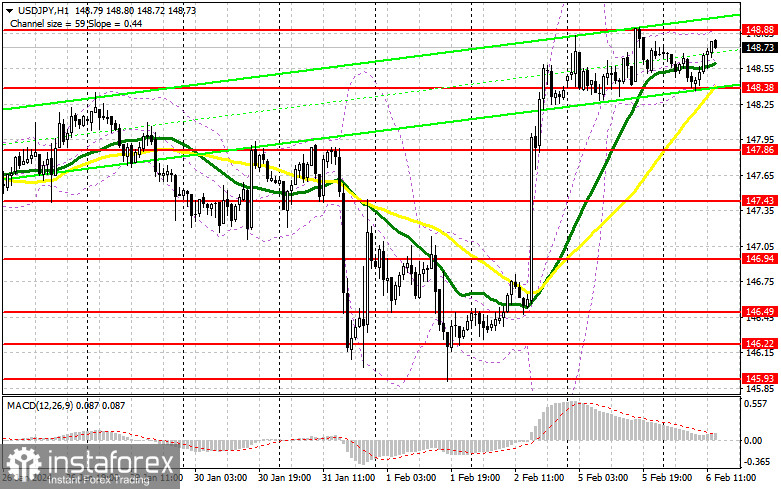

In my morning forecast, I drew attention to the level of 148.81 and planned to make decisions regarding market entry based on it. Let's take a look at the 5-minute chart and analyze what happened there. Growth occurred, but we did not reach the test and formation of a false breakout. In the second half of the day, the technical picture was slightly revised, but overall, trading continues within a sideways channel with a good prospect of breaking the annual high.

To open long positions on USD/JPY, the following is required:

The demand for the dollar will depend on the data on the RCM/TIPP Economic Optimism Index, which is not of great interest, as well as on the speech of FOMC member Loretta Mester, which may lead to a slight volatility spike. Mester's firm position can be interpreted by the markets in favor of the American dollar, leading to another upward spike in the pair in an attempt to break the annual high.

In case the pressure on the pair returns, I plan to act on buying in the second half of the day only after the formation of a false breakout around the new support at 148.38, formed after the European session. Good US data will be the key to the success of the upward trend of the dollar with the target of another update to the level of 148.88, which has not been surpassed this week. A breakout and reverse test of this range from top to bottom will lead to another option for increasing long positions, capable of pushing USD/JPY up to around 149.23. The ultimate target will be the area of 149.62, where I plan to make a profit. In the scenario of a pair's decline and the absence of buyer activity at 148.38 in the second half of the day, strengthening pressure on the dollar will lead to a small sell-off. In this case, I will try to enter the market around 147.86, where the moving averages supporting the bulls are located. Only a false breakout there will be a good condition for opening long positions. I plan to buy USD/JPY immediately on a rebound only from the minimum around 147.43, aiming for a 30-35 point correction within the day.

To open short positions on USD/JPY, the following is required:

Sellers did not show themselves much in the first half of the day, apparently postponing their efforts to defend the annual high. In case of a pair's growth, bears will have to defend the resistance at 148.88. A false breakout would be a suitable scenario for selling within the sideways channel with the aim of a decline to around 148.38, where the moving averages supporting the bulls are located. A breakout and reverse testing from the bottom to the top of this range after the data will deal a more serious blow to buyer positions, leading to the triggering of stop-loss orders and opening the path to 147.86. The ultimate target will be the area of 147.43, where I plan to make a profit. In the scenario of USD/JPY growth and the absence of activity at 148.88 in the second half of the day, and everything is heading in that direction, buyers will strengthen their advantage. In this case, it is best to postpone sales until testing the next resistance at 149.23. In the absence of downward movement, I will sell USD/JPY immediately on a rebound only from 149.62, but only counting on a pair correction down by 30-35 points within the day.

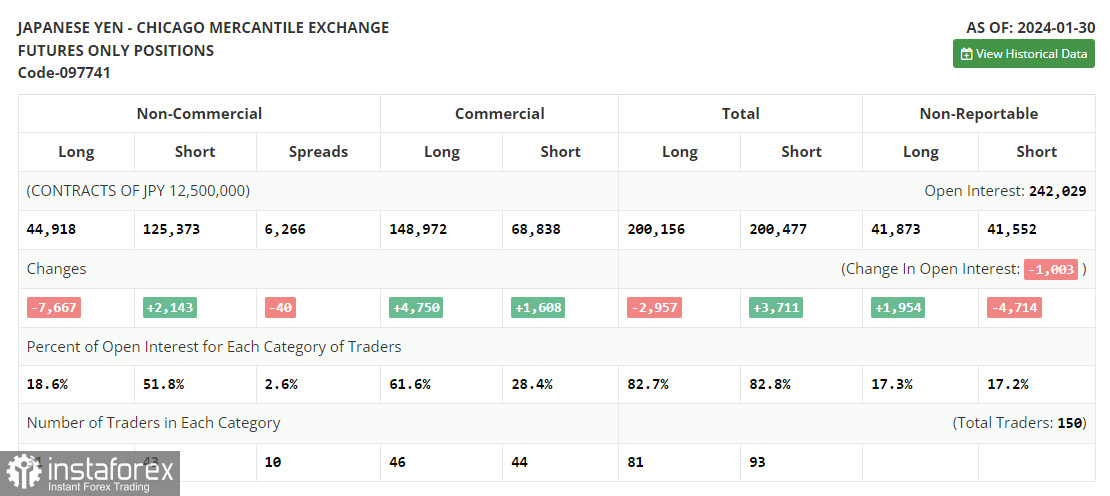

In the COT report (Commitment of Traders) for January 30th, there was an increase in short positions and a reduction in long positions. The results of the Bank of Japan's meeting have long been forgotten by everyone, but a certain emphasis and the Federal Reserve's wait-and-see position, even without clear indications of a possible interest rate hike – all of this maintain pressure on the yen and demand for the dollar. Most likely, buyers will continue active attempts to break beyond the annual high, which may result in a new ascending medium-term trend. The latest COT report states that long non-commercial positions decreased by 7,667 to the level of 44,918, while short non-commercial positions jumped by 2,143 to the level of 125,373. As a result, the spread between long and short positions decreased by 40.

Indicator signals:

Moving Averages:

Trading is conducted above the 30 and 50-day moving averages, indicating further dollar growth.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decrease, the lower boundary of the indicator will act as support around 148.38.

Description of indicators:

- Moving Average (MA) is used to determine the current trend by smoothing volatility and noise. The period is 50. Marked on the chart in yellow.

- Moving Average (MA) is used to determine the current trend by smoothing volatility and noise. The period is 30. Marked on the chart in green.

- The Moving Average Convergence/Divergence (MACD) indicator. Fast EMA period 12, slow EMA period 26, SMA period 9.

- Bollinger Bands. Period – 20.

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial trade