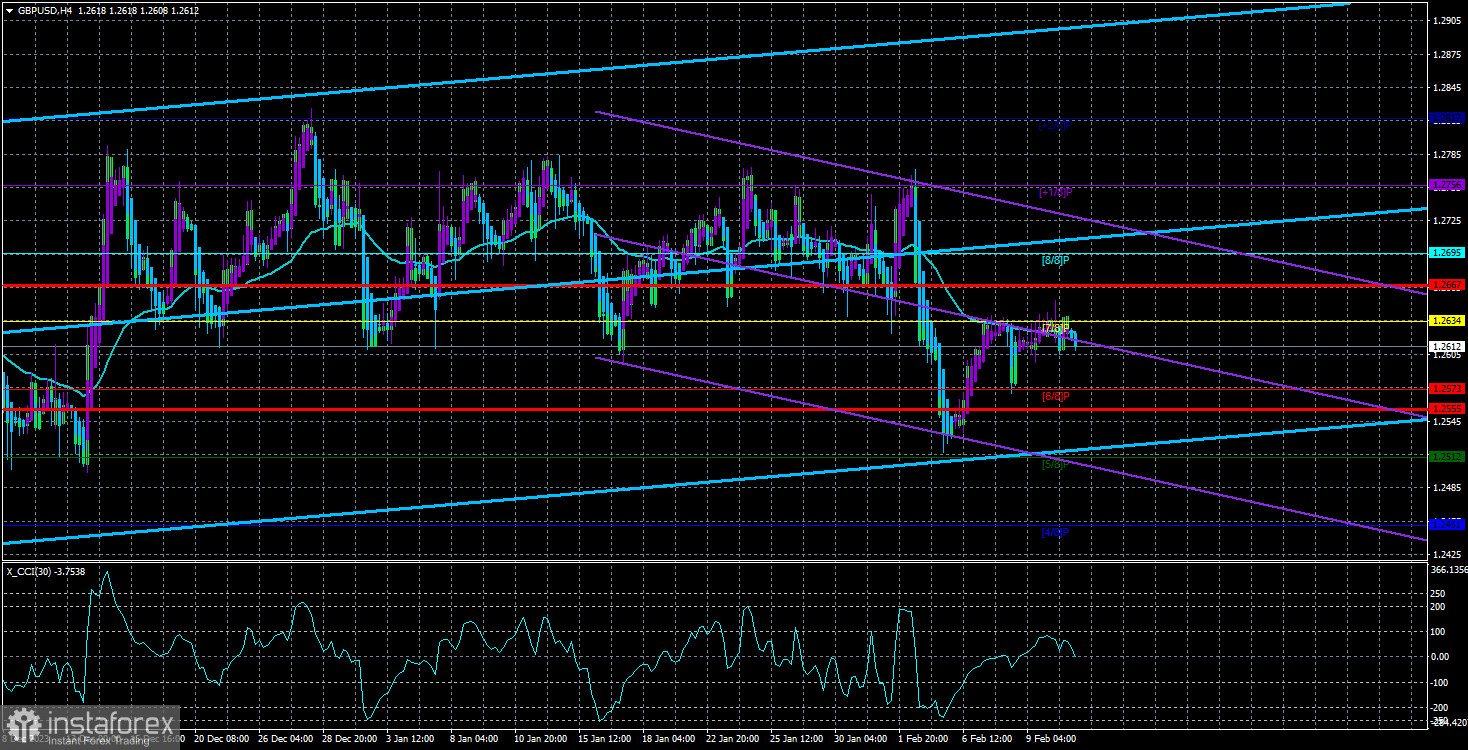

The GBP/USD currency pair leaned towards a decline on Monday. Once again, the Murray level of "7/8" (1.2634) was not overcome. Recall that this level (and several neighboring ones) formed a powerful support for about a month and a half - the lower boundary of the sideways channel. The pair cannot break through this "concrete slab" from below. Thus, the British pound has an excellent chance of resuming its decline.

Also, recall that we expect not just any decline from the British currency but a strong and prolonged one. Remember that the British pound is still close to its five-month highs and cannot adequately correct downward, despite almost all factors indicating its fall. The British economy continues to leave much to be desired, and the Bank of England, although taking a tough stance on monetary policy, will still begin to lower rates this year. Yes, it may happen later than in the US, but how much later? And how much longer can the British economy stay on the brink of recession?

At the same time, the US economy is not threatened by a recession, the unemployment rate is not far from the minimum, the labor market continues to create jobs, the number of job vacancies is not decreasing, business activity is growing, and inflation is around 3%. Objectively, the Fed can keep the rate at a maximum for as long as necessary.

However, recently, many representatives of the Fed have openly stated this. For example, the head of the Dallas Fed, Lorie Logan, stated yesterday that there is no need to rush to lower rates despite "serious progress" in slowing inflation. According to her, there must be 100% confidence that progress will be sustainable. The regulator should wait to rush to lower rates before obtaining this confidence. She also noted that supply chain problems due to COVID-19 have almost disappeared.

As we can see, another representative of the monetary committee stated that the Fed should not rush to soften its policy. This is what we talked about at the end of last year. Numerous factors and macroeconomic indicators testify to this. Based on what the market believed in a long-term rate cut in March, we still need to understand.

The more representatives of the Fed speak openly about the lack of haste now, the stronger the dollar can grow. Moreover, with the British pound, it is practically not growing. This means the bulls are strong, and a gap is opening up for a possible decline in front of the pound.

This week, important reports will be published in the US and the UK, and there will be several more speeches by central bank representatives. The market needs even more assurance that the Fed's monetary policy will remain tough soon. Or even more, assurance that the state of the American economy is far from the concept of a "recession." Either way, now we are only looking down. There is no overbought or oversold condition for the CCI indicator now. Only the one formed in November-December of last year and has not been worked out yet.

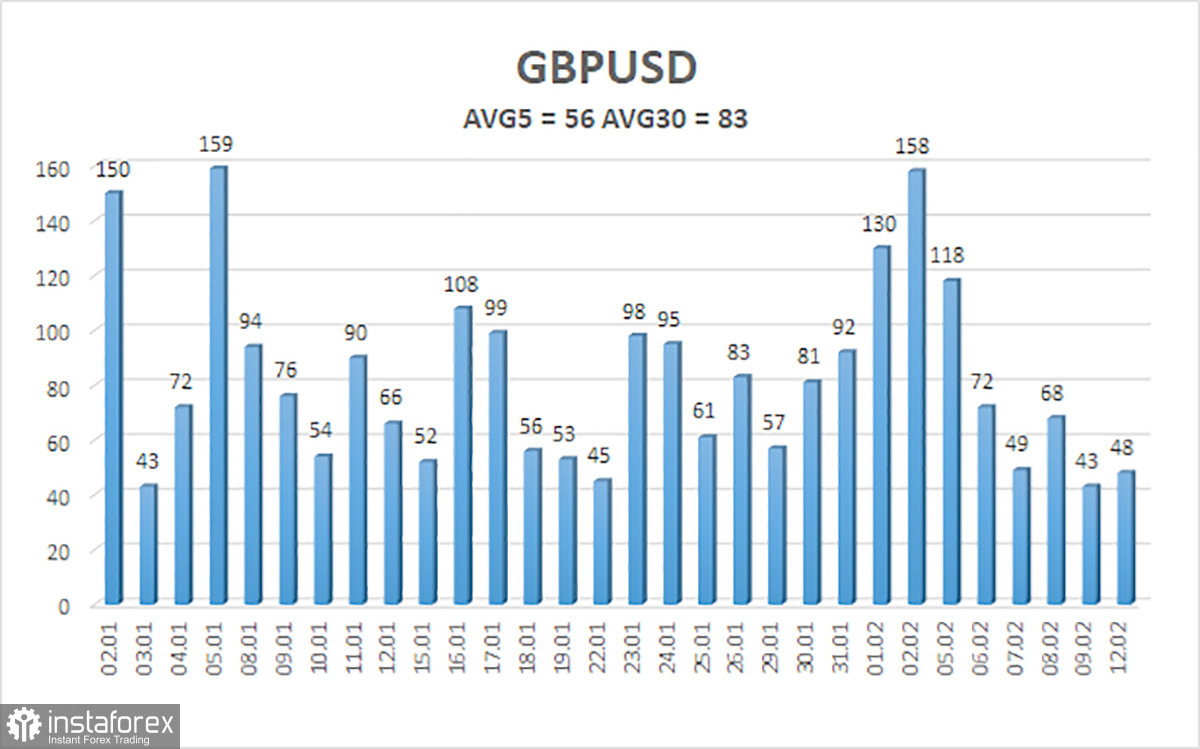

The average GBP/USD pair volatility for the last five trading days is 56 points. For the pound/dollar pair, this value is considered "low." Therefore, on Tuesday, February 13, we expect movement within the range limited by the levels of 1.2555 and 1.2667. The reversal of the Heiken Ashi indicator down will indicate a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Nearest resistance levels:

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

Trading recommendations:

The GBP/USD currency pair has left the sideways channel and may start forming a downtrend, as we have been saying for a long time. However, for some reason, this moment is dragging on. The pair managed to go down more than 200 points but then corrected to the moving average. After completing the current correction, we expect a resumption of the decline, with targets at 1.2512 and 1.2451. Long positions can be considered after the price consolidates above the moving average with targets at 1.2695 and 1.2756 and in the presence of a favorable macroeconomic background. However, purchases cannot be a priority if a downtrend has started.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (below -250) or the oversold area (above +250) indicates that a trend reversal towards the opposite direction is approaching.