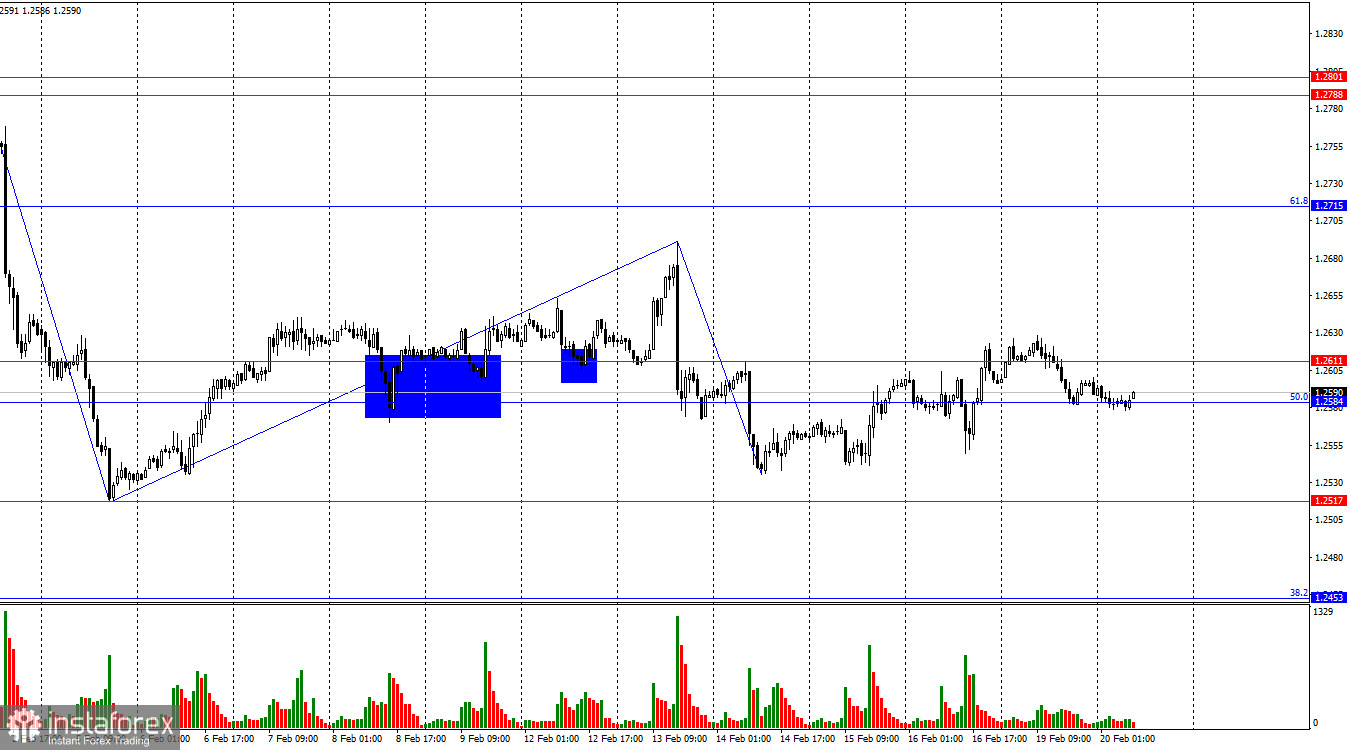

On the hourly chart, the GBP/USD pair remained within the range of 1.2584–1.2611 on Monday, which is now extremely difficult to call a "support zone" or "resistance zone." This zone used to have much greater strength than now, as traders break through it every other day. Therefore, in the near future, I will not expect strong signals to form around it. Consolidation above this zone allows counting on some growth towards the corrective level of 61.8% (1.2715), but the nature of trading in recent weeks allows for any developments. The chart pattern is currently very ambiguous.

The wave situation remains very ambiguous. For a long time, we observed horizontal movement, within which single waves or triples were formed almost all the time, alternating with each other and having approximately the same size. The flat is completed, and we continue to see the same single waves and triples. And even confidence in completing the flat is diminishing with each passing day. Trader sentiment has turned "bearish" recently, allowing for a prolonged decline in the pound, but bears are showing weakness again. The last downward wave failed to break the previous low (from February 5), and we got the first sign of the end of the "bearish" trend, which never really began.

There were no significant events in the UK or the US on Monday. However, in a few hours, Bank of England Governor Andrew Bailey will speak, who may provide the market with new information on the monetary policy outlook. Recall that the latest GDP report turned out to be weaker than traders' expectations and indicates the entry of the British economy into a recession. Bailey should comment on the situation with economic growth and the plans of the British regulator. The main problem in Britain is no longer inflation but the economic downturn.

On the 4-hour chart, the pair has consolidated below the level of 1.2620, which signals the completion of the flat and allows counting on a decline toward the level of 1.2450. As I mentioned, trader sentiment began to change to "bearish" after consolidating below the ascending trend corridor. Still, it took a month and a half for the bears to at least go on the offensive. And this offensive looks extremely unconvincing. The "bullish" divergence on the CCI indicator suggests some growth and the descending trend line indicates the "bearish" priority. The situation could be clearer.

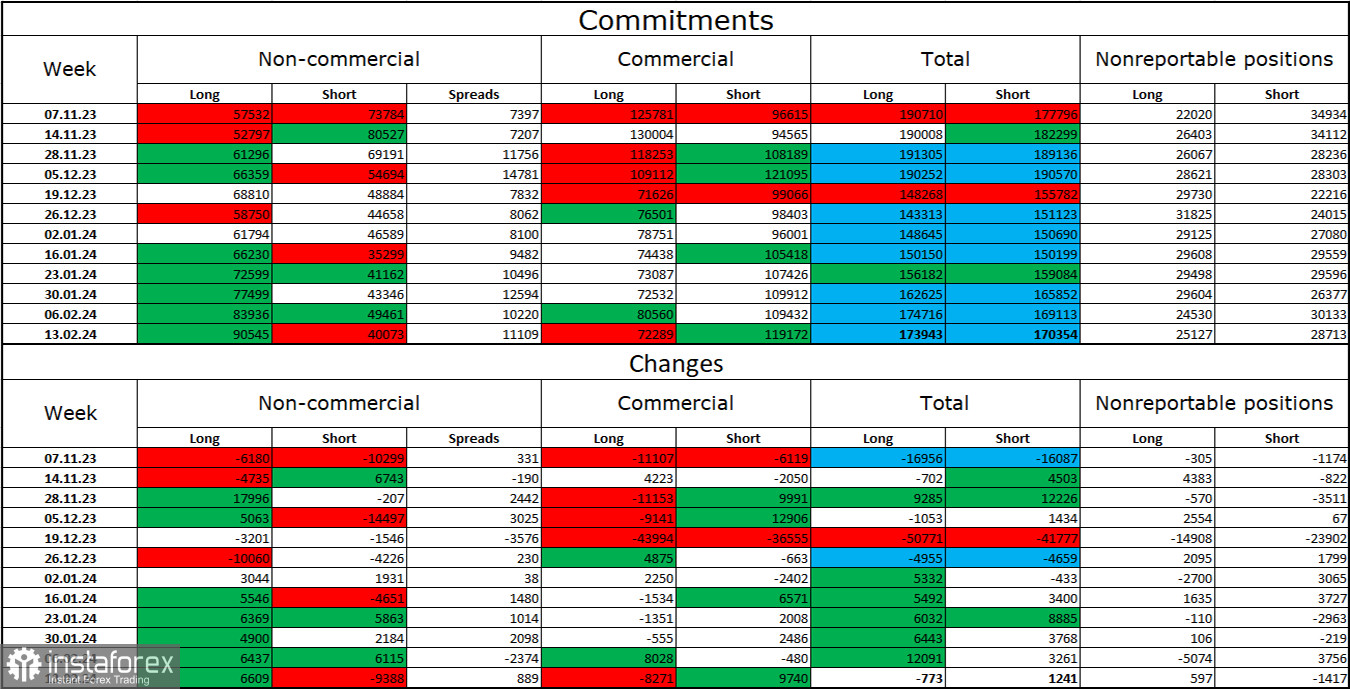

Commitments of Traders (COT) report:

The sentiment in the "non-commercial" trader category changed significantly over the past reporting week. The number of long contracts held by speculators increased by 6,609 units, while the number of short contracts decreased by 9,388. The overall sentiment of large players remains "bullish" and continues to strengthen, although I do not see any specific reasons for this. There is a more than two-fold gap between the number of long and short contracts: 90 thousand versus 40 thousand.

The prospects for a decline in the pound remain excellent. Over time, bulls will start getting rid of buy positions, as all possible factors for buying the British pound have already been worked out. Bulls have been unable to push through the level of 1.2745 for two months, but bears are also in no hurry to go on the offensive and are generally very weak right now.

News calendar for the US and the UK:

UK – Speech by Bank of England Governor Andrew Bailey (10-15 UTC).

On Tuesday, the economic events calendar contains only one entry. The impact of the information background on market sentiment today can be moderate in strength.

Forecast for GBP/USD and trader recommendations:

Today, it is possible to consider sales on a rebound from the trendline on the 4-hour chart with a target of 1.2517. Purchases will be possible with a close above the trendline on the 4-hour chart with a target of 1.2715.