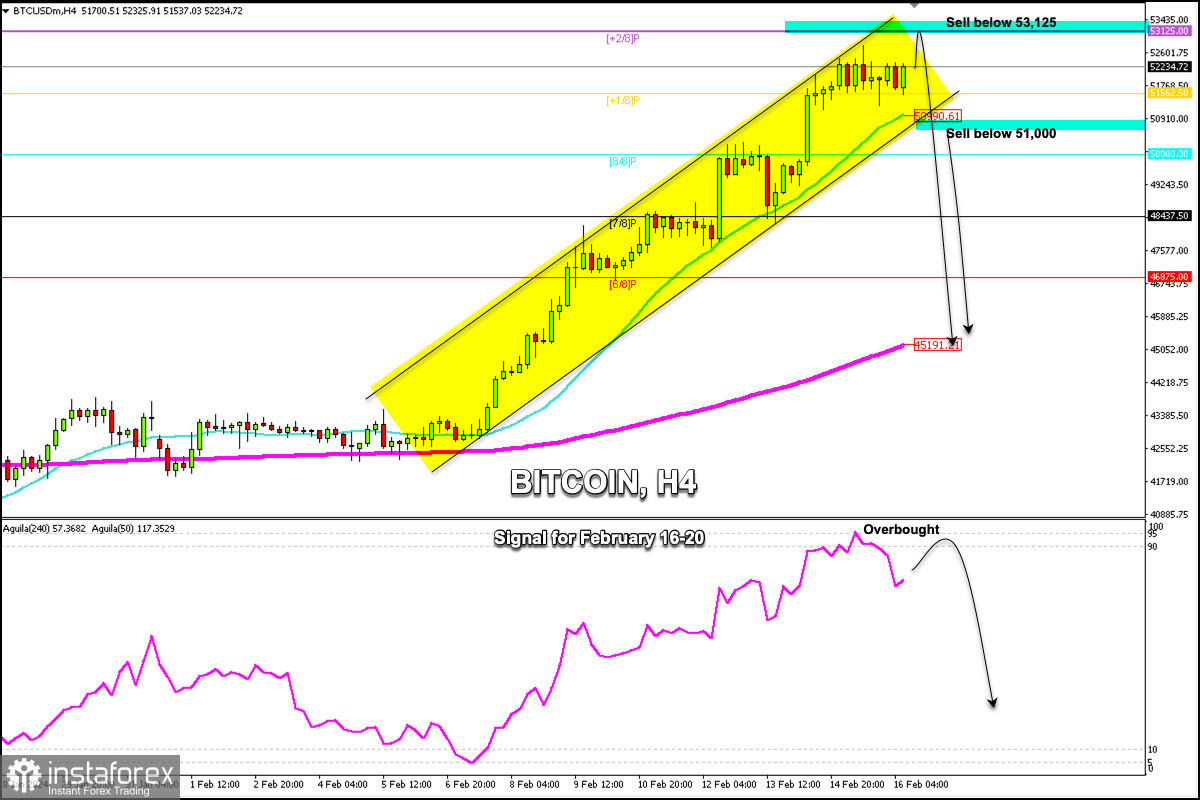

Bitcoin is trading around 52,234, consolidating above 1/8 Murray and showing exhaustion of bullish strength. Bitcoin has strong resistance around +2/8 Murray located at 53,125. This area is viewed as an extremely overbought zone. If Bitcoin reaches this area in the coming days, it will be seen as a signal to sell because a strong technical correction could occur.

According to the H4 chart, we observe a Japanese candlestick formation between a minimum of 51,500 and a maximum of 52,300. This range that has been formed could give us a signal that in the short-term Bitcoin could have a change in its trend, but for this, we should wait for a break sharply of the bullish trend channel forming since February 6.

If Bitcoin falls below the 21 SMA located at 50,990, we could expect that there will be a change in the trend and it could be the beginning of a series of consecutive falls. So, the price could reach the 200 EMA located at 45,191 in the short term.

The eagle indicator reached the extremely overbought zone on February 14. Since then, it is giving us a signal to sell, but we should expect a sharp break of the uptrend channel to sell with targets at the psychological level of $50,000, 48,431, 46,875, and finally at the landmark level of $45,000.