In the previous overview, which focused on the Federal Reserve rates and Fed Chair Jerome Powell's speech, I came to the conclusion that the market made an irrational decision to reduce demand for the U.S. currency on Wednesday. I also mentioned that the situation on Thursday was somewhat different due to the European Central Bank meeting and ECB President Christine Lagarde's speech. Now let's try to understand whether the market had any good reason to increase demand for the euro on Thursday and, more interestingly, for the pound.

All three interest rates remained unchanged. This didn't come as a surprise, as members of the Governing Council have repeatedly mentioned that they are ready to consider rate cuts no earlier than the summer. Lagarde said on Thursday that inflation in the eurozone has dropped rapidly from its peak, but it does not guarantee that consumer prices will maintain its downward trajectory. Lagarde says "we will know a lot more in June".

At first glance, the question is: if Lagarde did not talk about strong inflation or mention that it might take more time to tame it, then why did the demand for the euro increase? After all, Lagarde's rhetoric did not change. Lagarde also reiterated that the central bank will keep its policy stance unchanged, gradually moving towards monetary easing and then normalization. According to Lagarde, the central bank still needs more evidence that inflation is decreasing to 2% before it considers rate cuts. This topic (monetary easing) was not on the agenda for the current meeting.

A second question arises: if everything is going according to plan, and the ECB will start to consider rate cuts in early summer, then why did demand for the euro rise? After all, the ECB's sentiment has not changed! In my opinion, the market is currently bullish, and that explains everything. Market participants are not ready to sell, so any rhetoric from Powell and Lagarde cannot exert significant pressure on both instruments. In my opinion, this is not critical for EUR/USD, but it is always unpleasant to expect a drop and see an increase instead. If the instrument manages to rise due to strong U.S. data on Friday, it is unlikely for anyone to say that it was entirely predictable. On the other hand, weak or mixed data practically guarantees that the demand for the U.S. dollar will fall.

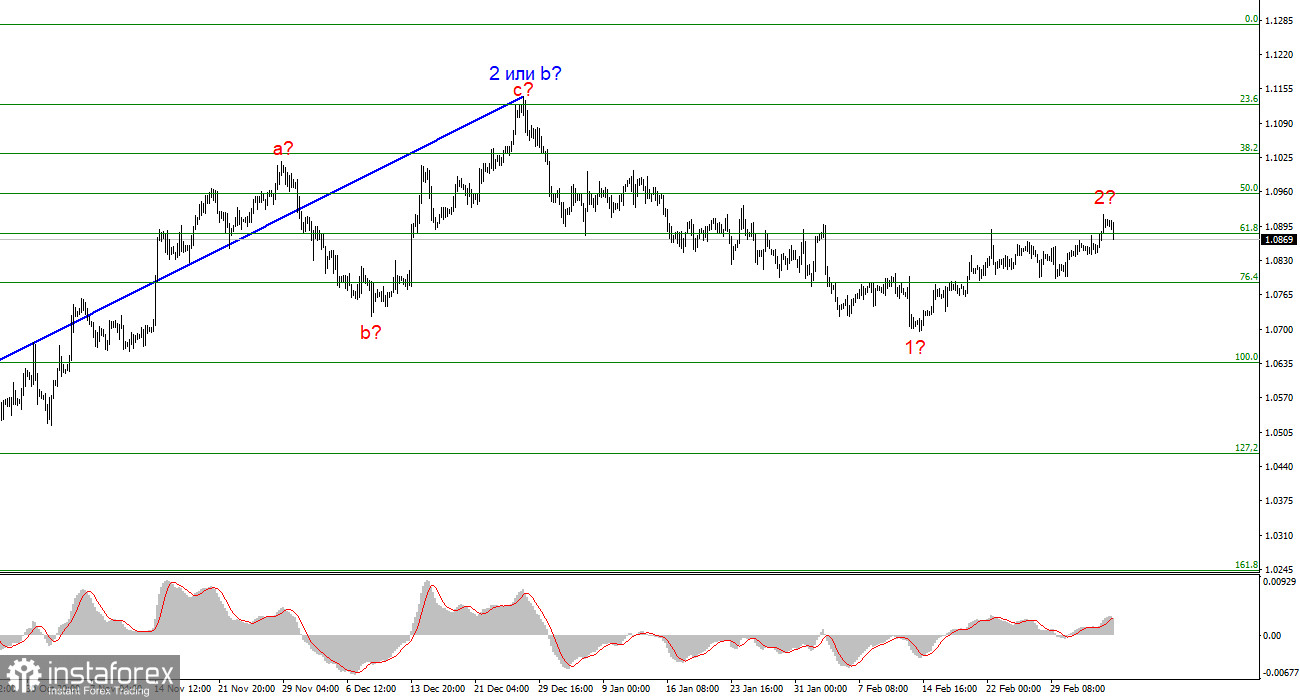

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which may end this week. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

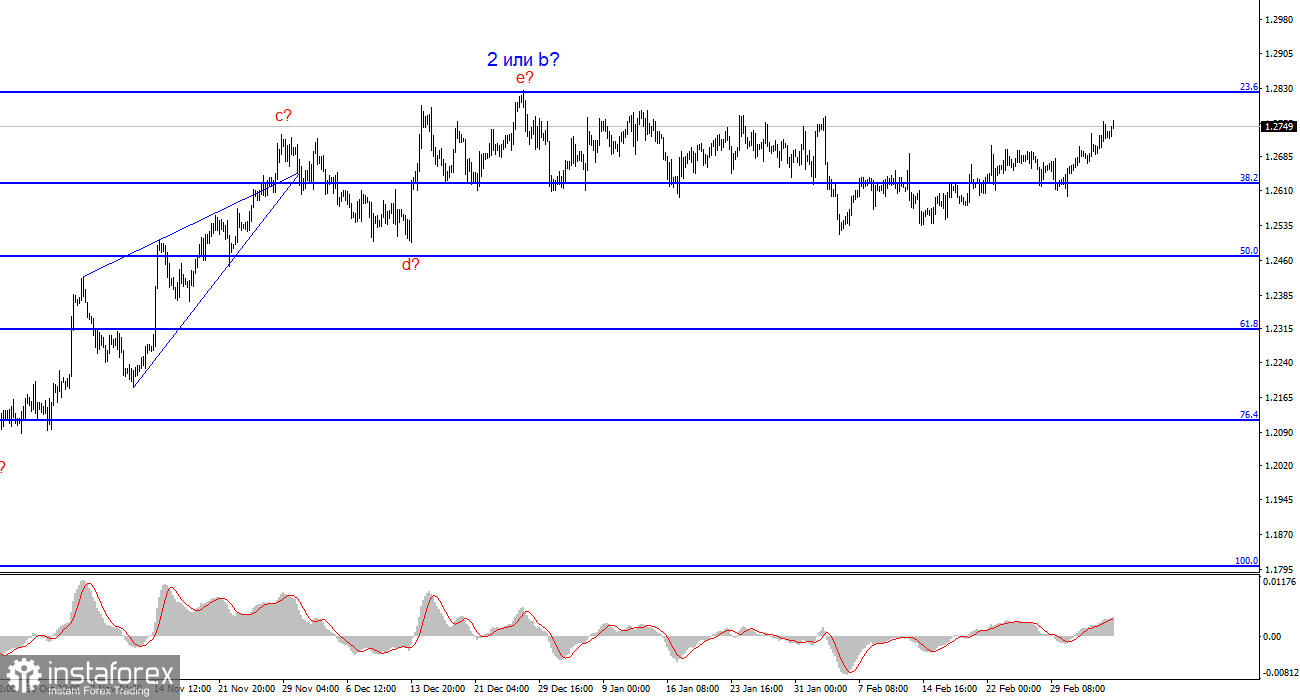

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will gain momentum sooner or later. A successful attempt to break through the 1.2627 level generated a sell signal, but at the moment, I can also identify a new sideways range with the lower boundary at 1.2500. In my opinion, this level currently acts as a limit for the pound's decline. The pair has already overcome the descending channel, so the pound may continue to rise for some time, which is another internal wave in the channel.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.