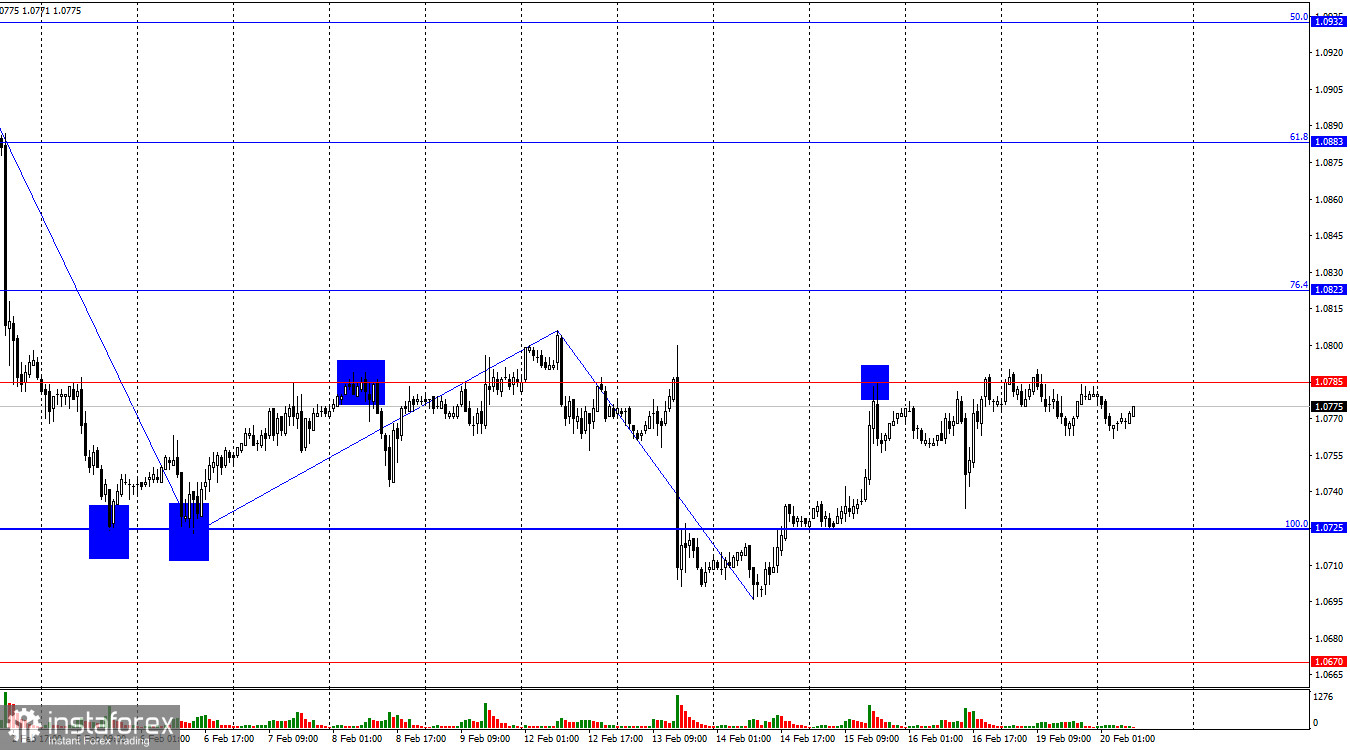

The EUR/USD pair returned to the level of 1.0785 on Monday. A rebound from this level will again favor the US dollar and the resumption of the decline towards the corrective level of 100.0% (1.0725). Consolidation of the pair's rate above the level of 1.0785 will favor the continuation of growth towards the next Fibonacci level of 76.4%–1.0823. Trader activity in recent weeks has been quite low, and Monday was no exception; it is very difficult to expect strong movements now.

The wave situation is becoming more understandable. The last completed downward wave confidently broke the low of the previous wave, and a new upward wave is approaching the peak of the previous wave (from February 12). Thus, at the moment, there is no sign of the end of the "bearish" trend, but it may appear today or tomorrow in the case of a breakthrough of 1.0806. In this case, we can expect a trend change to "bullish." The level of 1.0785 is holding back bull traders, and all the hopes of the bears are pinned on it.

There was no news on Monday. A national holiday was celebrated in America, so many banks and exchanges were closed. In the European Union, there was no holiday but no publication or event that traders could hold onto. Thus, we observed an almost complete absence of movement the whole day. The chart pattern still allows for the resumption of the "bearish" trend. The level of 1.0785 is currently significant because its breakthrough or rebound will determine the pair's direction in the coming days and weeks. However, the market is quick to make a decision. The information background allows for a continuation of the decline in the euro. If no "bullish" signals exist, one should look towards selling.

On the 4-hour chart, the pair has risen to the upper line of the descending trend channel. A rebound of quotes from this line will allow counting on a reversal in favor of the US currency and the resumption of the decline toward the corrective level of 23.6% (1.0644). The descending trend corridor still characterizes the current trader sentiment as "bearish." In consolidating quotes above the descending channel, one can expect a break of the "bearish" trend and the pair's growth, at least to the corrective level of 50.0% (1.0862).

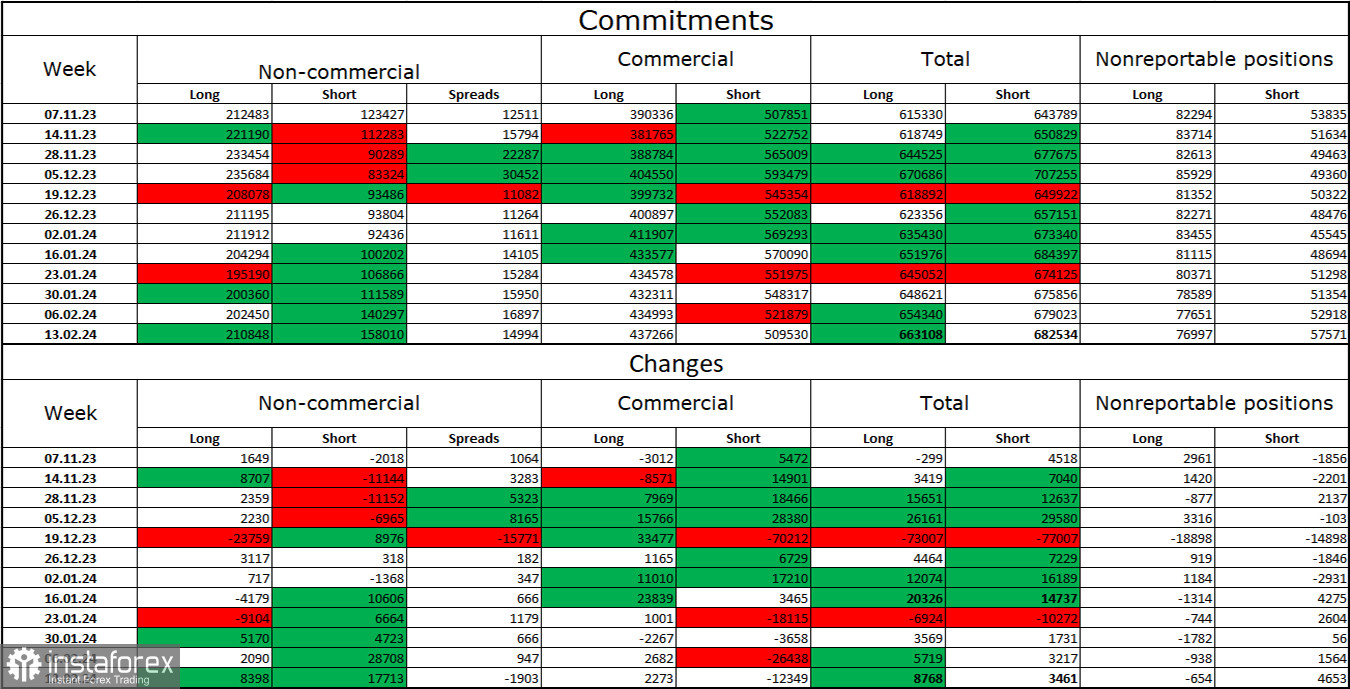

Commitments of Traders (COT) report:

In the last reporting week, speculators opened 8398 long contracts and 17713 short contracts. The sentiment of large traders remains "bullish" but continues to weaken. The total number of long contracts speculators hold is now 210 thousand, and short contracts are 158 thousand. The situation will continue to change in favor of the bears. Bulls have dominated the market for too long and need strong information to maintain the "bullish" trend. I do not see such a background now. Professional traders may continue to close long positions (or open short positions) soon. The current figures allow for a continuation of the decline in the euro in the coming months.

News calendar for the US and the European Union:

On February 20, the economic events calendar contains no interesting entries. The impact of the information background on trader sentiment today will be absent.

Forecast for EUR/USD and trader recommendations:

Sales of the pair are possible today on a rebound from the level of 1.0785 on the hourly chart, with targets at 1.0725 and 1.0670. Purchases of the pair will be possible with consolidation above the descending trend corridor on the 4-hour chart, with targets at 1.0823 and 1.0862. However, trader activity may be very low today.