this week, falling from 1.0786 (closing price of the last weekly candle) to the support line located at 1.0756 (thick blue line). Upon testing this line, the pair may start moving upward.

Fig. 1 (weekly chart)

Comprehensive analysis:

Indicator analysis - downward

Fibonacci levels - downward

Volumes - downward

Candlestick analysis - upward

Trend analysis - upward

Bollinger bands - downward

Monthly chart - upward

Conclusion: The indicators point to a downward movement in EUR/USD.

Overall conclusion: The pair will have a bearish trend, with no first upper shadow on the weekly black candle (Monday - downward) and a second lower shadow (Friday - upward).

Therefore, during the week, euro will decline from 1.0786 (closing price of the last weekly candle) to the support line located at 1.0756 (thick blue line), and then go upwards after testing the line.

Alternatively, it could move from 1.0786 (closing price of the last weekly candle) to the 61.8% retracement level of 1.0711 (yellow dashed line), followed by a rise to the 50% retracement level of 1.0861 (red dashed line).