The British pound is expected to face intense scrutiny in the coming days. Releases of data on the labor market, inflation, GDP, and retail sales will be the key factors influencing the Bank of England's decisions regarding future steps in monetary policy. These factors will also impact the pound's positions on the international currency market. When combined with the crucial report on U.S. inflation, the storm for GBP/USD is virtually guaranteed.

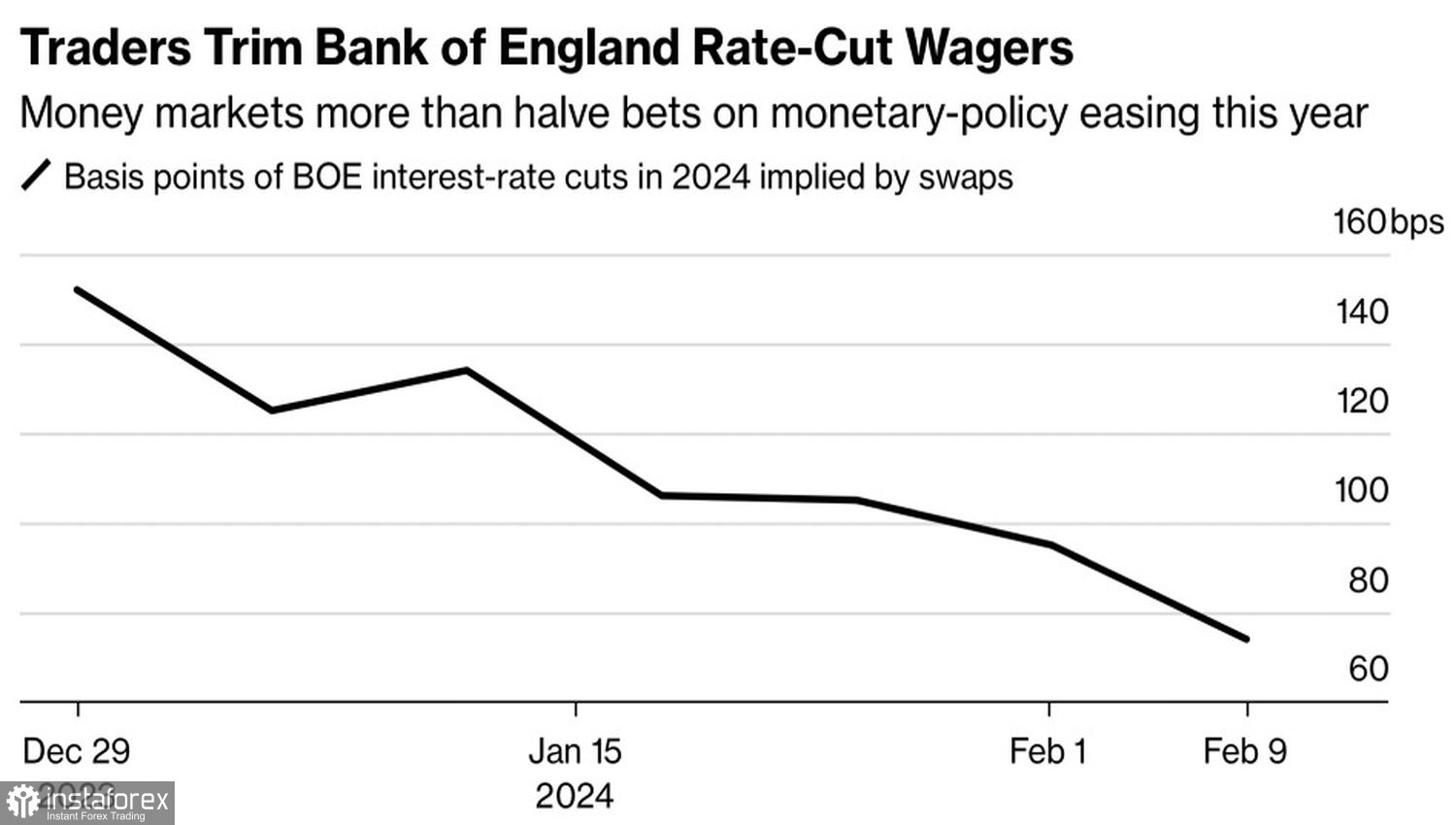

As of the start of 2024, markets are actively reassessing their views on the fate of central bank interest rates. Nowhere is this process unfolding as rapidly as in the United Kingdom. While derivative markets in late December anticipated a 150 basis points reduction in the repo rate over the next 12 months, the current expectations are a more modest 75 basis points reduction, bringing it to 4.5%. The timeline for the initiation of the Bank of England's monetary expansion has shifted to August, providing support for the pound.

Dynamics of the anticipated scale of the Bank of England's monetary expansion

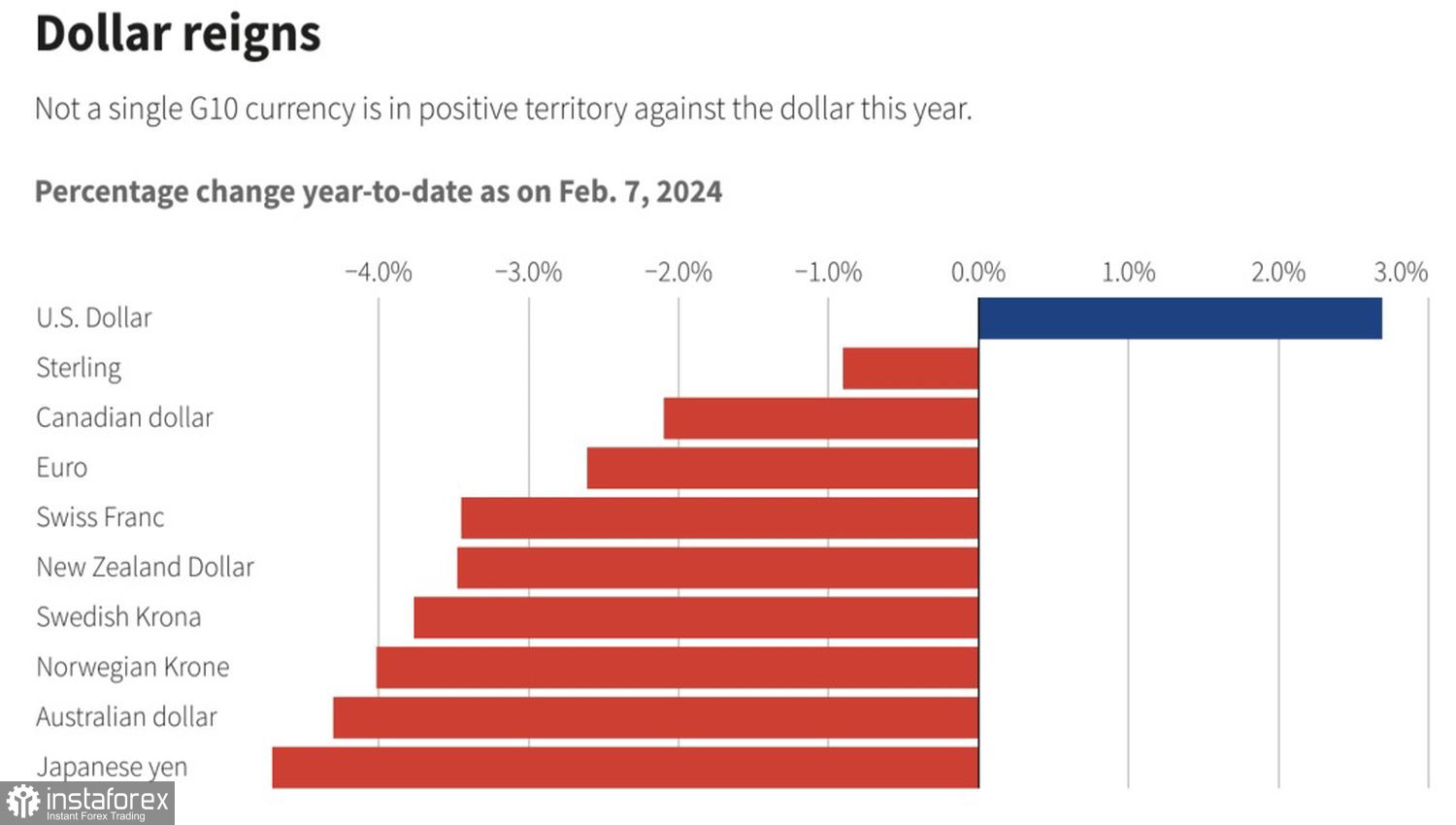

The shift in market preferences towards a slower pace of easing in BoE monetary policy has turned the pound into a favorite on the Forex market. Yes, it is conceding ground to the robust U.S. dollar due to the strength of the U.S. economy. However, against other G10 currencies, the pound is dominating. It has strengthened by 1.5% against the euro since the beginning of the year and by 5.4% against the Japanese yen. As a result, the trade-weighted exchange rate of the pound has soared to its highest level since May 2022.

Support for GBP/USD "bulls" came from the unexpected surge in inflation in December, the Bank of England's forecast that consumer prices may accelerate after approaching 2%, and the two MPC members who voted for a repo rate hike in February. Catherine Mann believes that financial conditions have weakened too much, posing a threat of a new inflation peak amid a tight labor market and rising real incomes. Jonathan Haskell requires more evidence of CPI reduction to the target to change his "hawkish" views.

G10 currency dynamics in 2024

Thus, sterling positions appear robust, but not everyone agrees. For instance, Societe Generale believes that the UK economy will disappoint, leading to a more extensive BoE monetary expansion than expected by markets and contributing to a decline in GBP/USD quotes.

Nevertheless, Bloomberg experts forecast further acceleration of British core inflation in January from 5.1% to 5.2% and consumer prices from 4% to 4.2%, which, in the context of slowing U.S. CPI, will allow GBP/USD bulls to lick their wounds inflicted by the U.S. labor market.

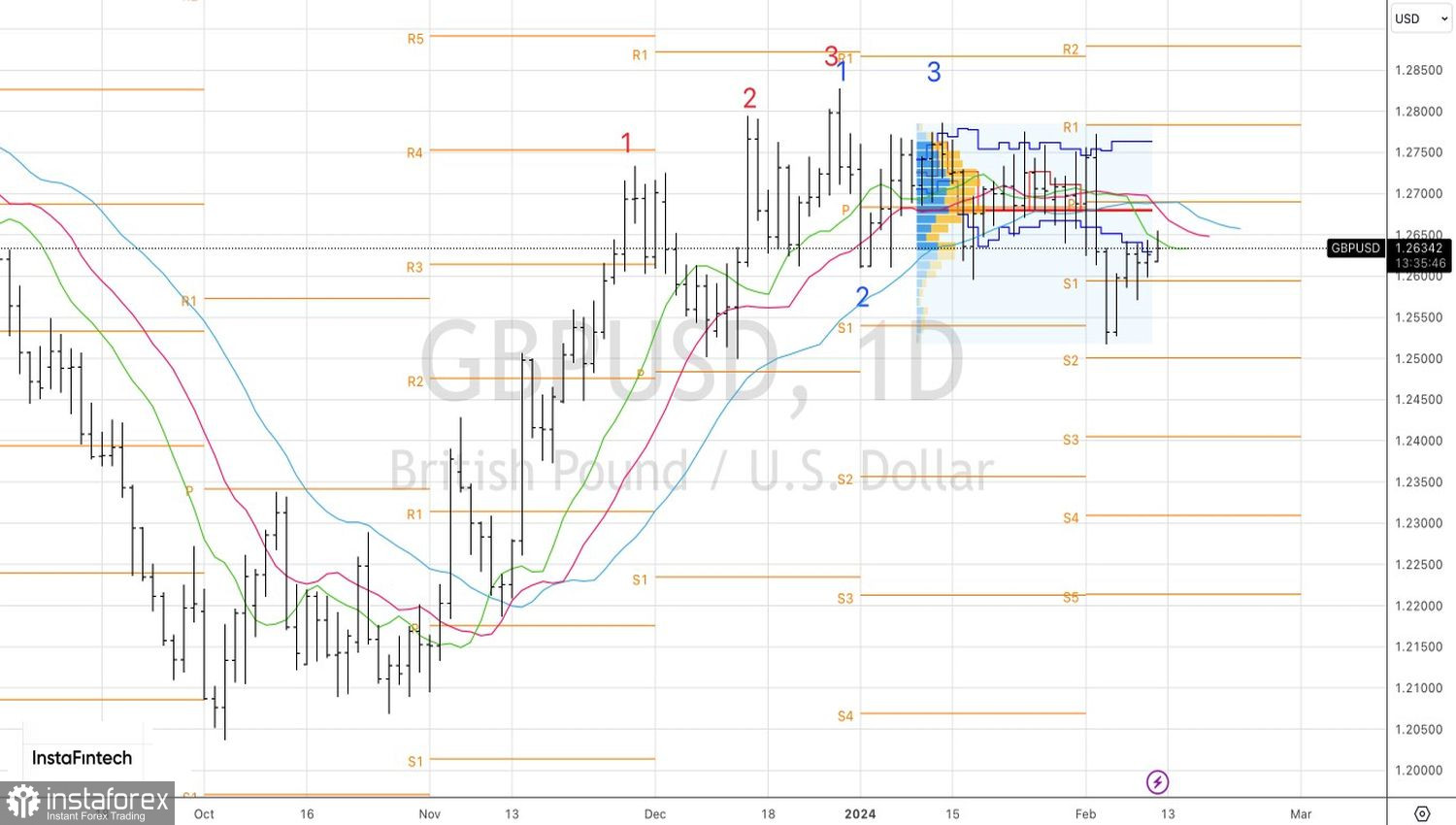

Technically, on the daily chart of the analyzed pair, there is an attempt by buyers to return to the fair value range of 1.264–1.276. If successful, the risks of transforming the "Splash and Shelf" pattern based on 1-2-3 into a "False Breakout" pattern will increase. A breakthrough of resistance at 1.2685 will serve as a basis for GBP/USD purchases. Conversely, the pound's inability to establish itself above $1.264 is a reason for selling.