Analysis of EUR/USD 5M

The EUR/USD pair's decline stopped and it started to correct higher on Tuesday. The euro fell for two consecutive days, and the pair is following a downtrend. Therefore, the movements we observed in the last few days are entirely logical. The pair cannot continuously fall every day, so we might see pullbacks and corrections from time to time. However, the main thing is that not only does the downtrend persist, but it is also supported by almost all types of analysis. Only market participants themselves can spoil this if they go back to buying the euro for illogical reasons.

Among the macroeconomic events on Tuesday, we can only highlight the euro area retail sales report. Since this report turned out to be worse than forecasts and even previous values, the euro could have fallen even lower. However, we already warned you that traders do not consider this a significant report, so the market reaction is improbable. As a result, we saw low volatility and weak, non-trending movements.

The pair may correct up to the Kijun-sen line or even the Senkou Span B, but then we expect it to resume the downward movement. Take note that the targets of the current trend are much lower.

Yesterday, on the 5-minute timeframe, only one trading signal was generated. During the European session, the pair bounced off the level of 1.0757 but managed to fall by only 25 pips. This was enough to set a Stop Loss to breakeven, but it was very difficult to count on profit due to low volatility.

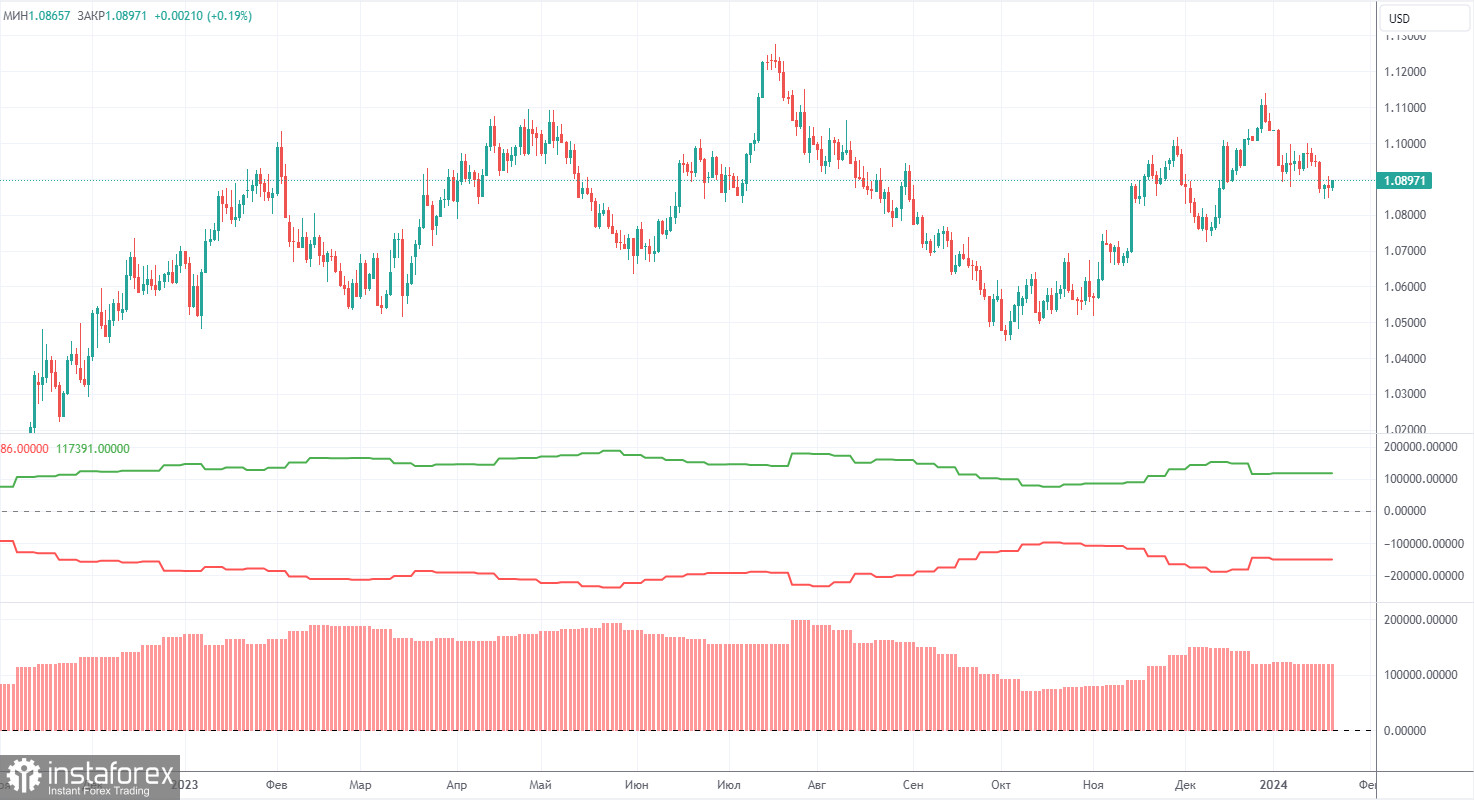

COT report:

The latest COT report is dated January 23. As seen in the charts above, it is clear that the net position of non-commercial traders has been bullish for quite some time. To put it simply, the number of long positions is much higher than the number of short positions. This should support the euro, but we still do not see fundamental factors for the euro to strengthen further. In recent months, both the euro and the net position have been rising. However, over the past few weeks, big players have started to reduce their long positions, and we believe that this process will continue.

We have previously pointed out that the red and green lines have moved apart from each other, which often precedes the end of a trend. At the moment, these lines are still far apart. Therefore, we support the scenario in which the euro should fall and the uptrend must end. During the last reporting week, the number of long positions for the non-commercial group decreased by 9,100, while the number of short positions increased by 6,600. Accordingly, the net position fell by 15,700. The number of buy contracts is still higher than the number of sell contracts among non-commercial traders by 89,000 (it was 104,000). The gap is quite large, and even without COT reports, it is clear that the euro should continue to fall.

Analysis of EUR/USD 1H

On the 1-hour chart, the downtrend persists. Since the US economy is still strong and rarely disappoints, the euro may continue to fall further, which is exactly what we expect. In our opinion, nearly all the current factors indicate that the dollar will strengthen.

On February 7, we highlight the following levels for trading: 1.0581, 1.0658-1.0669, 1.0757, 1.0823, 1.0889, 1.0935, 1,1006, 1.1092, 1.1137, 1.1185, as well as the Senkou Span B (1.0864) and Kijun-sen (1.0811) lines. The Ichimoku indicator lines can move during the day, so this should be taken into account when identifying trading signals. Don't forget to set a breakeven Stop Loss if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

On Wednesday, we can only highlight the German industrial production data, and US reports on import, export, and trade balance. All these reports are of secondary importance, so we do not expect a strong market reaction. We believe that we will continue to see low volatility and a corrective nature of movements.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.