Technology indices break records again as investors hold their breath in anticipation of key data

US stock exchanges showed impressive results again on Tuesday, with the S&P 500 and Nasdaq indices updating their historical closing highs. Tech stocks continue to lead, fueling the interest of investors who are eagerly awaiting new data on the state of the labor market.

Growth leaders: technology, communications and consumer sector

Among the main growth engines were three sectors of the S&P 500 index: technology, communications services and consumer discretionary goods. These segments not only maintained Monday's positive trend, but also strengthened it. Such confident growth indicates continued investor confidence in these sectors.

Fed Optimism: Is Inflation Under Control?

The positive mood in the markets is also fueled by statements from Federal Reserve officials. Two senior officials expressed confidence that inflation is moving toward the 2% target level, and the labor market remains stable. However, the question of further interest rate cuts remains open.

Christopher Waller, one of the Fed's leaders, said on Monday that at this stage he is inclined to support additional rate cuts this month, but has not yet given a clear signal. Such a cautious attitude adds intrigue.

Investors Await Friday's Data

The key moment this week for investors is the publication of the monthly US employment report, scheduled for Friday. In addition, the market is eagerly awaiting the November data on private sector wages and the report of the Institute for Supply Management (ISM), which will be released earlier. "We are currently waiting for the big ISM numbers and Friday's employment report, so many market participants are choosing to hold off for now," said Paul Nolte, senior wealth advisor at Murphy & Sylvest in Elmhurst, Illinois.

What's next?

Investors are waiting, balancing hopes for economic stability with uncertainty about the Federal Reserve's actions. The data that will be released in the coming days could have a significant impact on the future dynamics of the markets. In the meantime, tech stocks continue to set the tone, filling the market with optimism.

Job openings are growing, layoffs are falling: the labor market is showing resilience

According to a new report, the number of open positions in the U.S. increased significantly in October, while the layoff rate reached its lowest levels in the last 18 months. These data confirm the strength of the American labor market, despite the uncertainty in the economy.

Rate cut odds: what do the forecasts say?

Financial markets are pricing in a 72% chance of another interest rate cut at the Federal Reserve meeting on December 17-18. This forecast was made based on data from the FedWatch tool from CME Group. If the rate is cut, it could provide additional support to the economy and markets.

Amazon is betting on artificial intelligence

Shares in e-commerce giant Amazon rose 1.3% after announcing the launch of new artificial intelligence platforms. At its annual AWS conference, the company presented so-called fundamental models that could form the basis for innovative technologies of the future. This move strengthened Amazon's position as a leader in the development of AI solutions.

Index dynamics: Nasdaq is back in the green

US stock indices showed mixed dynamics:

- The Dow Jones Industrial Average fell 0.17%, ending the day at 44,705.53;

- The S&P 500 rose a symbolic 0.05% to 6,049.88;

- The Nasdaq Composite added 0.40% to 19,480.91.

The rise in the Nasdaq reflects continued investor interest in technology companies, which remain market drivers.

November in the Green: Key S&P 500 Gains

The S&P 500 ended November with an impressive gain of 5.7%. The jump was partly driven by political events: Donald Trump returned to the White House after winning the presidential election on November 5, and his party won control of both houses of Congress. These changes have strengthened investors' expectations for new economic stimulus.

The S&P 500 has gained nearly 27% year-to-date, highlighting its outstanding performance even amid global economic turbulence.

Looking Ahead: Where to Look for New Momentum

"The market has performed strongly and now needs some breathing room to wait for the next catalyst to push it higher," said Quincy Crosby, chief strategist at LPL Financial.

There are a number of events ahead that could impact markets. Fed decisions, economic reports, and developments in key tech trends like artificial intelligence will set the tone in the coming weeks.

Transportation Index Drop, Korean Political Turbulence: Markets at a Crossroads

The Dow Transportation Average fell 2% on Thursday, its biggest daily drop since September. The decline reflects investor concerns about slowing economic growth and increased instability in global markets.

South Korea Political Crisis: How Has It Affected the Market?

US markets have also felt the impact of political uncertainty in South Korea. The iShares MSCI South Korea ETF fell 1.6%, while South Korean stocks listed on US exchanges also lost ground.

South Korean President Yoon Seok-yeol first declared martial law, then suddenly lifted it hours later. The controversial decision has sent investors into a frenzy and added to pressure on Asian markets.

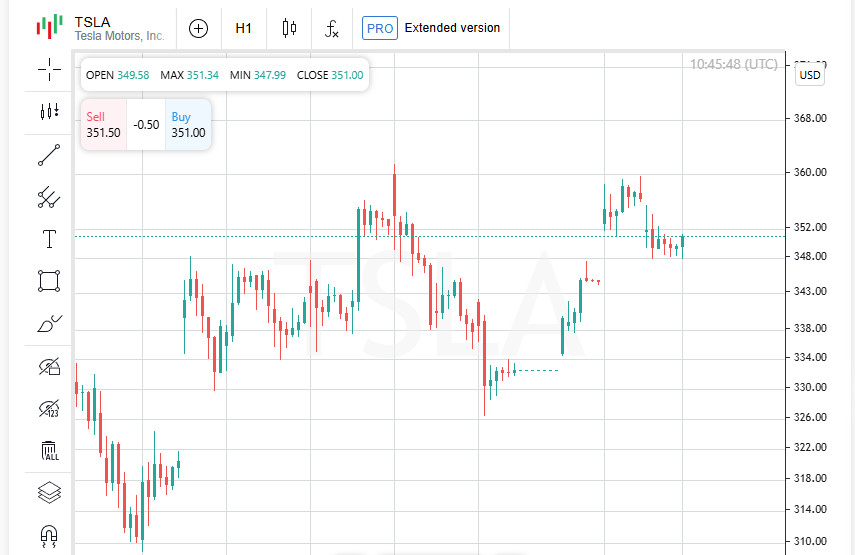

Tesla: China Sales Slowdown Hurts Shares

Tesla shares fell 1.6% after the company released its sales data. In November, the company's Chinese electric vehicle sales fell 4.3% year-on-year to 78,856 units. The decline fueled investor concerns about competition in the world's largest electric vehicle market.

Salesforce Pleases Investors: Shares Rise After Report

Despite the general volatility, Salesforce managed to pleasantly surprise investors. Its shares rose about 7% in after-hours trading after reporting quarterly revenue that beat analysts' estimates. The company's shares showed a modest 0.1% gain during the main session, but the evening results significantly boosted market optimism.

Trading Dynamics: Stocks Down

On the New York Stock Exchange, the number of falling stocks outnumbered the rising ones by 1.24 to 1. At the same time, 310 stocks reached new highs, and 50 — new lows.

On the Nasdaq, the picture was more pessimistic: 1,647 stocks showed growth, while 2,732 fell. The ratio between falling and rising stocks was 1.66 to 1.

Trading Volume Falls

Trading volume on American exchanges amounted to 12.7 billion shares, which was lower than the average value over the past 20 days — 14.81 billion shares. This may indicate that market participants prefer caution amid political and economic uncertainty.

Markets continue to balance between hopes for recovery and the threat of new shocks. Political risks, a decline in sales in key industries and investor caution set the tone for the coming days. Solid results from companies like Salesforce may ease the overall pessimism, but global events remain in focus.

European bourses remain quiet as French political drama nears its conclusion

European markets opened little changed on Wednesday, with investors focusing on political developments in France, where an impending no-confidence vote could see Prime Minister Michel Barnier's government fall.

STOXX 600 continues to strengthen

The pan-European STOXX 600 index gained 0.1% this morning, marking a steady move higher as the index heads for its fifth straight session of gains. It closed at a one-month high on Tuesday, gaining ground on gains in key sectors.

Germany sees steady gains

Germany's DAX showed a more confident result, rising 0.5% in early trading. This reflects the resilience of Europe's largest economy despite political uncertainty in neighbouring France.

France: Minimal gains in the shadow of political crisis

France's CAC 40 added a modest 0.05%, showing cautious growth. However, investors' attention is focused on the parliamentary vote, which could dramatically change the country's political landscape. The decision of lawmakers will have far-reaching consequences not only for France, but for the entire Eurozone.

Retail and technology sectors lead the way

Among the sectors, European retail companies and the technology sector showed the best performance.

- The retail index rose by 0.8%, reflecting solid demand for shares of large retailers;

- The technology sector strengthened by 0.6%, continuing its recovery from recent declines.

What to expect next?

European markets are showing relative stability amid political turbulence. Investors will be closely watching developments in France, as the outcome of the no-confidence vote could have a significant impact on the market. Meanwhile, key sectors such as retail and technology continue to set a positive tone. However, the situation remains uncertain and the coming days could bring new challenges for European markets.

France on the brink of political crisis: decisive no-confidence vote

French lawmakers are preparing for a fateful vote that could result in the resignation of Prime Minister Michel Barnier's government. The no-confidence vote is expected to be a response to the government's inability to cope with a growing budget deficit.

Last-minute debate: Barnier seeks compromise

Parliamentary debates will begin at 15:00 GMT, with a vote expected a few hours later. Ahead of the outcome, Barnier has indicated his willingness to negotiate with Marine Le Pen's far-right National Rally and other parties to avoid resignation.

Despite the prime minister's optimism, the political atmosphere remains tense and analysts doubt he will be able to retain office without making major concessions.

Automakers in Focus: Stellantis Shares Rise

Amid political turmoil, Stellantis shares rose more than 1% on the Paris Stock Exchange following speculation that Apple's outgoing CFO Luca Maestri might be appointed CEO of the Italian-French automaker.

Although the company later denied the news, the news spurred investor interest and supported the CAC 40, which continues to show cautious growth.

Key Economic Data of the Day

Investors are awaiting the release of PMI and producer price data in the eurozone today. These figures could provide a clearer picture of the current state of the region's economy and indicate further steps by the European Central Bank in the fight against inflation.

Outlook: Politics and Economics at the Crossroads

The political situation in France could have a significant impact on economic stability both within the country and across the eurozone. A vote of no confidence, if it leads to a change in government, would add uncertainty at a time when the region faces multiple challenges. In the meantime, markets are watching developments closely, remaining cautiously optimistic as they await both political and economic news.