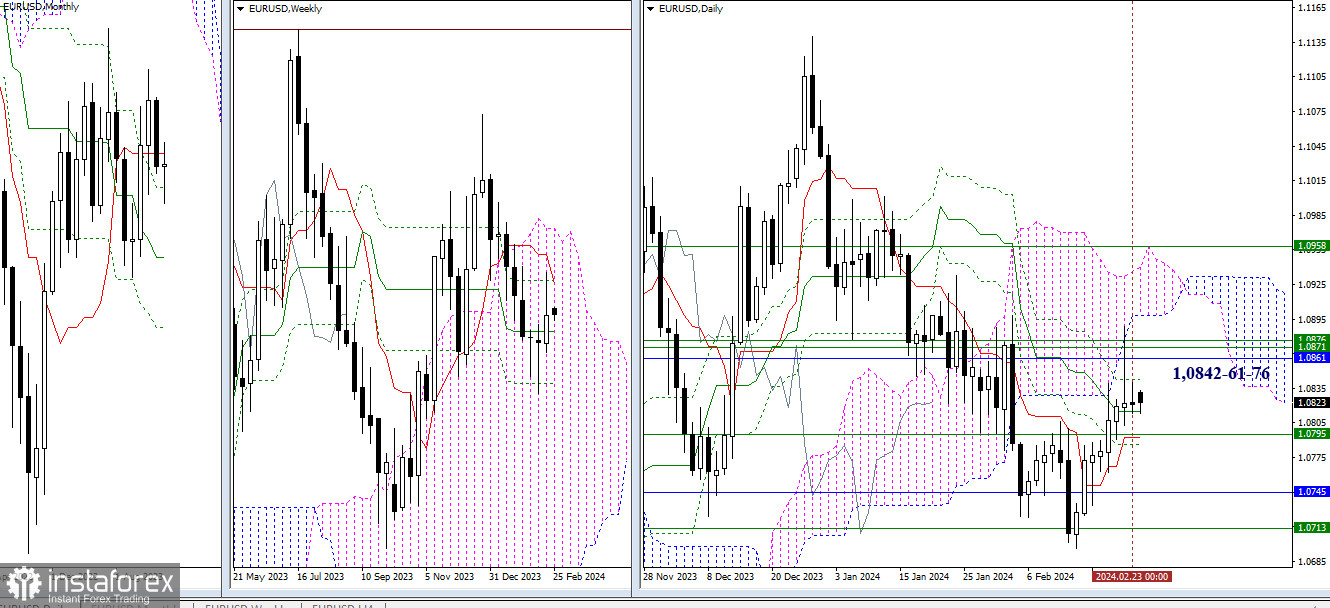

EUR/USD

Higher Timeframes

Despite the proximity to and testing of crucial levels, the bulls have not yet managed to turn the situation in their favor and achieve the planned results. Therefore, previously stated targets and tasks in this market segment remain relevant. Bulls need to eliminate the death cross of the daily Ichimoku cloud (1.0842) and overcome the accumulated resistances at 1.0861 – 1.0876 (monthly short-term trend + weekly levels). The next step will be entering the bullish zone relative to the daily and weekly Ichimoku clouds (1.0958).

Inability to implement the outlined plans will change the leadership and priorities. The tasks for bearish players will involve testing and breaking through existing supports (1.0795 – 1.0745 – 1.0713).

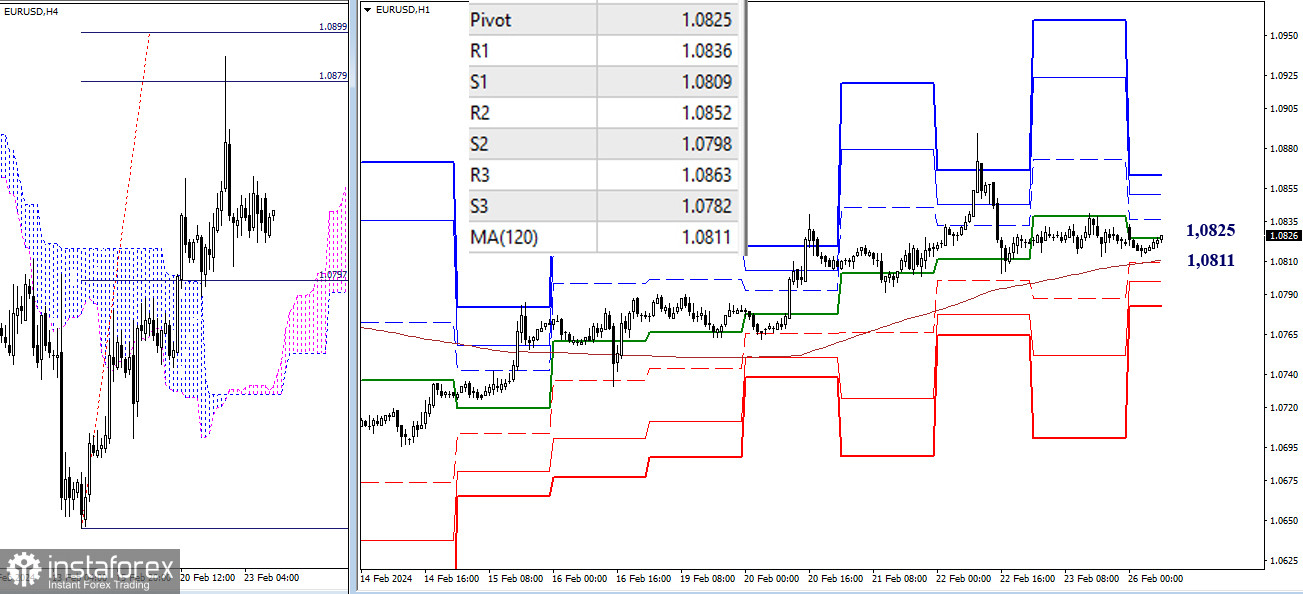

H4 – H1

On lower timeframes, the main advantage belongs to the bulls, but the pair has been in a correction zone with a sideways trend for a long time. Key levels can currently be noted at 1.0825 (central pivot point of the day) and 1.0811 (weekly long-term trend). A consolidation below these levels may change the current balance of power, shifting the advantage towards strengthening bearish sentiment. In case of activity and development of the movement, intraday focus will be on either resistances (1.0836 – 1.0852 – 1.0863) or support levels (1.0809 – 1.0798 – 1.0782) of the classic pivot points.

***

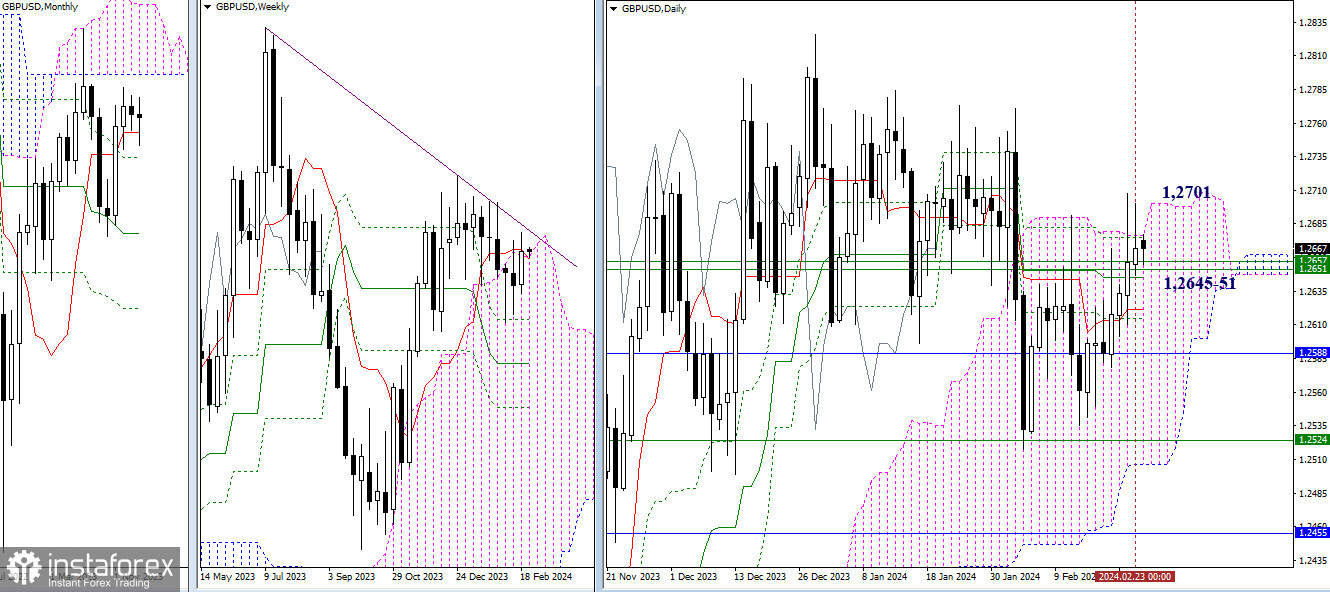

GBP/USD

Higher Timeframes

The pound does not give up hope for strengthening bullish positions. To achieve this, it needs to seize the tested levels, securely consolidate in the bullish zone relative to the Ichimoku clouds, and eliminate the death cross of the daily timeframe. This can be done by breaking away from the attraction and influence of the zone (1.2701 – 1.2645), where levels from different timeframes have currently accumulated and merged. If the bulls fail to realize such plans, a decline below 1.2645 will turn attention to supports, the nearest of which can be identified today at 1.2622 (daily short-term trend) and 1.2588 (monthly short-term trend).

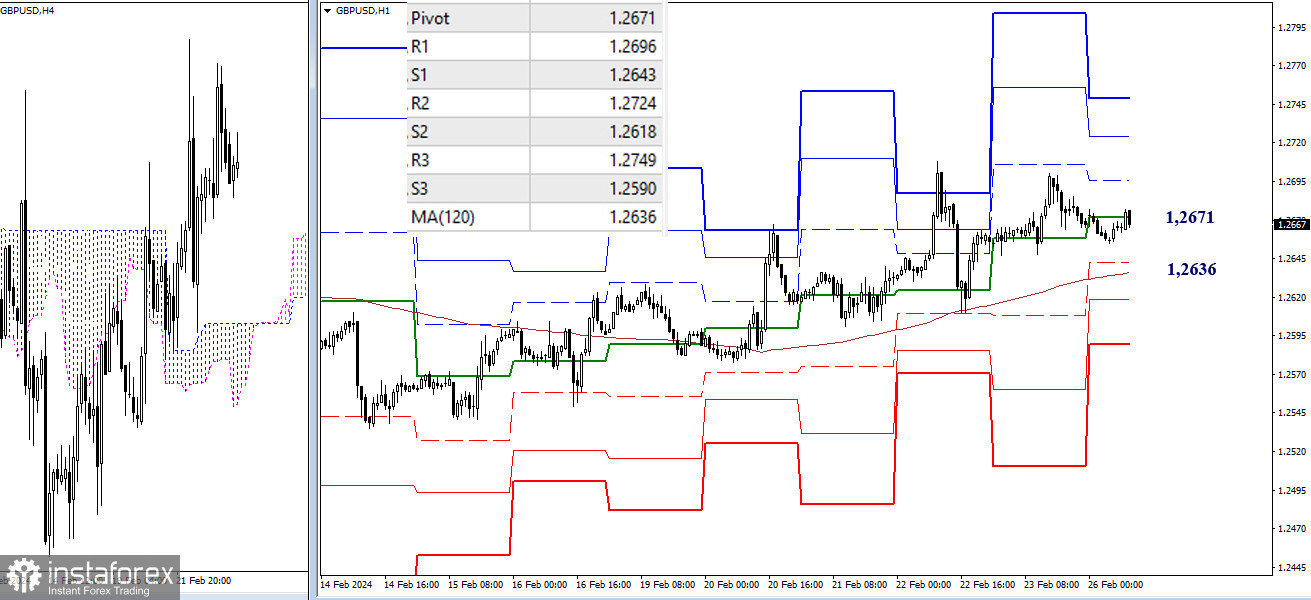

H4 – H1

The main advantage on lower timeframes belongs to the bulls, but the pair has been in a correction zone for a long time. Upon resumption of the ascent, intraday movement will develop through the passage of resistances at classic pivot points (1.2696 – 1.2724 – 1.2749). If the correction development leads to the loss of the weekly long-term trend (1.2636), and the moving average changes its direction, the supports of classic pivot points (1.2618 – 1.2590) will come into play.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)