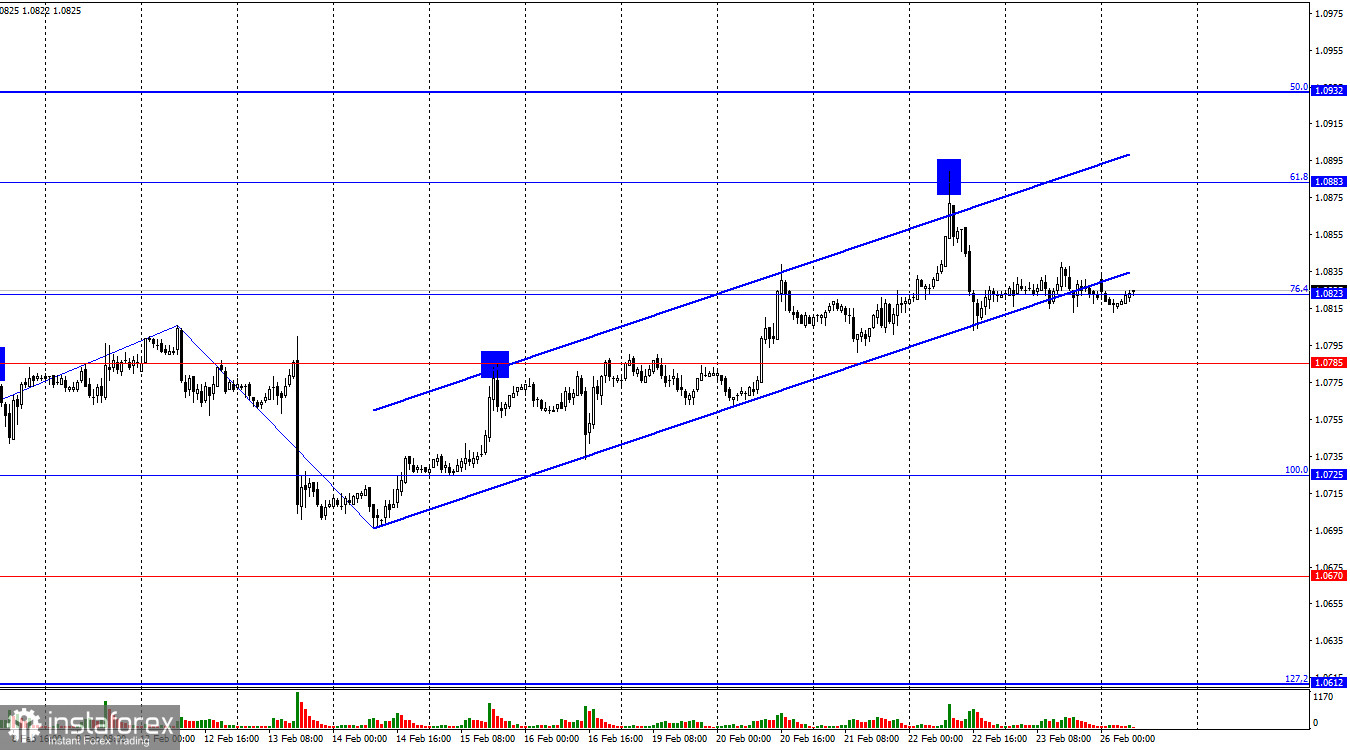

The EUR/USD pair traded very poorly on Friday. One might say it didn't trade at all. Throughout the day, bulls and bears struggled to tilt the balance in their favor and moved along the corrective level of 76.4%–1.0823. Nevertheless, quotes were consolidated below the upward trend corridor, allowing us to expect a decline toward the levels of 1.0785 and 1.0725. However, traders should first "warm up" at the beginning of the new week. It is still too early to conclude a change in the trend to "bearish."

The wave situation is becoming clearer. The last completed downward wave confidently broke the low of the previous wave, but the new upward wave broke the peak of the previous wave (from February 12). Thus, we currently have a "bullish" trend, and there is no sign of its completion. If so, bullish traders may attack more actively over the next weeks. However, consolidating quotes below the corridor can be considered the first sign of bull retreating. However, it may be short-lived – just long enough to form a corrective wave downward.

The information background on Friday disappointed bulls more than pleased them. If they had hoped to continue the pressure, their desire clearly diminished after the GDP report for Germany in the fourth quarter. The largest economy in the European Union contracted by 0.3%, making purchases of the European currency inappropriate.

ECB President Christine Lagarde will speak, and that's why I believe it is not worth rushing to conclude a trend change to "bearish." Lagarde's speech may be more "hawkish" than it seems, and on Mondays, the market often takes a long time to "get into gear." Traders may deliberately wait for Lagarde's speech to determine the preferred currency for the week.

On the 4-hour chart, the pair has risen to the corrective level of 50.0% (1.0862) and bounced off. Also, a "bearish" divergence has formed on the CCI indicator, increasing the probability of a reversal in favor of the US dollar and the beginning of a pair's decline towards the corrective level of 38.2% (1.0765). Earlier, the pair closed above the descending corridor; however, in consolidating quotes below the upward corridor on the hourly chart, bears will again gain an advantage over bulls. If the pair remains above the level of 1.0862, the probability of further growth towards the next corrective level of 61.8% at 1.0959 will increase.

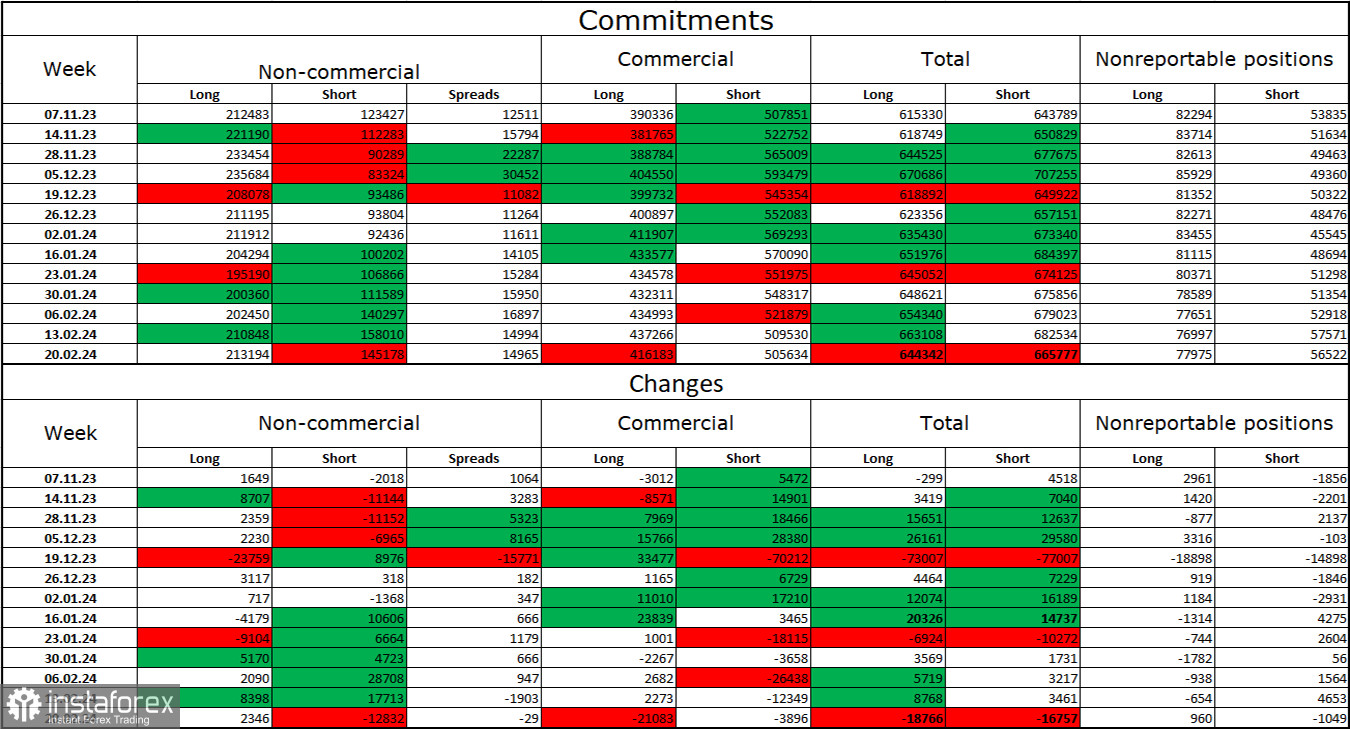

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 2346 long contracts and closed 12823 short contracts. The sentiment of the "Non-commercial" group remains "bullish" but continues to weaken. The total number of long contracts speculators hold now is 213 thousand, and short contracts are 145 thousand. The situation will continue to change in favor of bears. Bulls have dominated the market for too long and need strong information to maintain the "bullish" trend. At the same time, the total number of open long positions is less than the number of short positions (644K versus 665K). However, such a balance of power has been observed for quite some time.

News Calendar for the US and the European Union:

US - New Home Sales (15:00 UTC).

European Union - Speech by ECB President Christine Lagarde (16:00 UTC).

On February 26, the economic events calendar contains only two entries, among which Lagarde's speech stands out. The impact of the information background on traders' sentiment today may be of medium strength.

EUR/USD Forecast and Trading Recommendations:

Selling the pair was possible with consolidation below the upward corridor on the hourly chart with targets at 1.0785 and 1.0725. However, today, traders should be cautious with them, as Lagarde's speech may support euro bulls. Purchases of the pair will be possible on a rebound from the level of 1.0785 on the hourly chart with a target of 1.0883.