The EUR/USD currency pair continued to trade in an ultra-calm mode on Monday. In the early hours, there was a potential breakthrough of the moving average line; however, a minor decline in the European currency resumed in the afternoon. Therefore, a clear consolidation above the moving average did not occur as in the previous three times. We have already drawn traders' attention to the fact that a breakthrough of the moving average is possible. However, it will not signify a shift to an upward trend under current circumstances.

The European currency has no winning cards. It is important to clearly understand how the market works and how trends are formed. For example, for some reason, the market starts buying euros. This corresponds to the fundamental background. After some time, the background becomes neutral, and there is no longer a reason for the market to buy. Still, it continues to do so out of inertia because everyone knows that long positions are needed if the asset is rising. So, without background, the euro in our example is growing based on technical factors. However, any trend sooner or later ends, and at its end, it turns out that the euro is too expensive, which does not correspond to the current background.

This is the picture we are currently observing in the market. The euro showed several growth spurts last year that were not justified. It turns out that the euro is overbought; there is no reason for its new growth, but there are reasons for the US dollar to rise. Also, the market erred, expecting the Fed to start the cycle of easing monetary policy in March. Based on this factor, it also bought the EUR/USD pair for some time. And again, it turns out that the euro rose unjustifiably. Therefore, we continue to believe that its only way now is down.

On Monday, one of the ECB's monetary committee members, Pablo Hernandez de Cos, stated that in March, the relevant department of the Central Bank will provide updated forecasts for economic growth and inflation. Based on this data, the monetary committee will decide on the timing of rate cuts. According to de Cos, the ECB must be confident that the mid-term value of 2% inflation will be achieved. Only then will it consider options for easing monetary policy.

De Cos also mentioned that inflation in the European Union is decreasing even faster than the regulator expected. He also believes that deflation will persist in the coming quarters. If Mr. de Cos is correct, statements about the upcoming easing of monetary policy can be expected from the ECB soon. Recall that in January, Christine Lagarde announced that the rate could decline "closer to summer," much earlier than the market expected. It is likely that this is how it will happen in reality.

In this case, the European currency will remain under market pressure, as a faster transition to rate cuts is a "bearish" factor for the euro. We do not expect a rapid decline in the EUR/USD pair. Remember, historically, this instrument is not volatile. We can expect a gradual decline of 50–100 points per week. If we also consider corrections, it may take a month or a month and a half to reach the level of 1.0450. The CCI indicator does not currently indicate local overbought or oversold conditions.

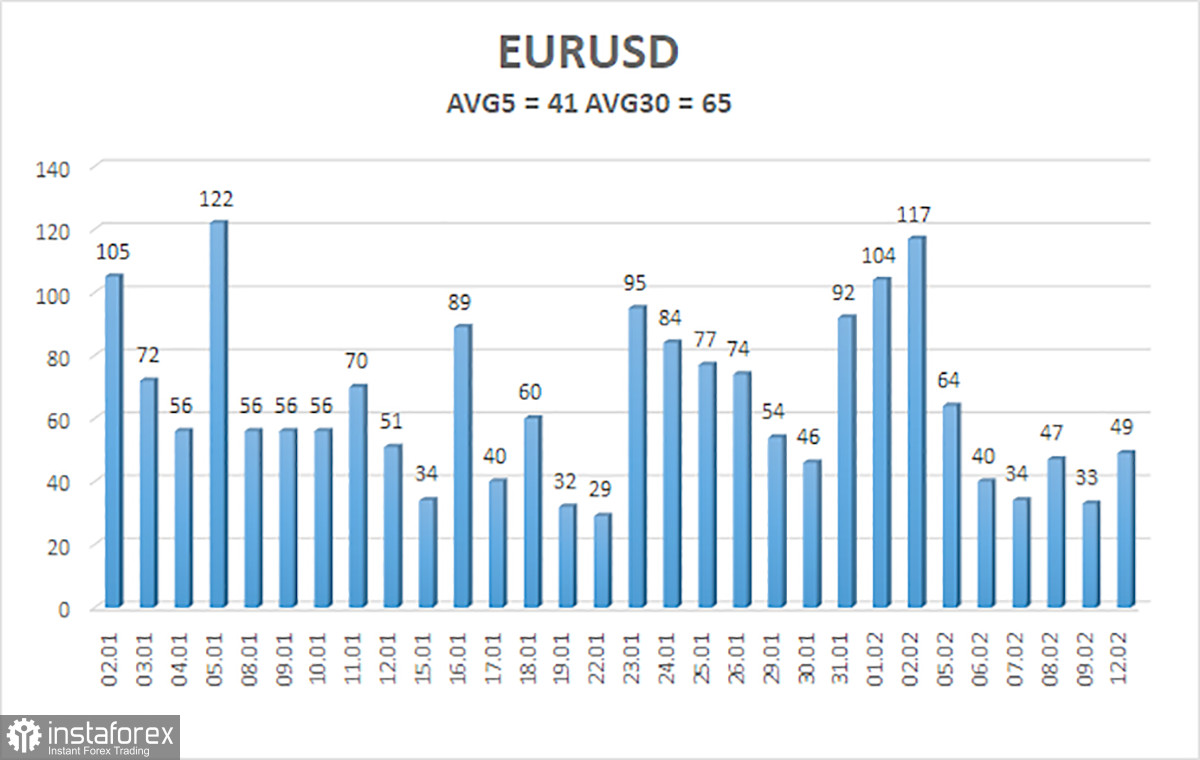

The average volatility of the EUR/USD currency pair for the last five trading days as of February 13 is 41 points and is characterized as "low." Thus, we expect movement between the levels of 1.0723 and 1.0805 on Tuesday. The reversal of the Heiken Ashi indicator down indicates a resumption of the downward movement.

Nearest support levels:

S1 – 1.0742

S2 – 1.0681

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0803

R2 – 1.0864

R3 – 1.0925

Trading recommendations:

The EUR/USD pair continues to be below the moving average line. We continue to look towards short positions, with targets at 1.0742 and 1.0681. The decline of the European currency is stable but very slow. We see no reasons for a global rise in the euro except for corrective ones. If the price consolidates above the moving average line, long positions can be considered with targets of 1.0864 and 1.0925. Still, we see on the chart that the last three consolidations above the moving average did not increase the pair. Therefore, caution is needed with purchases.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (below -250) or the oversold area (above +250) indicates that a trend reversal towards the opposite direction is approaching.