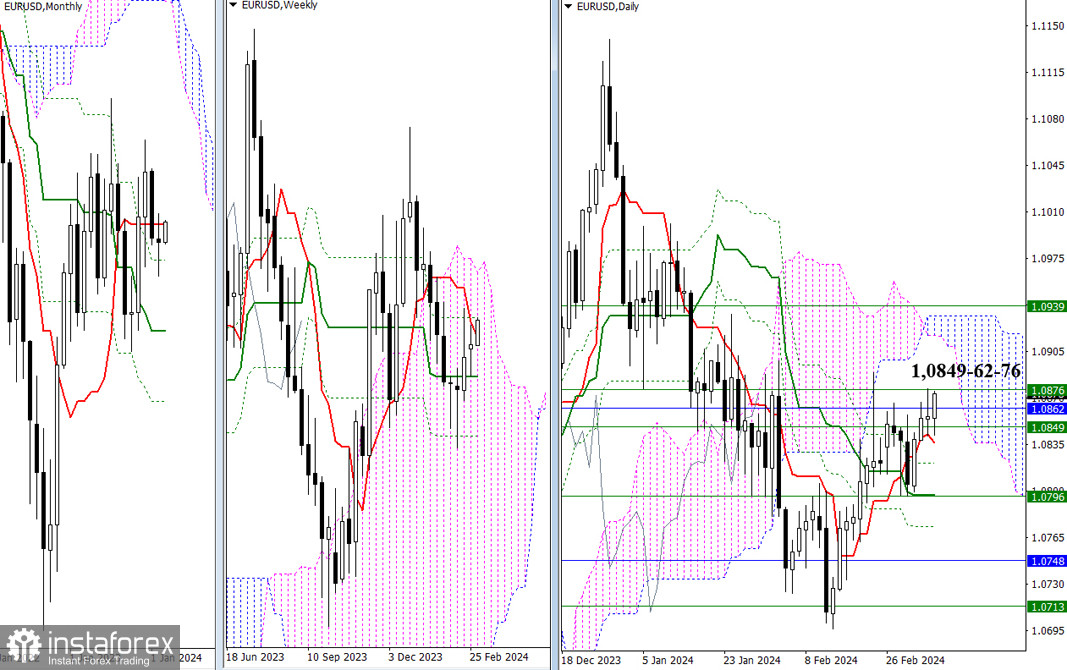

EUR/USD

Larger timeframes

EUR/USD has not revealed any significant changes over the past 24 hours. The currency pair continues to trade next to the resistance zone 1.0849-62-76 represented by weekly levels + a one-month short-term trend. A breakout of the zone and a fixation above will allow us to take into account new levels. In case the instrument fails to test the above-said resistance area, the market will shift focus to the daily Ichimoku cross. Today its support levels are seen at 1.0837 – 1.0821 – 1.0797 – 1.0793. The daily cross is reinforced in the current situation due to the weekly medium-term trend line of 1.0796.

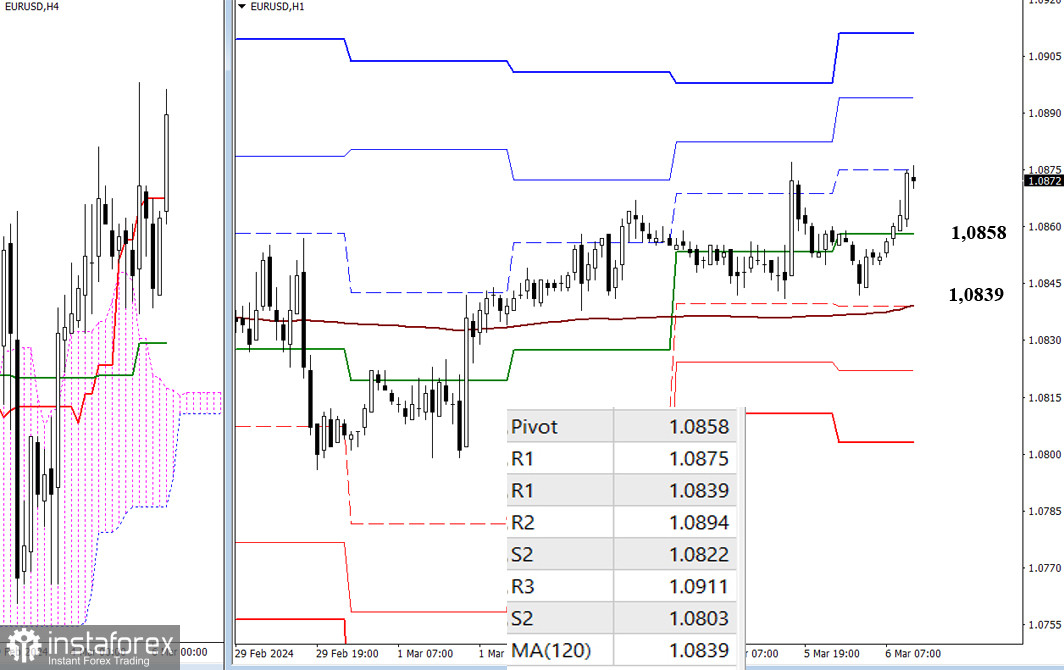

H4 – H1

At lower time intervals, the advantage of bull traders helps them to push the price up. At the moment, the bulls are testing the first resistance of the classic Pivot levels (1.0875). Then, when the bulls rise, they will encounter resistance 2 (1.0894) and resistance 3 (1.0911). A change in priorities may return the market to key support levels, which today are located at 1.0858 (central Pivot level of the day) and 1.0839 (weekly long-term trend). A breakout of key support levels can change the current balance of trading forces in favor of strengthening bearish sentiment. The reference points for intraday decline are the support of classic pivot levels (1.0822 – 1.0803).

***

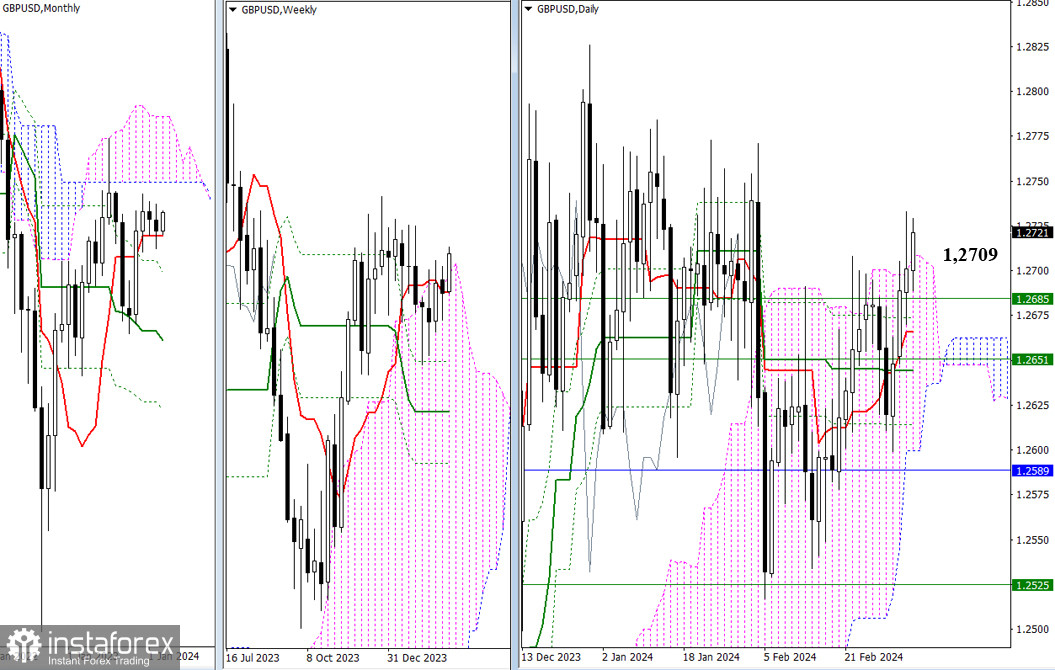

GBP/USD

Larger timeframes

The last 24 hours ended with a long upper shadow. Today, the bulls are striving to move beyond the Ichimoku cloud. The border of the daily cloud is at 1.2709 at the time of analysis. Consolidation above it will allow the bulls to make new trading plans. If the bears return to the market, they could come across support on their way between 1.2685 (upper limit of the weekly cloud), 1.2666 (daily short-term trend), and 1.2644-51 (weekly short-term trend + daily medium-term trend).

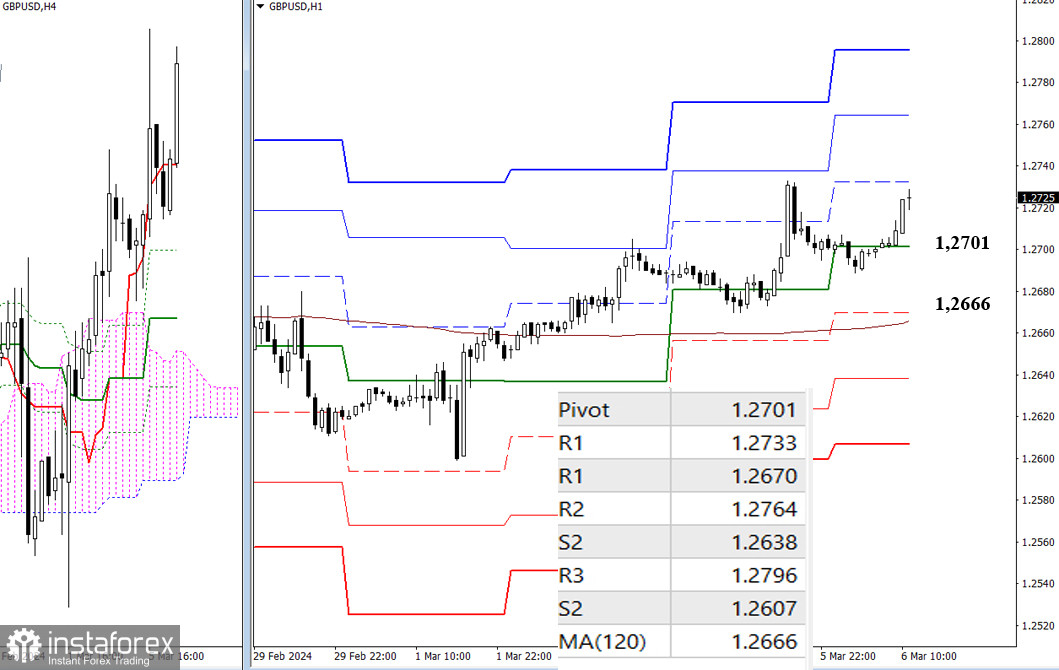

H4 – H1

On lower timeframes, the bulls are seeking to regain their positions and go beyond the correctional level of 1.2733. Additional reference points within the day are the classic pivot levels. The bulls are interested in raising the resistance levels. Today they can be found at 1.2733 – 1.2764 – 1.2796. The key levels are currently slightly distant from each other 1.2666 – 1.2701 (central pivot level + weekly long-term trend), which creates room for a correction.

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 – classic pivot points + 120-period Moving Average (weekly long-term trendline)