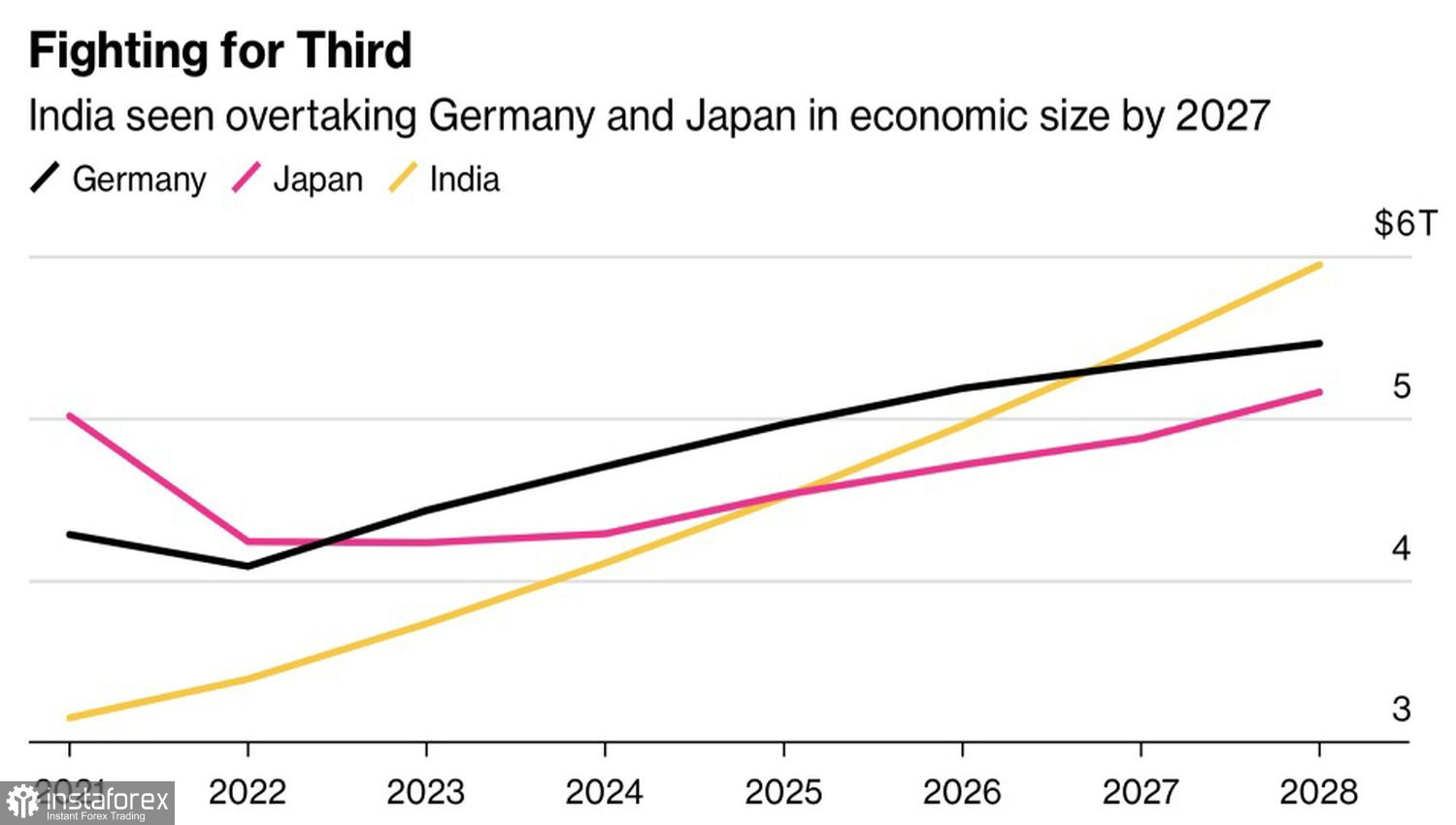

Traders went all-in, betting on the divergence in the monetary policies of the Federal Reserve and the Bank of Japan in 2024. This was expected to lead to the formation of a sustainable downward trend in USD/JPY. In fact, instead of one divergence, another worked. Divergence in economic growth easily turned the yen from the main favorite of the year into an outsider. Apparently, Japan will yield the third position in the list of the world's largest economies to Germany. Soon, India will surpass it. How can they compete with the United States?

Dynamics of the World's Largest Economies

The unexpected acceleration of the U.S. GDP by 3.3% in the fourth quarter and the expected leading indicator from the Federal Reserve Bank of Atlanta by 3.4% in January–March made the U.S. dollar the leader in the G10 currency race. Investors are betting on American exceptionalism. At the same time, the game involves buying high-yield currencies against low-yield ones. The carry trade is thriving, and the yen, with its status as a funding currency, is rightly under pressure. Since the beginning of the year, USD/JPY quotes have already risen by 6%.

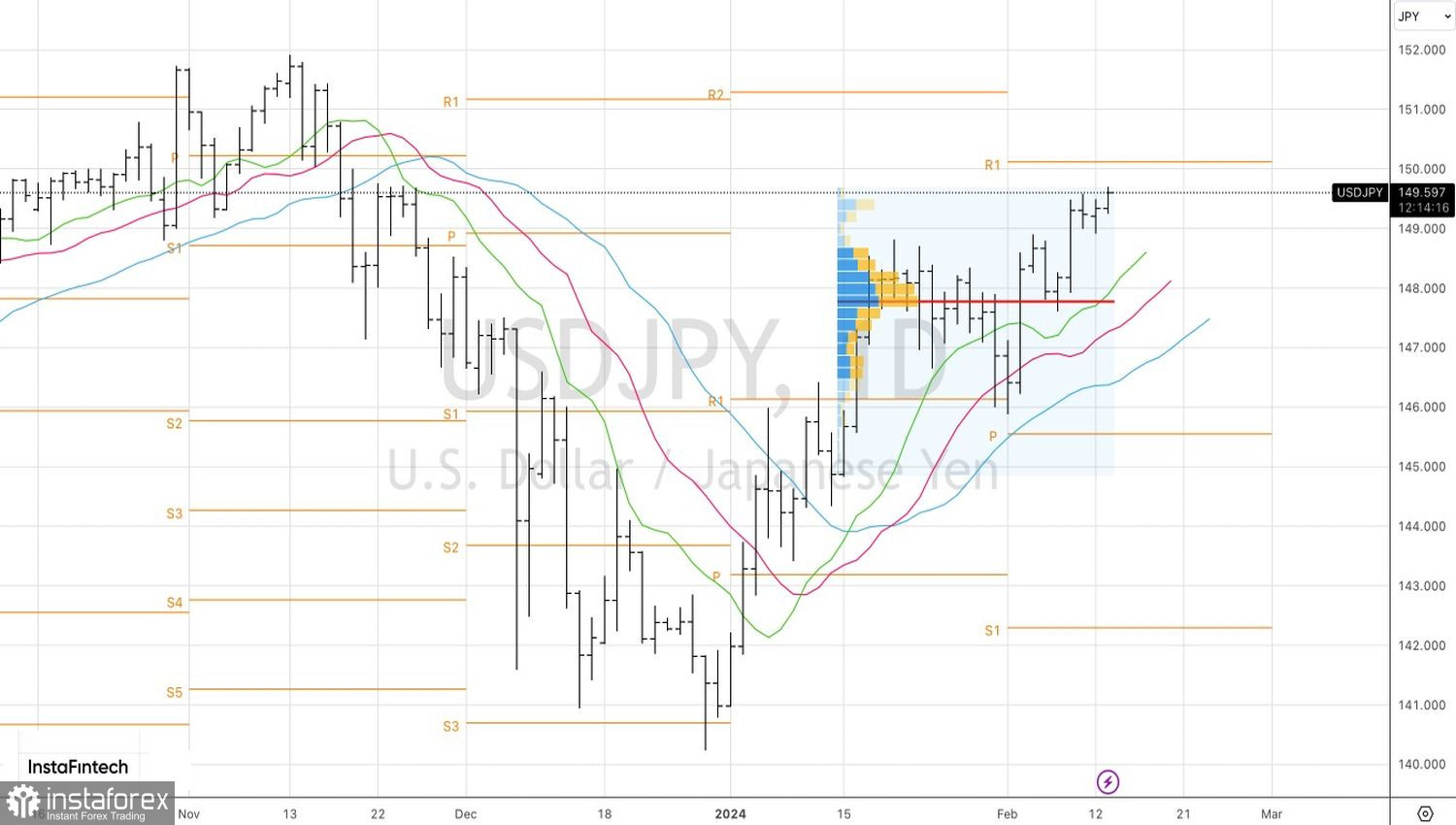

The pair is approaching the psychologically important level of 150, after which, according to Nomura, verbal interventions by official Tokyo will resume. For this reason, and also due to the gradual waning of Japanese investors' appetite for buying foreign stocks and the possible withdrawal of the Bank of Japan (BoJ) from yield curve control in March, the company considers the potential for a USD/JPY rally limited.

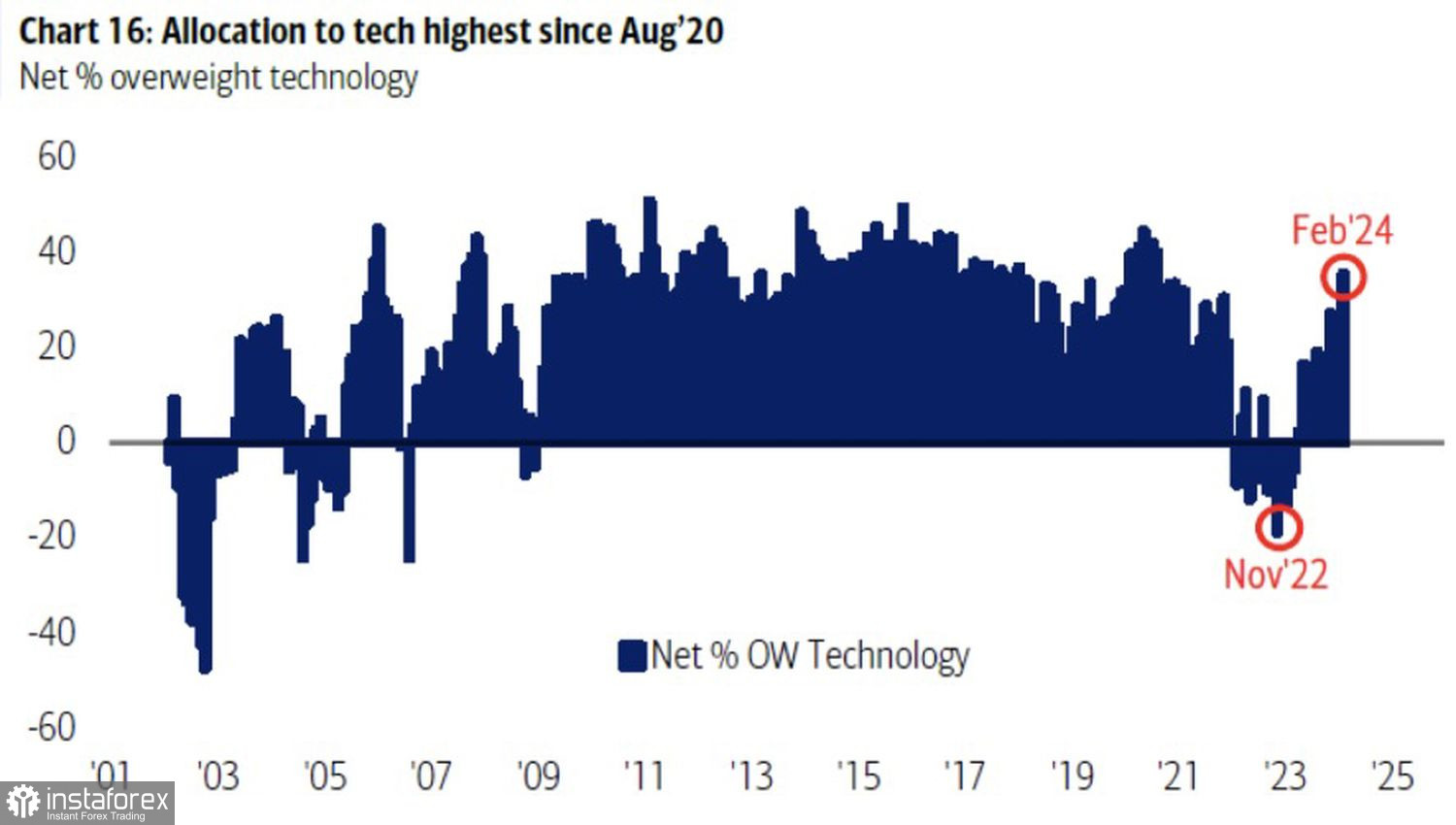

Indeed, the successes of the Nikkei 225, which has grown by 13.5% since the beginning of the year, and the record highs of the S&P 500, may keep the Japanese from shifting capital from Asia to North America. Nevertheless, the Bank of America survey confirmed high demand for American securities. There are plenty of bulls in the market. The last time this happened, the broad stock index rose by another 4%.

Dynamics of Investor Sentiment in the U.S. Stock Market

USD/JPY bears may have likely overestimated the determination of the Federal Reserve and the Bank of Japan. After aggressive cycles of tightening monetary policy in other countries, investors expected the BoJ to actively raise the overnight rate. But this is not the case. According to Kazuo Ueda, even abandoning negative borrowing costs will maintain the accommodative nature of monetary policy. The central bank will move at a turtle's pace, which, against the Federal Reserve's lack of haste, does not give the yen an advantage over the U.S. dollar.

The market is reassessing its views on the fate of the federal funds rate. Not so long ago, it gave an 85% probability of a rate cut in May. Now, the indicator has dropped to 56%. Investors are starting to doubt the early start of the Fed's monetary expansion cycle, which supports the U.S. dollar.

Technically, on the daily chart, the USD/JPY rally continues. The fact that the bulls managed to keep quotes above the pivot level at 148.9 indicates their strength. Longs formed on the rebound from the support in the form of moving averages and built up from 148.8 should be held. The nearest targets are 150.1 and 151.25.