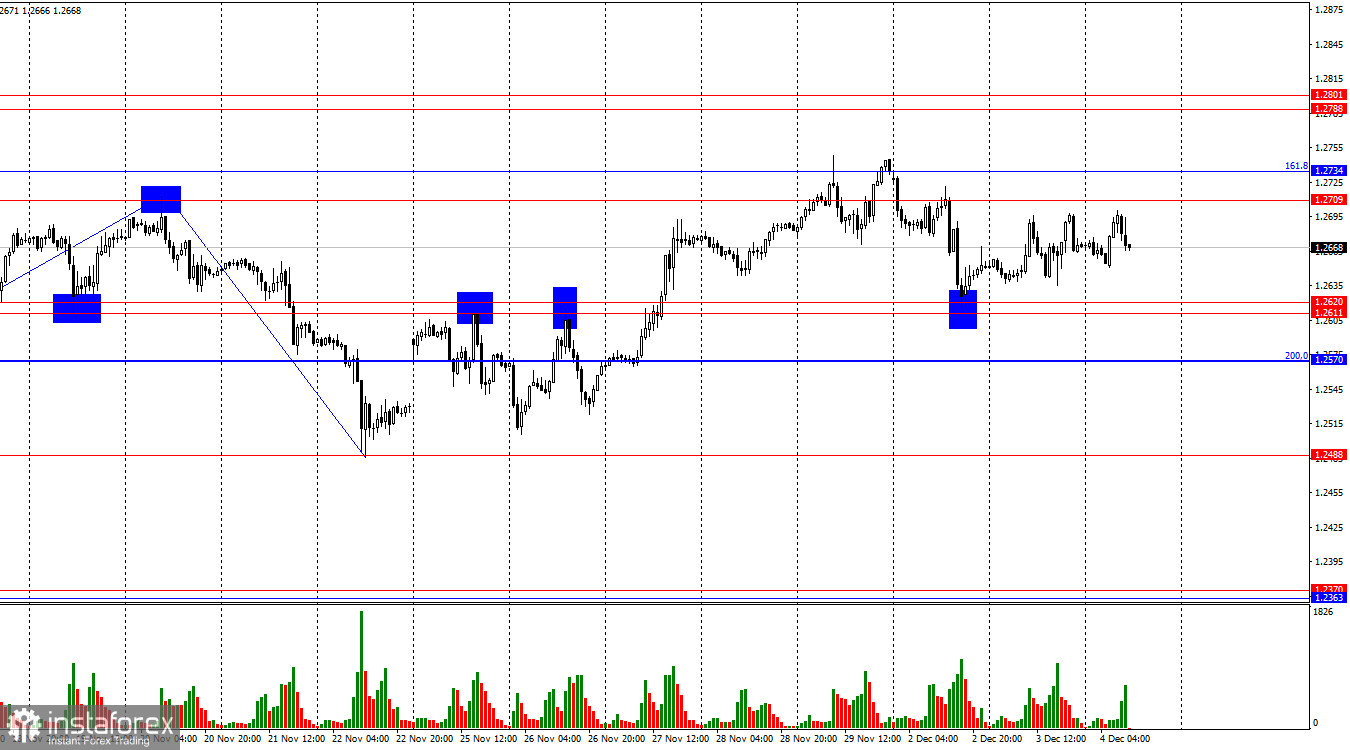

On the hourly chart, the GBP/USD pair continued to trade within the 1.2611–1.2620 zone and the 1.2709–1.2734 zone on Tuesday. The pair remains in the same range during the first half of Wednesday. Thus, we are in a local sideways market. A breakout above or below this range will determine the potential future direction of the British pound.

The wave structure is clear. The last completed downward wave broke the low of the previous wave, and the new upward wave broke the last peak. Therefore, there is a probability that the "bearish" trend could be coming to an end or pausing. However, as long as the bears hold the 1.2709–1.2734 zone, they maintain a certain advantage in the market. A long-term decline in the pound is still very likely.

On Tuesday, there were no news events for the British pound, and the JOLTs report, which was the only significant event of the day, only provided nominal support for the dollar. Today, there will be much more news for both the British pound and the US dollar. Among the highlights are the speeches of Andrew Bailey and Jerome Powell. As I previously mentioned regarding Powell, it is unlikely to expect any "dovish" rhetoric from him that could benefit the bulls. As for Andrew Bailey, it is even harder to predict what to expect from him. Nevertheless, in the morning, the pound is trading lower, and Bailey will speak in the next hour. Also, today, the important ISM Services PMI for the US will be released. A slight decline is expected, but for the dollar, the key point is that the reading should be above 55.5 (the forecast). If this condition is met, the pair's decline may continue. However, undoubtedly, the primary focus today will be on the speeches of Bailey and Powell.

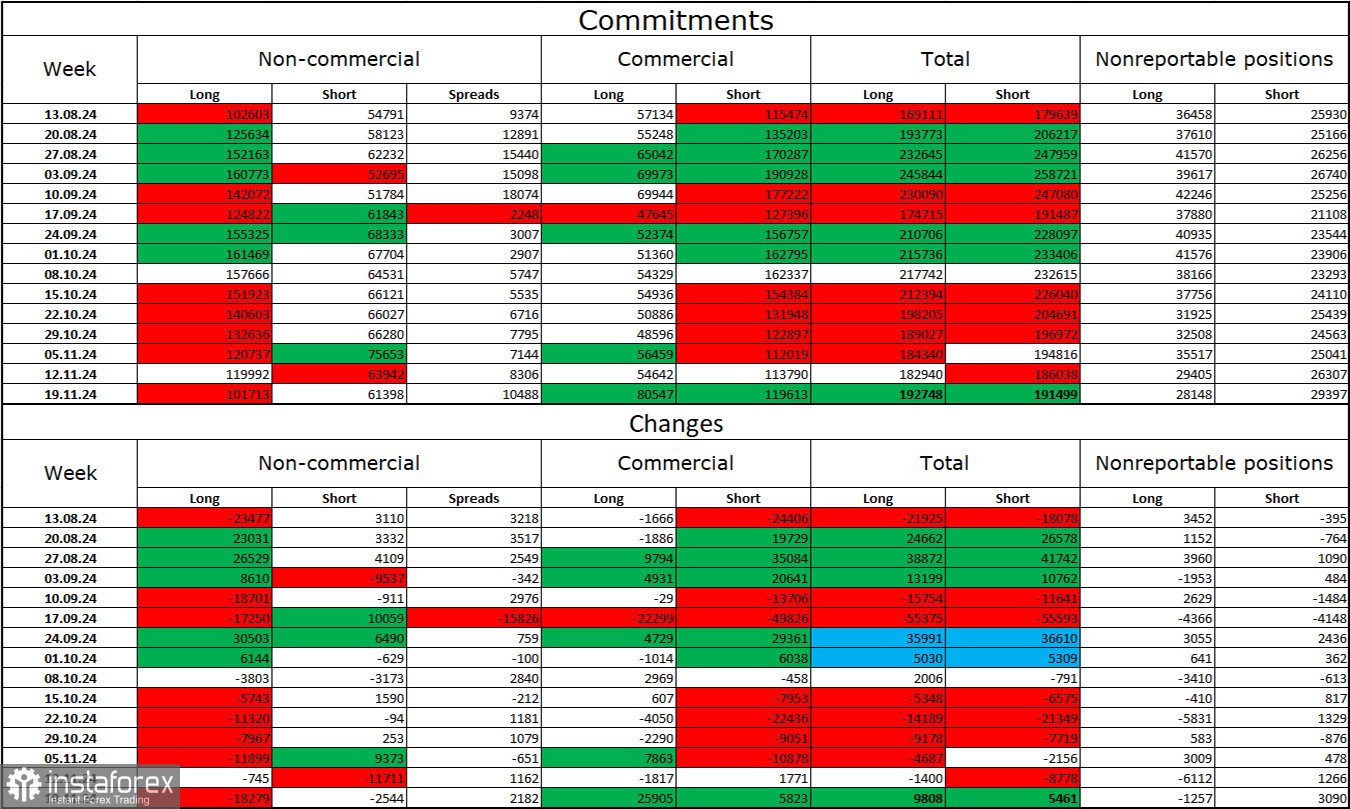

The sentiment of "Non-commercial" traders during the last reporting week became less "bullish." The number of long positions held by speculators decreased by 18,279, while short positions decreased by 2,544. The bulls still hold a solid advantage. The gap between long and short positions is around 40,000: 102,000 vs. 61,000.

In my view, the pound still faces a potential decline, and the COT reports are indicating the growing strength of bearish positions almost every week. Over the past three months, the number of long positions has decreased from 102,000 to 101,000, while short positions have increased from 55,000 to 62,000. I believe that, over time, professional traders will continue to reduce long positions or build up short positions, as all possible factors for buying the British pound have already been priced in. Technical analysis also supports the bearish outlook for the pound.

Economic Calendar for the UK and the US:

- UK: Speech by Bank of England Governor Andrew Bailey (09:00 UTC)

- UK: Services PMI (09:30 UTC)

- US: ADP Non-Farm Employment Change (13:15 UTC)

- US: S&P Services PMI (14:45 UTC)

- US: ISM Services PMI (15:00 UTC)

- US: Speech by Federal Reserve Chairman Jerome Powell (18:45 UTC)

The economic calendar on Wednesday contains many important events. The impact of the news on trader sentiment today could be strong.

GBP/USD Forecast and Trading Advice:

Short positions were possible when the pair rejected from the 1.2709–1.2734 zone on the hourly chart with a target of 1.2611–1.2620. The target has been reached. New short positions are possible after another rejection from the 1.2709–1.2734 zone or if the pair closes below the sideways range on the hourly chart. I would not risk considering long positions at this time.

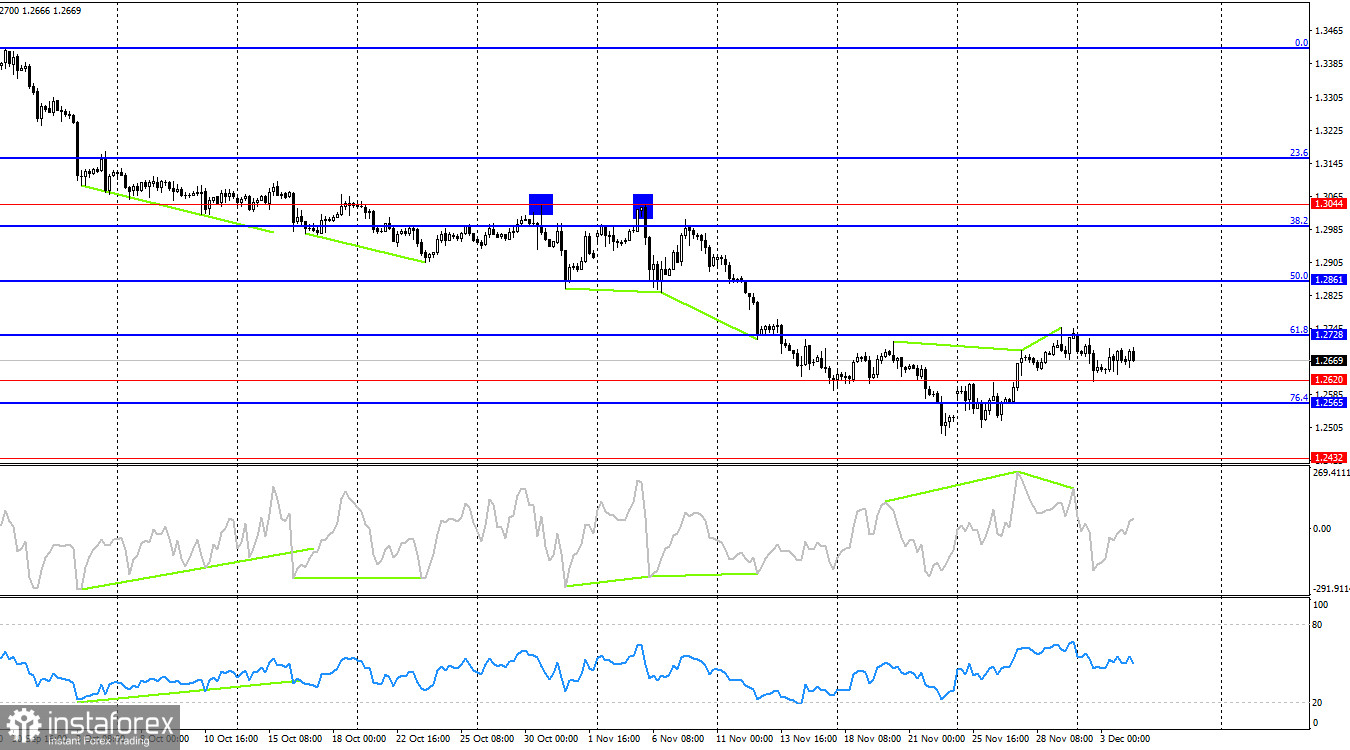

Fibonacci levels have been drawn from 1.3000 to 1.3432 on the hourly chart and from 1.2299 to 1.3432 on the 4-hour chart.