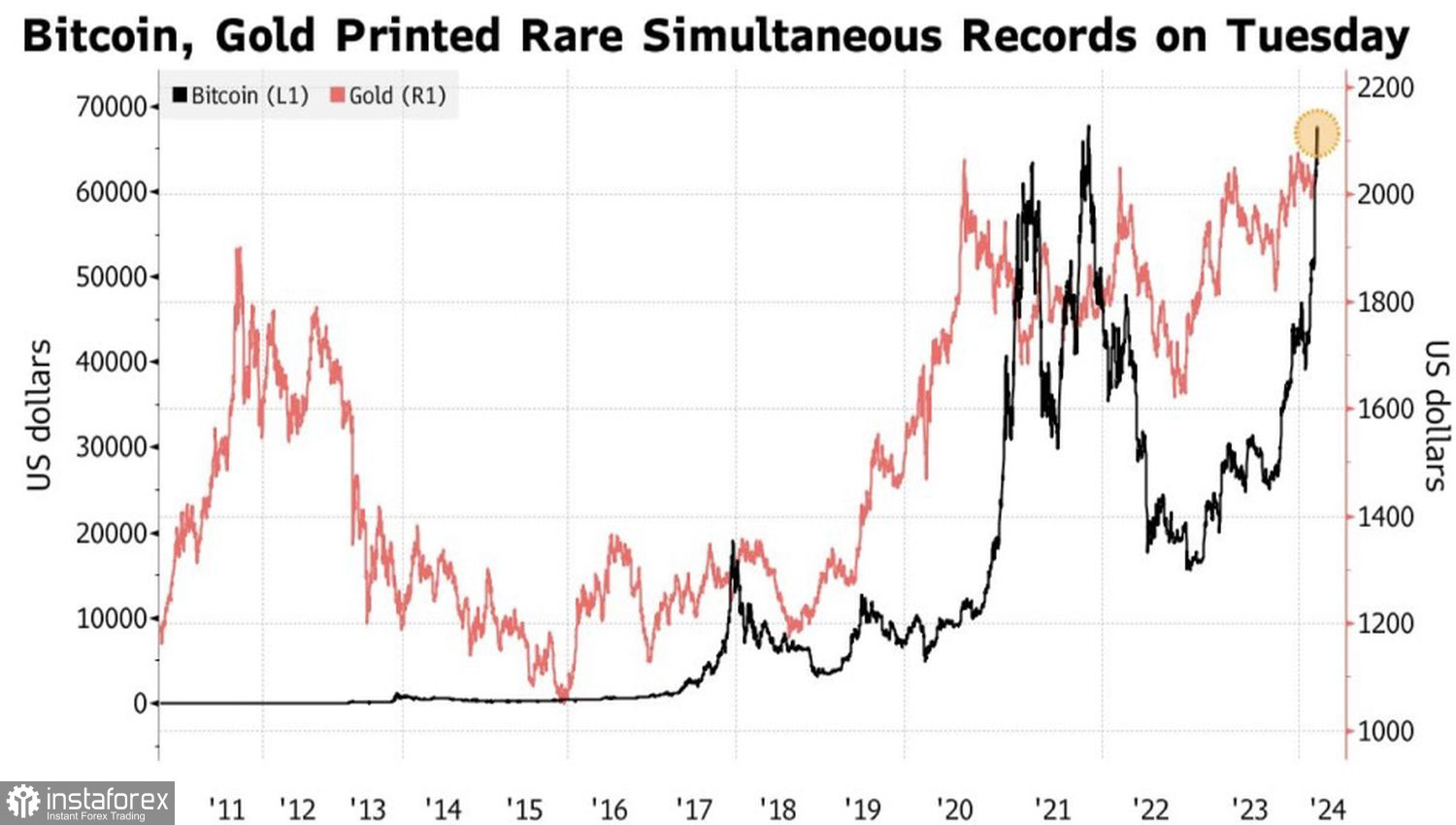

March 2024 has entered the history of financial markets. At the start of spring, gold and bitcoin simultaneously marked new record highs. These two assets, fundamentally different in nature, showcased remarkable performance. While precious metals are traditionally perceived as a safe haven, with demand increasing during global economic turmoil, cryptocurrencies are considered risky assets. It is particularly astonishing to witness the rapid rallies of XAU/USD and BTC/USD happening simultaneously.

While bitcoin's growth is attributed to the April halving and an $8 billion capital inflow into ETFs since SEC approval and the introduction of specialized exchange-traded funds on January 11, gold lacks similar catalysts. Gold is said to be supported by geopolitical factors, anticipations of a Federal Reserve interest rate cut, and a capital shift from the stock market due to increasing risks of a correction in the S&P 500. Nevertheless, none of these factors account for the rapid surge in XAU/USD quotes.

Dynamics of Bitcoin and gold

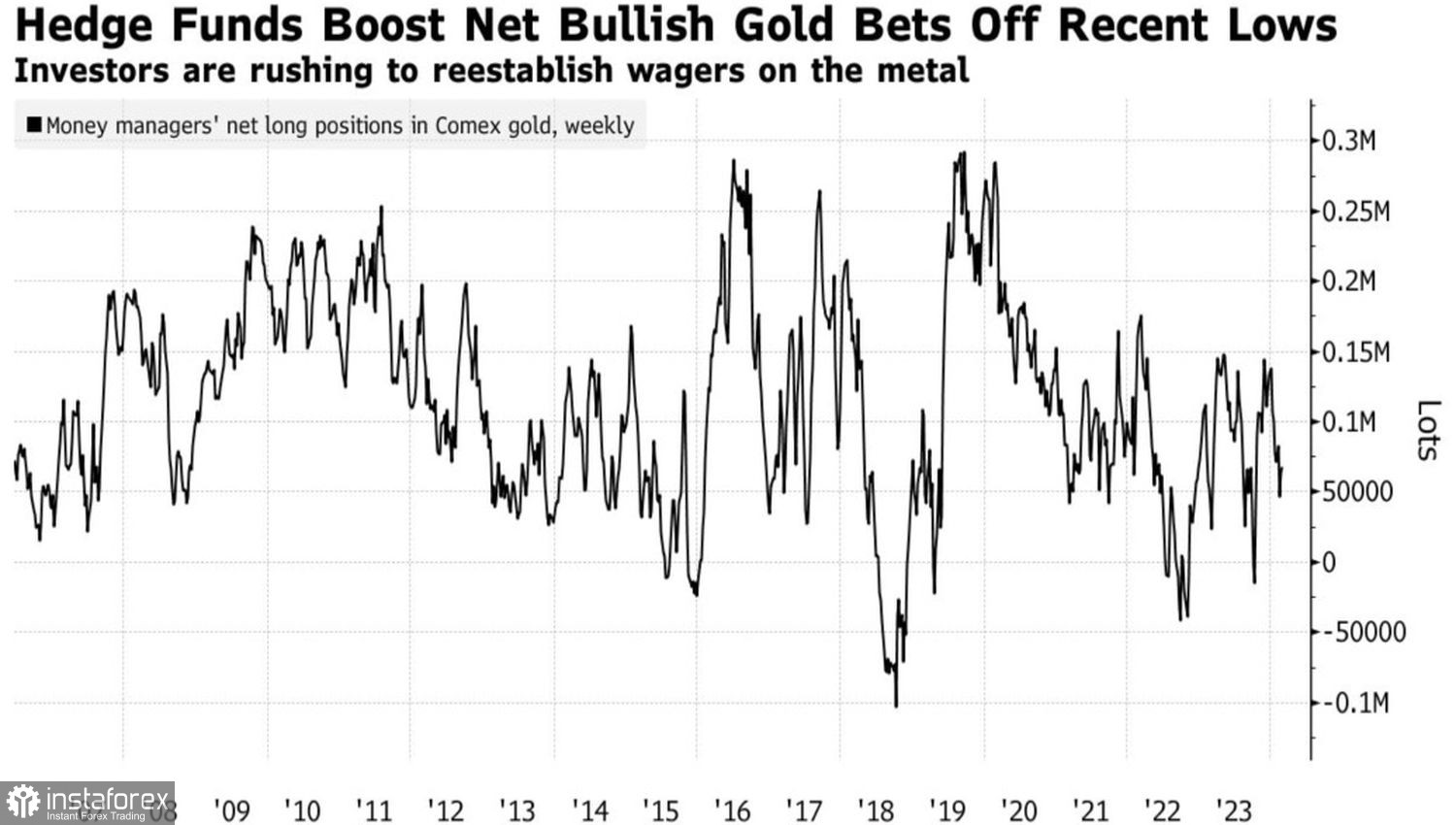

Additionally, several limiting factors affect the precious metal. Gold-focused ETF holdings recently dropped to their lowest levels since July 2019, with a total outflow of approximately $4.6 billion since the start of the year. The U.S. dollar is currently outpacing other G10 currencies, and given that the precious metal is traded in U.S. currency, an increase in the USD index poses a headwind for gold. Furthermore, the neutral positioning of financial managers mitigates the risk of significant fluctuations, essentially reducing it to zero.

So, what is the reason for the sharp surge in XAU/USD? It is attributed to momentum trading, where growth begets new growth. One can also draw parallels with a spring that was compressed for a long time as gold languished in a consolidation range. Finally, an explosion occurred.

Dynamics of positions of asset managers in gold

There are other explanations as well. In 2024, traders are making earlier bets on significant events and are often proven correct. The rally in precious metals may be linked to expectations of Jerome Powell's dovish rhetoric during his testimony before the U.S. Congress and the market's faith in weak employment statistics for February. Could it be that the Fed Chairman will not rule out an earlier rate cut? If so, derivatives will restore chances to April, which would be a disaster for the dollar.

In reality, the easing of monetary policy by the Federal Reserve and other central banks creates a favorable backdrop for low-yield assets such as gold, the Japanese yen, and the Swiss franc – considered safe-haven assets. The earlier the federal funds rate starts to decline, the better for the XAU/USD bulls.

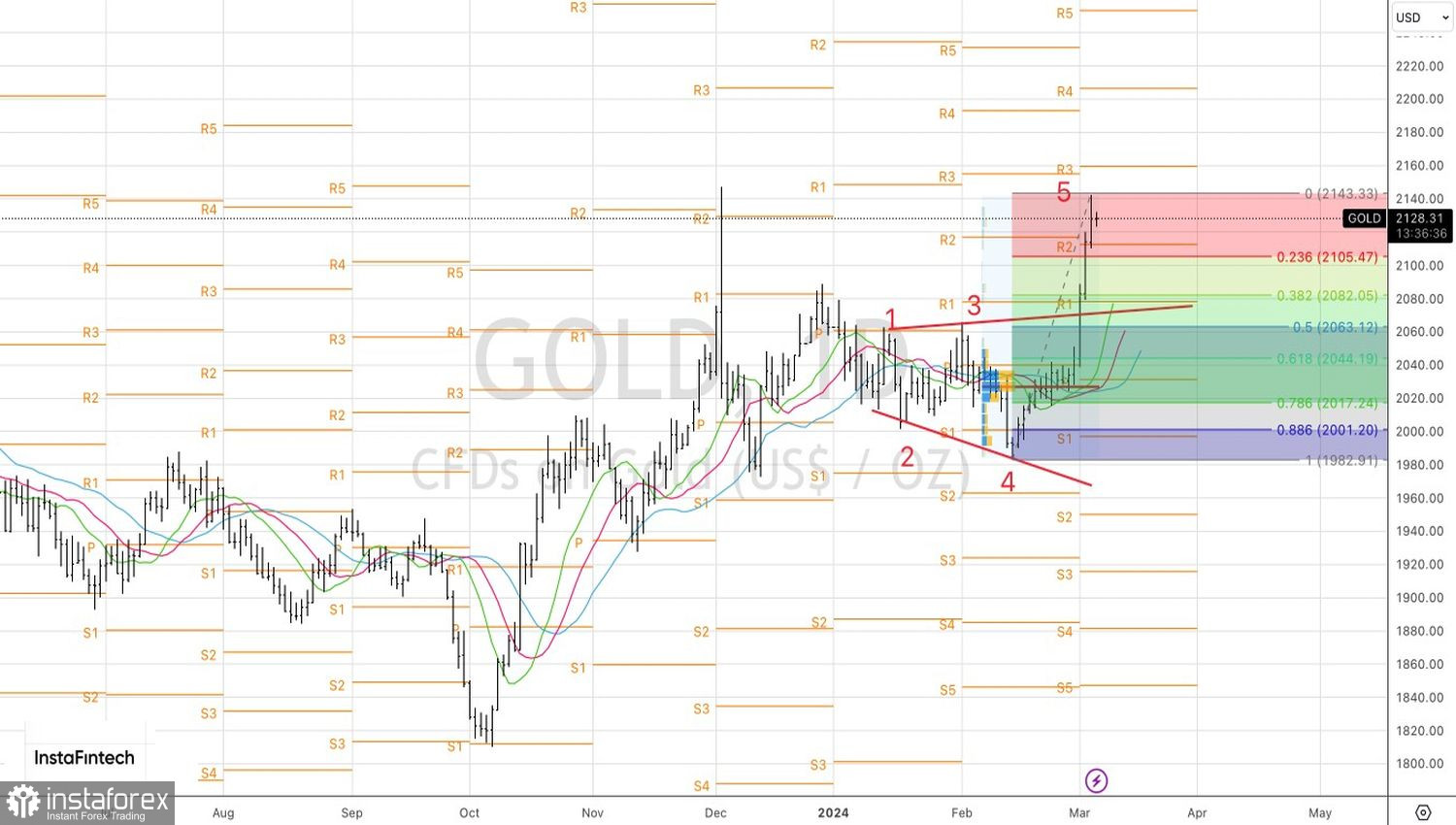

Technically, on the daily chart of gold, a reversal pattern called the Expanding Wedge has been realized. Pullbacks to the levels of 23.6%, 38.2%, and 50% from the last upward wave 4-5, followed by rebounds, should be used to form long positions in precious metals. These levels are at $2,105, $2,082, and $2,061 per ounce.