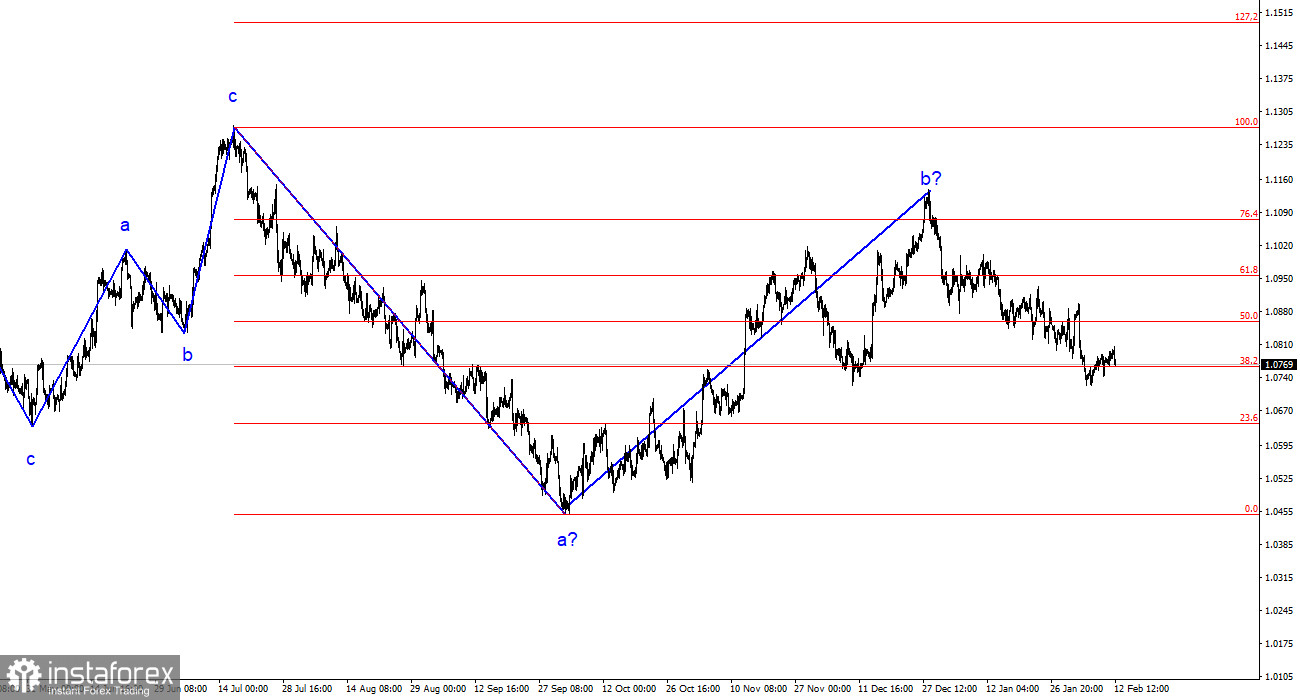

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. Over the past year, we have seen only three-wave structures that constantly alternate with each other. At the moment, the construction of another three-wave downward structure continues. The assumed wave 1 is completed, wave 2 or b has become more complex three or four times, but at the moment, it can still be considered conditionally completed since the pair's decline has been going on for over a month.

The upward trend section may resume, but its internal structure will be unreadable. I want to remind you that I try to highlight unambiguous wave structures that do not tolerate double interpretation. If the current wave analysis is correct, the market has moved on to wave 3 or c formation. A successful attempt to break the level of 1.0788, corresponding to 76.4% according to Fibonacci, once again confirmed the market's readiness for sales. Now, the nearest target is the level of 1.0637, which is equivalent to 100.0%, according to Fibonacci. But I do not expect the end of the euro's decline. Wave 3 or c should be much more extensive regarding time and targets.

Demand for the euro may start falling again.

The exchange rate of the euro/dollar pair decreased by 15 basis points on Monday. This is a natural market behavior, as we still have a downward trend, and the upward corrective wave is completed. An unsuccessful attempt to break the level of 1.0788 also indicates the market's readiness for new sales. Based solely on this, it can be assumed that demand for the euro will continue to decline. A successful attempt to break the low of wave b in 2 or b will be sufficient grounds to consider that the pair's decline will continue.

On Monday, the news background was very weak. During the day, there were only a few economic reports worth paying attention to. However, over the weekend and on Monday, speeches by ECB members de Cos and Panetta took place, and in America, Lorie Logan spoke. This information strongly impacted the market sentiment. However, Lorie Logan confirmed Powell's words that the Fed does not need to hurry with easing monetary policy. The more such statements we see and hear, the more intense the strengthening of the American currency will be.

At the same time, ECB members have taken a softer position on monetary policy, which affected demand for the euro. Fabio Panetta stated that the time for the first rate cut is inevitably approaching. Such a difference in opinions between Logan and Panetta could not cause anything other than a decrease in demand for the euro.

General conclusions.

Based on the conducted analysis, I conclude that the construction of a bearish wave set continues. Wave 2 or b has taken on a completed form, so in the near future, I expect the continuation of the construction of an impulsive downward wave 3 or c with a significant decline in the pair. An unsuccessful attempt to break the level of 1.1125, corresponding to 23.6% according to Fibonacci, indicated the market's readiness for sales a month ago. I am considering only sales with targets around the calculated level of 1.0462, corresponding to 127.2% according to Fibonacci.

The assumed wave 2 or b, which is more than 61.8% according to Fibonacci from the first wave in length, may be completed on a larger wave scale. If this is indeed the case, then the scenario with the construction of wave 3 or c and a decline in the pair below the 1.4-figure has begun to be implemented.