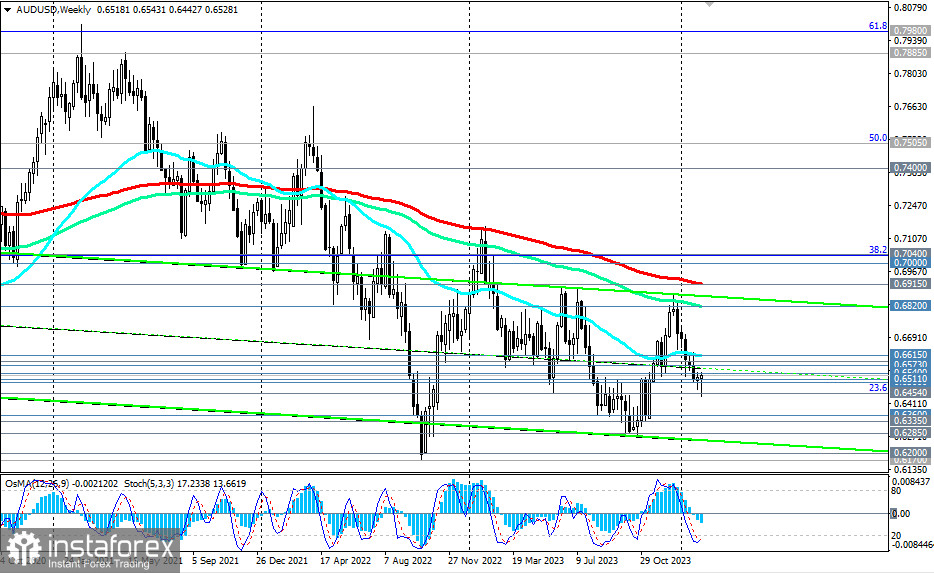

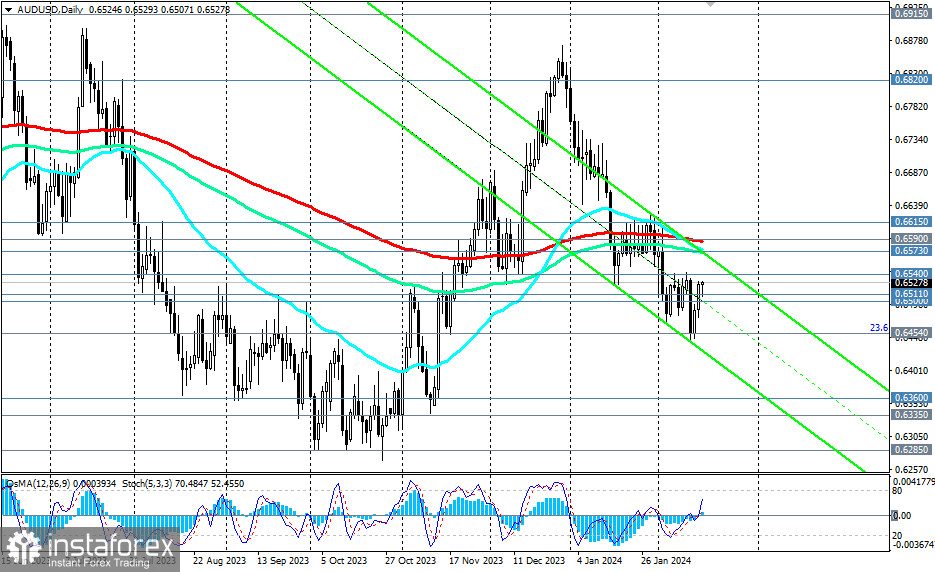

AUD/USD continues to move deeper into the downward channel on the daily chart, remaining within the zone of medium-term and long-term bearish markets, below key resistance levels of 0.6590 (200 EMA on the daily chart), 0.6573 (144 EMA and the upper line of the downward channel on the daily chart), and 0.6915 (200 EMA on the weekly chart). Overall, the dynamics of the pair continue to be bearish.

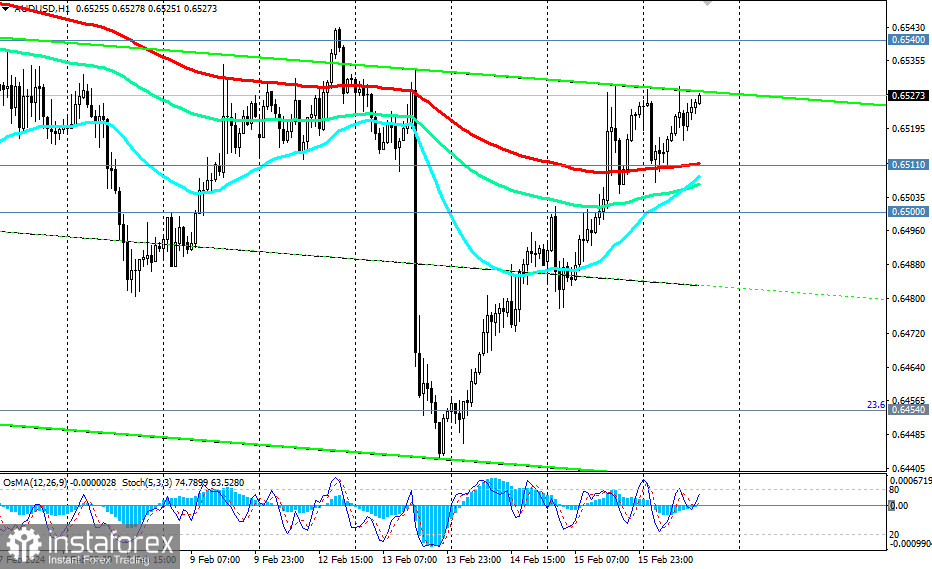

Therefore, short positions remain preferable. A breakdown of the important short-term support level at 0.6511 (200 EMA on the 1-hour chart) and the local support level at 0.6500 will signal a resumption of selling the pair.

The nearest downside targets are 0.6454 (23.6% Fibonacci level correction in the downward wave from the level of 0.9500 to the level of 0.5510) and 0.6400 (lower boundary of the said channel). A more distant target is a local low near the levels of 0.6360, 0.6335, 0.6300.

In an alternative scenario, a breakout of the local high at 0.6540 will be the first signal to resume long positions. With further growth, AUD/USD will break the key medium-term resistance level at 0.6590, and then the local resistance level at 0.6615, continuing to rise towards the key long-term resistance level at 0.6915.

Its breakout and reaching the level of 0.7000 will bring AUD/USD into the long-term bullish market zone with the prospect of growth to important resistance levels at 0.7400 (200 EMA on the monthly chart) and 0.7505 (50.0% Fibonacci level). Their breakout, in turn, will bring AUD/USD into the global bullish market zone.

Support levels: 0.6511, 0.6500, 0.6454, 0.6400, 0.6360, 0.6335, 0.6300, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6540, 0.6573, 0.6590, 0.6600, 0.6615, 0.6625, 0.6700, 0.6800, 0.6820, 0.6900, 0.6925, 0.7000, 0.7040

Trading Scenarios

Main Scenario: Sell Stop 0.6490. Stop-Loss 0.6550. Targets 0.6454, 0.6400, 0.6360, 0.6335, 0.6300, 0.6285, 0.6200, 0.6170

Alternative Scenario: Buy Stop 0.6550. Stop-Loss 0.6490. Targets 0.6570, 0.6590, 0.6600, 0.6615, 0.6625, 0.6700, 0.6800, 0.6820, 0.6900, 0.6925, 0.7000, 0.7040

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a guide when planning and placing your trading positions.