The Japanese yen is declining amid the Bank of Japan's uncertain policy and risk sentiment.

On Friday, Bank of Japan Governor Kazuo Ueda said that it was too early to declare victory over inflation. In addition, Japan's technical recession suggests that the BOJ may postpone its plan to tighten monetary policy. This, in turn, undermines the yen.

Nevertheless, it is reported that the Japanese government has begun to consider declaring an official end to deflation. However, traders are sure that another sharp wage hike could trigger a spiral of price and wage increases, thus forcing the Bank of Japan to abandon its ultra-soft monetary policy. Together with the situation in stock markets, this could help limit the yen's losses and prevent USD/JPY appreciation.

Tomorrow, the Tokyo consumer price index report will be released. It is important for the Japanese yen.

Also, this week, Fed Chairman Jerome Powell will deliver a speech to Congress on Wednesday and Thursday. Then, the US will disclose the NFP non-farm payrolls report on Friday. This may give new signals about the Fed's rate cut and affect the USD/JPY pair.

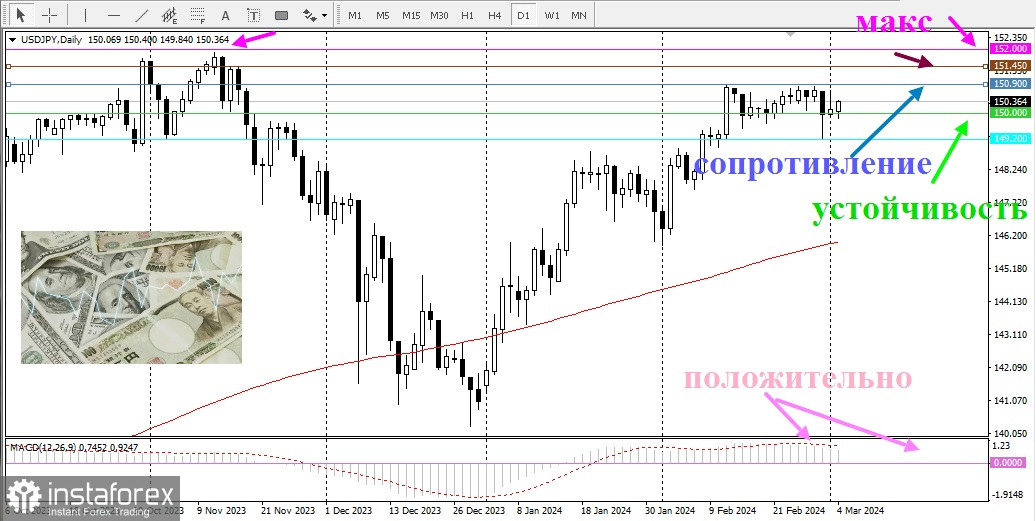

From a technical point of view, Friday's slump is not far from the major resistance at 150.80–150.90, and the absence of any meaningful buy orders forces bulls to be cautious. However, the following pullback showed resilience around 150.00. Moreover, the oscillators on the daily chart are holding in positive territory and support the growth prospects of the USD/JPY pair.

Nevertheless, before making new bullish bets, it would be wise to wait for a sustained rise above the aforementioned barrier. Spot prices could then rise towards the 151.45 interim resistance on the way to 152.00, or the multi-year high set in October 2022 and retested in November 2023.

On the other hand, any decline will find decent support and attract new buyers near last week's low, near 149.20. Sell orders may lead to a break below 149.00 that would shift the bias in favor of bears and leave USD/JPY vulnerable to further declines. Spot prices could fall towards the 148.30 support on the way to the 148.00 figure and the 100-day simple moving average SMA, which is currently pegged to the 147.80 area.

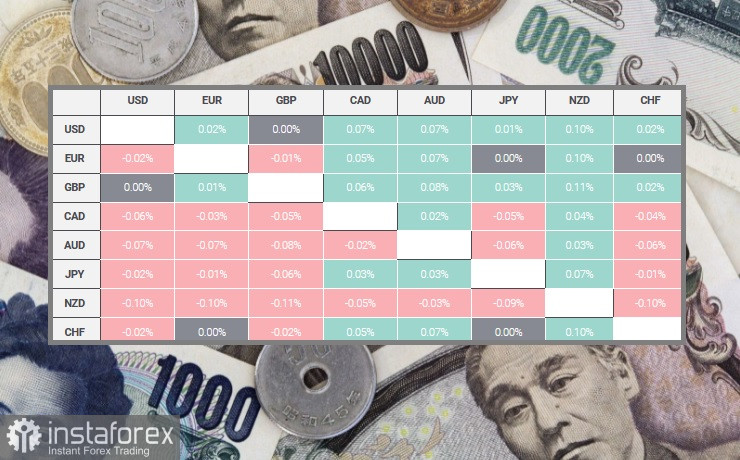

The chart below shows the percentage change in the Japanese yen against the major currencies.

The Japanese yen showed a good performance against the New Zealand dollar.