The U.S. dollar continues to decline across the market, although the news background often indicates the opposite. If for the EUR/USD instrument everything can be written off as the need to build a corrective wave, the GBP/USD instrument does not work that way. The British pound certainly remains within a sideways range, which can show any kind of movement. And due to this, the horizontal movement does not bring any notable changes. Nevertheless, I am personally surprised by the recent growth of the euro and the pound. I cannot identify a clear pattern behind it.

On Wednesday, Federal Reserve Chair Jerome Powell delivered a speech in the U.S. Congress. The text of his speech was posted on the Fed's website several hours before the presentation, so everyone can review it. Since the demand for the dollar decreased on Wednesday and it continued to fall on Thursday, one might assume that Powell suggested that the central bank is ready to lower rates in the near future. However, this is not the case. The head of the Fed said that the central bank is not ready to move towards lower rates until it is confident that inflation will reach the 2% mark in the medium term.

Therefore, Powell's rhetoric was not dovish. The Fed chair also reiterated that the central bank is waiting to become more confident that inflation is moving sustainably, and that interest rates may remain at peak levels for some time. Again, this is not a dovish stance. Based on this, I believe that the market's reaction was unreasonable for the last two days.

On Thursday, the situation was somewhat different. The European Central Bank meeting had an impact on market sentiment, but take note that the Bank left all three rates unchanged, yet demand for the euro rose again. In any case, I find Wednesday more illustrative than Thursday. The U.S. dollar could have appreciated on Wednesday, but the market decided otherwise, which, in my opinion, does not align with the news background. If the U.S. reports show strong values on Friday and this does not support the dollar, everything will fall into place. Weak labor market and unemployment data will almost certainly reduce demand for the dollar.

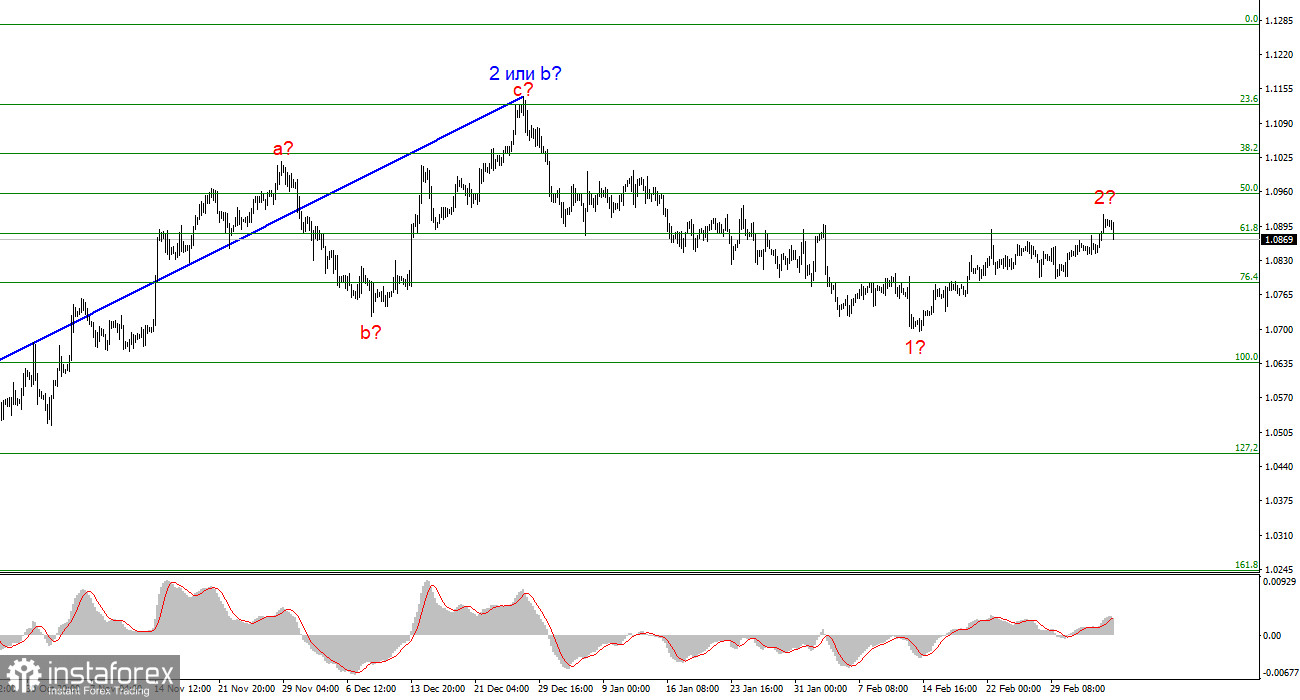

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which may end this week. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

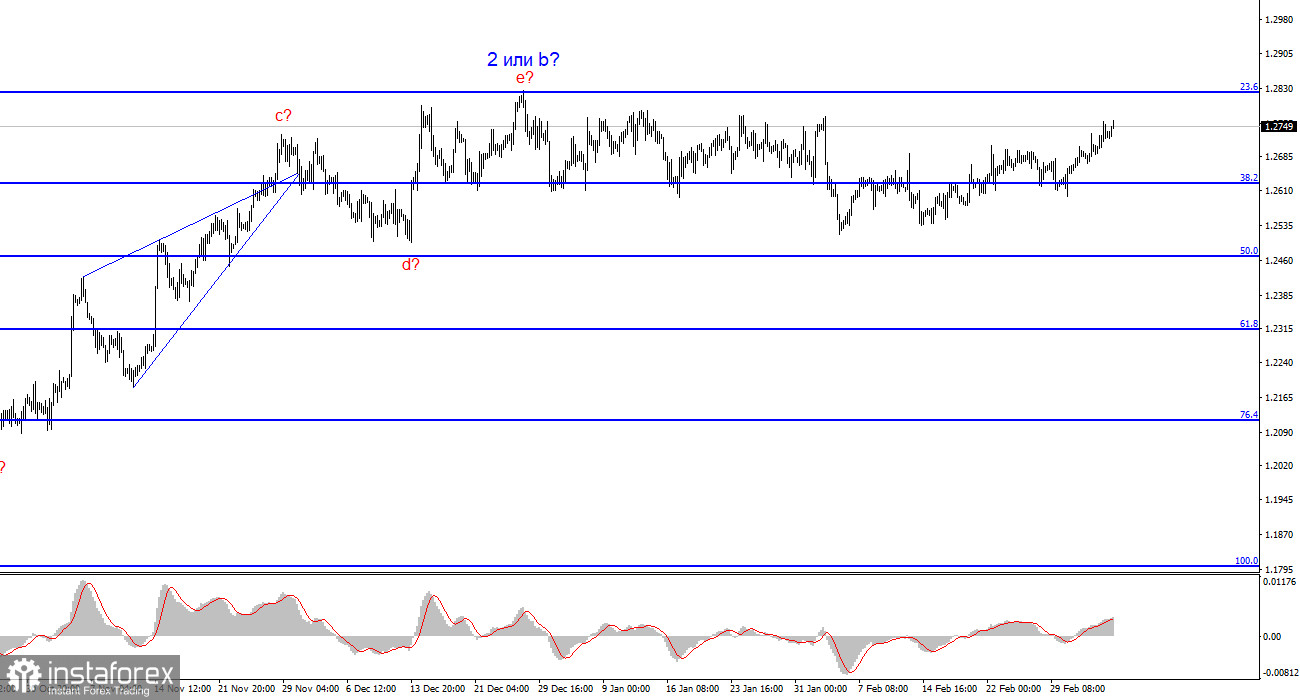

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will gain momentum sooner or later. A successful attempt to break through the 1.2627 level generated a sell signal, but at the moment, I can also identify a new sideways range at 1.2500-1.2821. There are still 50-70 pips to the upper boundary of this range. As long as the instrument stays inside the range, the sideways movement persists. It is logical to assume that a bearish reversal may follow near the upper boundary of the range.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.