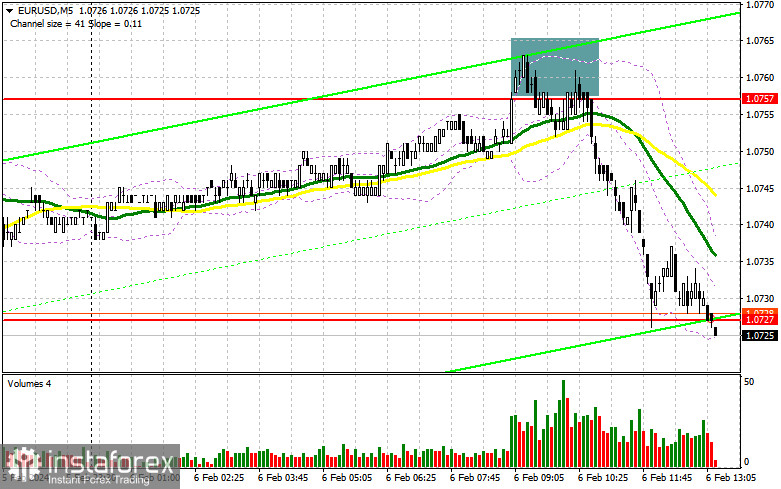

In my morning forecast, I paid attention to the 1.0757 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The growth and formation of a false breakdown in the area of 1.0757 led to an excellent entry point for sale further along the trade, which resulted in a drop in the pair by more than 3 points. In the afternoon, the technical picture was revised.

To open long positions on EURUSD, you need:

As expected, the released data on Germany and the eurozone did not provide any support for the euro, although in the first half of the day the bulls tried to return to the market. During the American session, data on the RCM/TIPP economic optimism index is expected, which is not of great interest, as well as a speech by FOMC member Loretta Mester, which may lead to a small spike in volatility, but is unlikely to reverse the observed bearish trend.

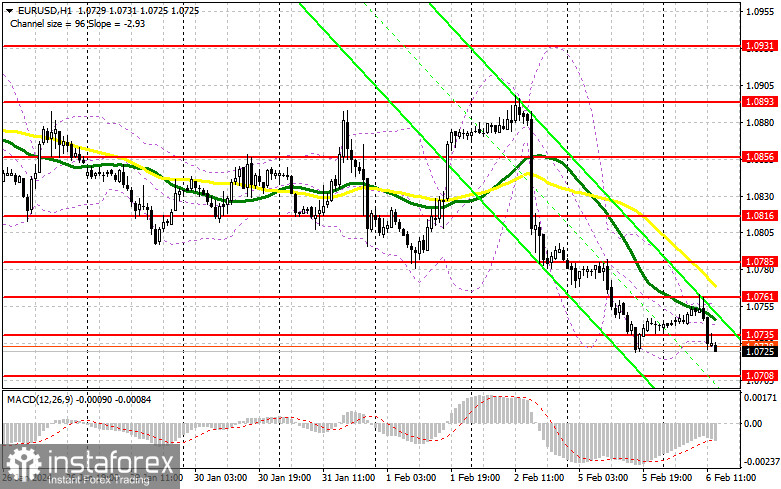

I will act to buy against the trend only in the area of the new support 1.0708, the movement to which may occur in the near future.. Only with the formation of a false breakout, there will be a suitable entry option for me, expecting the pair to move upward towards 1.0735 – the resistance formed during the first half of the day. A breakout and a new low below this range will provide an opportunity to buy with the development of a more powerful upward correction and the prospect of updating 1.0761, where we already experienced a significant drop today. The ultimate target will be a maximum of 1.0785, where I will take profit. Moving averages, playing on the sellers' side, are also present there. In the case of a decline in EUR/USD and the absence of activity at 1.0708 in the second half of the day, which is the likely scenario, pressure on the pair will persist. In this case, I plan to enter the market only after the formation of a false breakout around 1.0667. I will consider opening long positions immediately on a rebound from 1.0642 with the target of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, the following is required:

Bears have achieved their targets for the first half of the day and continue to control the market. As long as trading is conducted below 1.0735, further decline in the pair can be expected. Protecting this level in case of pair growth is the priority task for sellers during the American session. The formation of a false breakout there may lead to further downward movement of EUR/USD towards 1.0708. Only a breakout and consolidation below this range on the background of hawkish comments from Federal Reserve representatives, as well as a reverse test from bottom to top, will provide another selling point with a collapse of the pair towards 1.0667. The ultimate target will be a minimum of 1.0642, where I will take profit. In the case of an upward movement of EUR/USD in the second half of the day, as well as the absence of bears at 1.0735, demand for EUR/USD will return. In this case, I will postpone sales until testing the next resistance at 1.0761. I will also sell there, but only after an unsuccessful consolidation similar to what I discussed earlier. I plan to open short positions immediately on a rebound from 1.0785 with the target of a downward correction of 30-35 points.

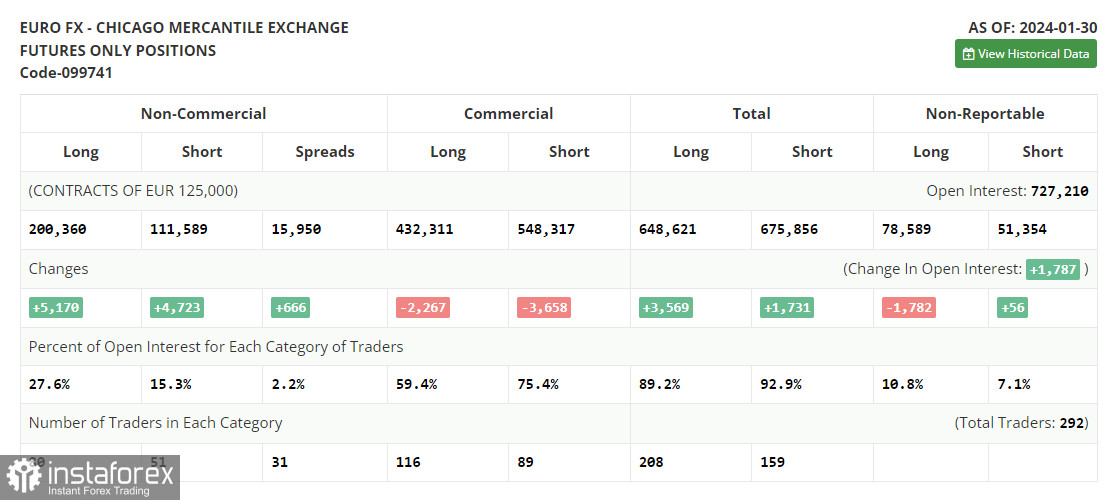

In the COT report (Commitment of Traders) for January 30th, there was an increase in both long and short positions. Obviously, after the Federal Reserve meeting, it became clear that no one intends to change anything for now. The latest data on the US GDP and job market also indicate that rates need to be kept high for as long as possible since lowering them now may lead to another surge in inflationary pressure, which the central bank has been fighting for almost two years. This week promises to be quite calm in terms of statistics, so one can expect the continuation of the bearish trend for the euro and the strengthening of the US dollar. According to the COT report, long non-commercial positions increased by 5,170 to the level of 200,360, while short non-commercial positions increased by 4,723 to the level of 111,589. As a result, the spread between long and short positions increased by 666.

Indicator signals:

Moving Averages:

Trading is carried out below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decrease, the lower boundary of the indicator will act as support around 1.0725.

Description of indicators:

Moving Average (MA) is used to determine the current trend by smoothing volatility and noise. The period is 50. Marked on the chart in yellow.

Moving Average (MA) is used to determine the current trend by smoothing volatility and noise. The period is 30. Marked on the chart in green.

The Moving Average Convergence/Divergence (MACD) indicator. Fast EMA period 12, slow EMA period 26, SMA period 9.

Bollinger Bands. Period – 20.

Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

Long non-commercial positions represent the total long open position of non-commercial traders.

Short non-commercial positions represent the total short open positions of non-commercial traders.

The total non-commercial net position is the difference between the short and long positions of non-commercial traders.