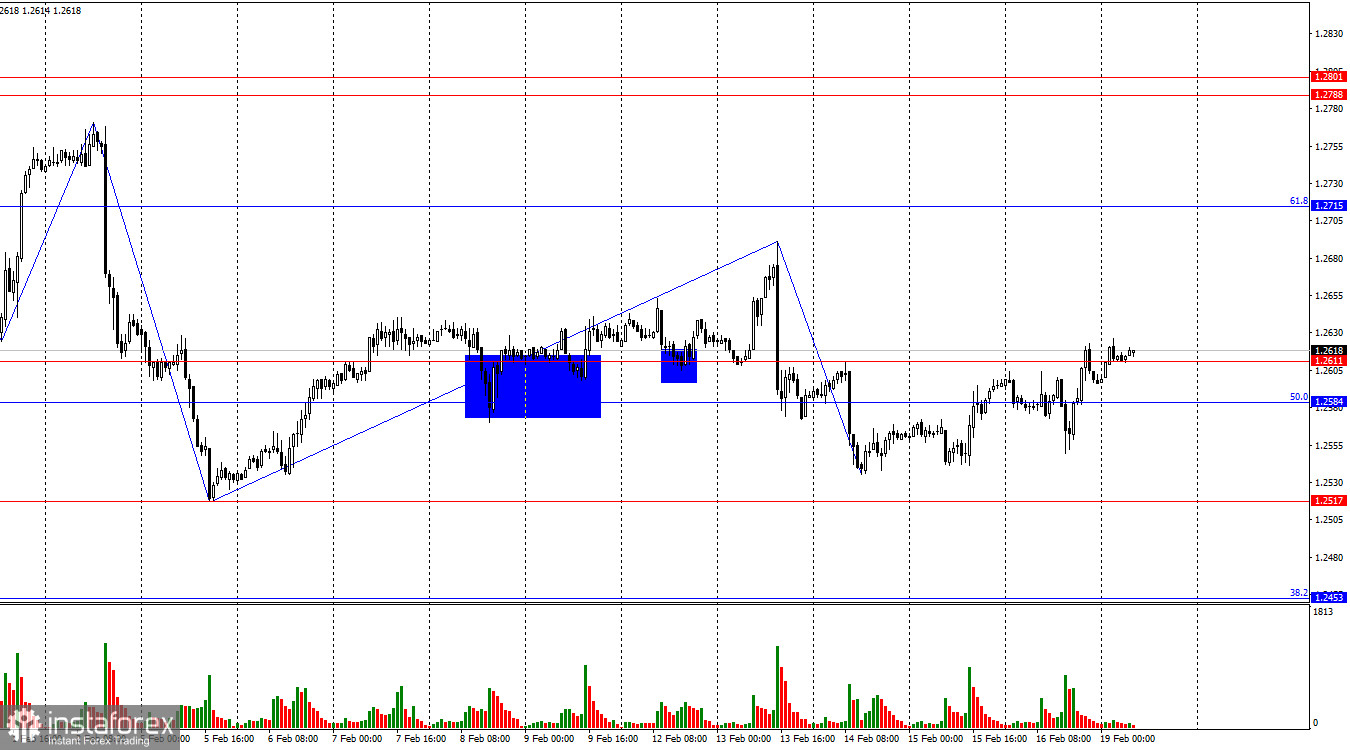

Hi, dear traders! On the 1-hour chart on Friday, the GBP/USD pair performed a reversal in favor of the British currency and consolidated above the zone of 1.2584 – 1.2611. This is not the first time the price surpasses this zone, which previously had much greater significance. Now traders overcome it with ease, both up and down. So, I won't be looking at signals around it anytime soon. Consolidation above this zone allows us to count on some growth in the direction of the correctional level of 61.8%, 1.2715, but the nature of trading in recent weeks allows for any development of events.

The situation with the waves remains very ambiguous. For a long time, we observed a horizontal movement, within which single waves or triplets were almost always formed. The waves alternated with each other and were approximately the same size. Now too little time has passed since the end of the sideways move to draw any conclusions. I'm less certain about its completion. The sentiment of traders has changed to bearish, which allows us to expect a long fall in the British currency, but the bears are again showing their weakness. The last downward wave failed to break through the previous low (from February 5). So, we received the first sign of the end of the bearish trend, which has not been full-fledged.

In the UK, a retail trade report was released on Friday, which did not have any impact on traders' sentiment, despite retail sales growth of 3.4% m/m. The market had projected a much more modest reading. However, as already mentioned, the British pound did not receive support. However, American reports supported the pound to a greater extent than the US dollar. At the end of the day, it was the British pound that increased in price, and the bulls again had an advantage despite the overall bearish trend.

On the 4-hour chart, the instrument consolidated below the level of 1.2620, which signaled the end of the sideways trend and allows us to expect a fall in the direction of the level of 1.2450. As I said earlier, the mood of traders began to change to bearish after consolidating under the upward trend corridor, but it took a full month and a half for the bears to even go on the offensive. This advance looks extremely unconvincing. The bullish divergence of the CCI indicator suggests some growth, while the downward trend line indicates a bearish priority. The situation is ambiguous.

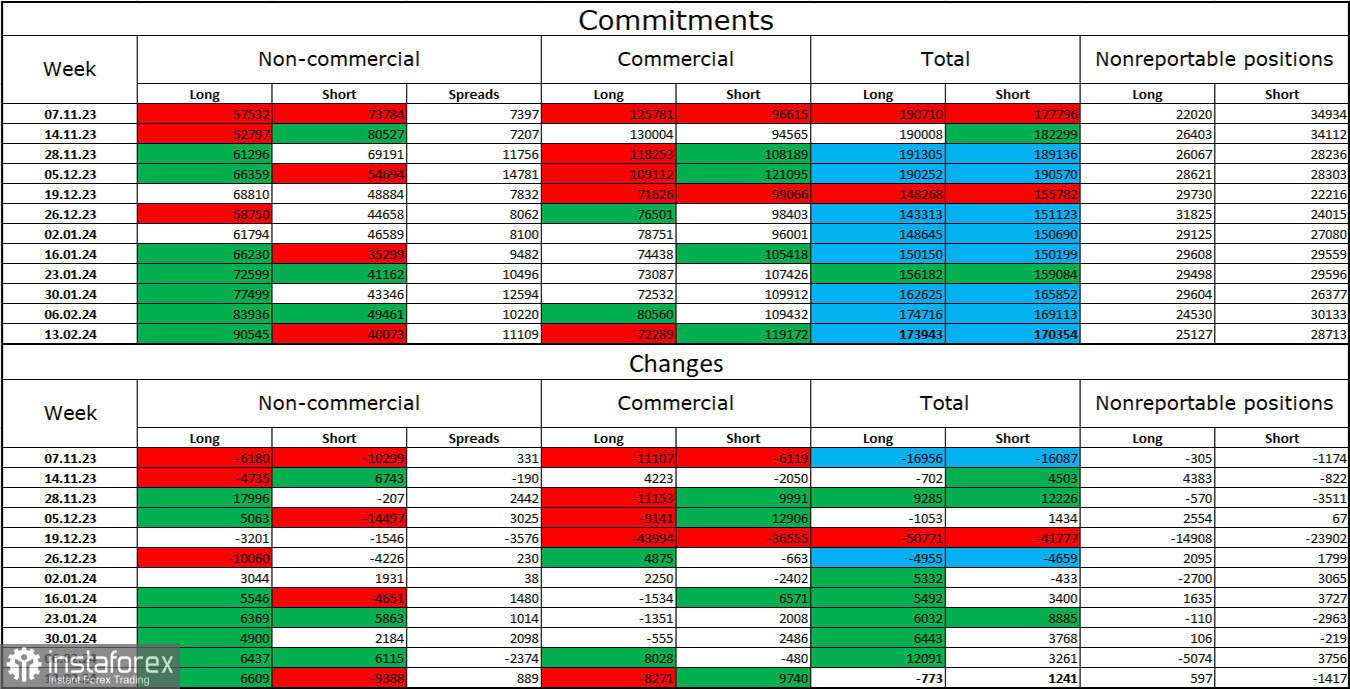

Commitments of Traders (COT):

The sentiment of the "Non-commercial" category of traders has changed quite a lot over the last reporting week. The number of long contracts held by speculators increased by 6,609, while the number of short contracts decreased by 9,388. The general mood of major market players remains bullish and continues to strengthen, although I do not see any specific reasons for this. There is more than a twofold gap between the number of long and short contracts: 90K versus 40K.

In my opinion, the British currency still has excellent downside prospects. I believe that over time the bulls will begin to get rid of buy positions, since all possible factors for buying the British pound have already been worked out. For two months now, the bulls have not been able to push through the level of 1.2745, but the bears are also in no hurry to go on the offensive and are generally very weak now.

Economic calendar for US and UK

On Monday, the calendar of economic events does not contain a single report. The information background will have no influence on market sentiment for the rest of the day.

Intraday outlook for trading tips on GBP/USD

Today we can again plan sell positions when there is a rebound from the trend line on the 4-hour chart with a target at 1.2517. Buying will be possible when the price closes above 1.2584 – 1.2611 on the 1-hour chart with a target at 1.2715.