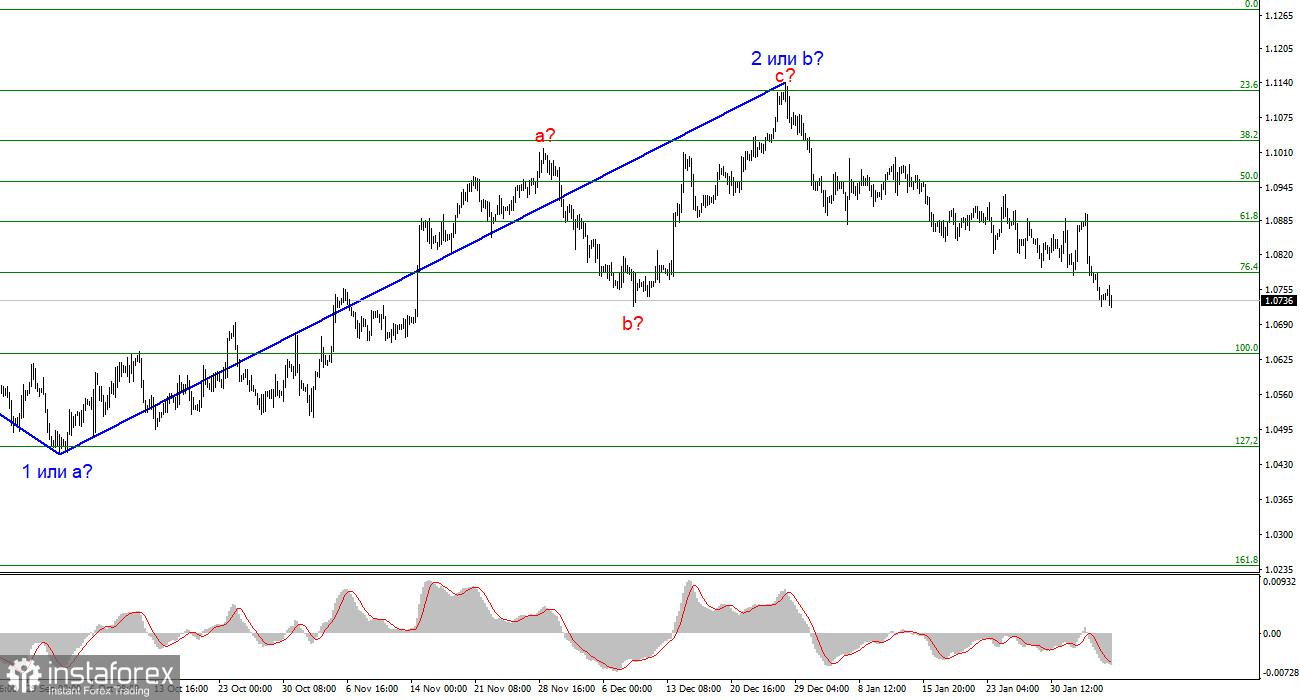

The first days of the new week did not go very well for the euro. However, it was good for us, as I have long insisted that the instrument has switched to building an impulsive downward wave 3 or c, with targets located below the 5th figure. This gives us grounds to expect that the euro will fall further by at least 400-500 basis points. However, such a decline does not happen out of nowhere; it requires specific reasons and grounds.

In my opinion, the basis for the euro's decline has long been generated. It is expressed by a whole range of factors. I will briefly list them. First - the current part of the trend is bearish, and the corrective wave 2 or b is completed. Second - the market believed that the Federal Reserve would be the first central bank to immediately lower rates, followed by the European Central Bank, but the first central banks' meetings this year showed that reality could be the opposite. Third - the U.S. economy is showing growth from quarter to quarter, while the European economy has been in stagnation for over a year. Fourth - overall, the U.S. economic reports have been much more optimistic.

As the ECB allows the first rate cut as early as the beginning of summer, each subsequent statement by a member of the ECB Governing Council who voices a dovish stance only diminishes the market's desire to increase demand for the euro. On Tuesday, Pablo de Cos delivered a speech, saying that the ECB is confident in returning inflation to the target of 2%. I would like to remind you that many ECB and Fed members have repeatedly stated that they are not confident in reducing inflation to 2%, which explains why they are cautious about monetary easing. In general, de Cos became the first politician to express confidence in achieving the target. If so, is the ECB ready to lower the interest rate?!

Pablo de Cos is confident that the next move will be a rate cut, but did not specify a specific timeframe. However, this is not required, as an increasing number of ECB officials are talking about the imminent start of the easing procedure. Now it no longer matters when exactly the central bank will embark on this action; the market has become convinced that interest rates will start to fall soon. Since the market likes to anticipate events in advance, it has already started to reduce demand for the euro, which fully corresponds to the current wave pattern.

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

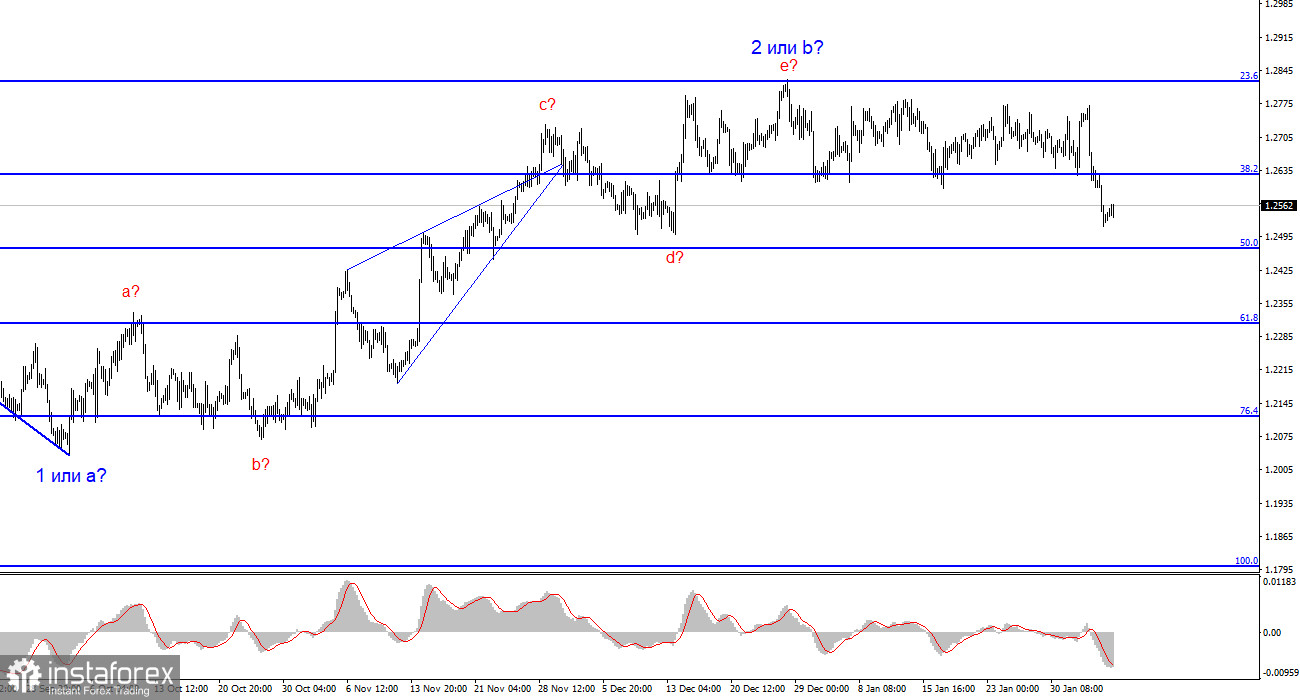

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. I would wait for a successful attempt to break through the 1.2627 level, as this will serve as a sell signal, which, hopefully, everyone managed to open. Take note that after a daily decline, the instrument may rebound, but I only expect it to fall further.