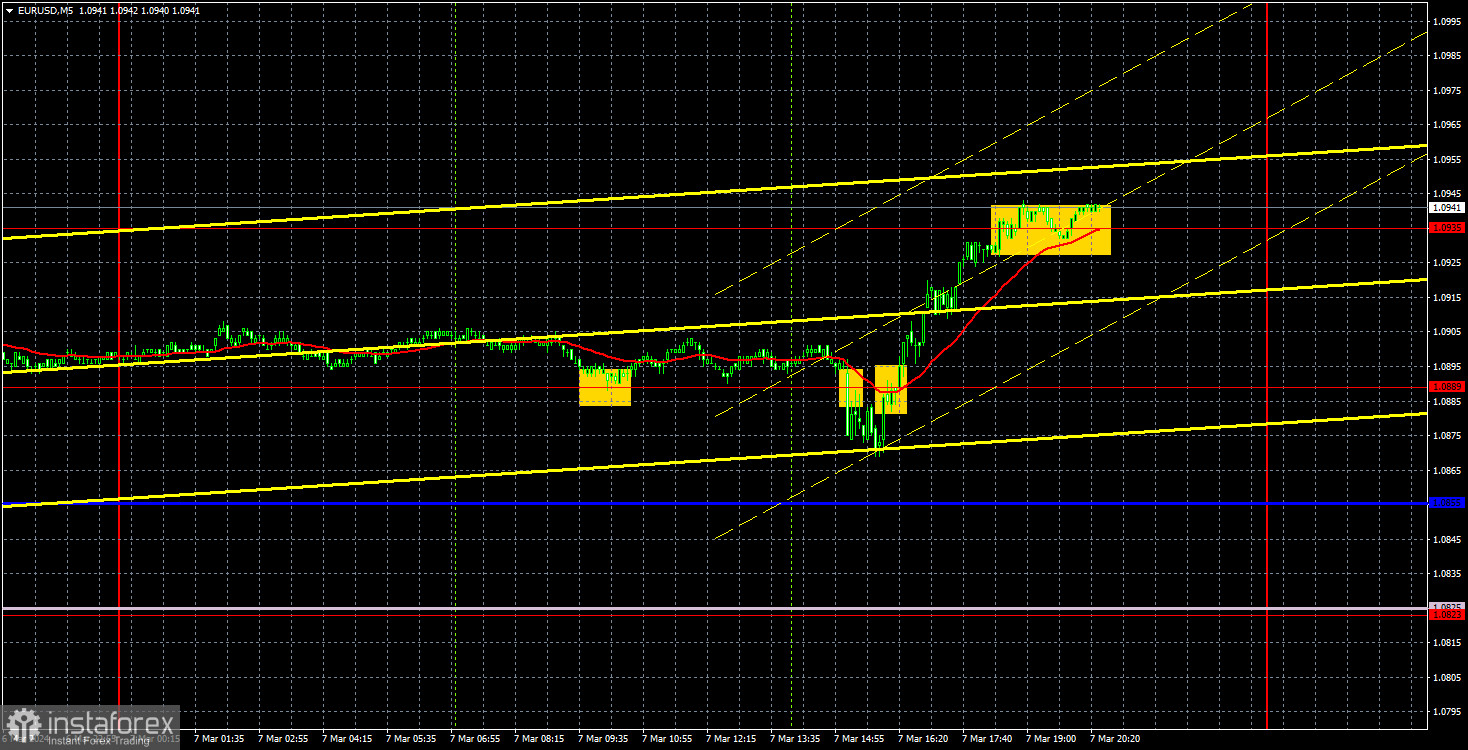

Analysis of EUR/USD 5M

EUR/USD showed positive trades on Thursday. This time, the growth was quite impressive, especially if we count from the day's low. Just like it happened a day earlier, the market had no particular reasons to buy the euro. The key event of the day was the European Central Bank meeting, or more precisely, the speech of ECB President Christine Lagarde. And what did she tell us that made the market suddenly want to buy the euro?

In short, nothing special. The ECB head confirmed that it is not yet time to lower interest rates. The central bank is impressed that inflation has dropped rapidly from its peak, but is still not confident that the target level of 2% will be reached. According to Lagarde, it would be appropriate to make a decision in early summer when the ECB has more information. That's all traders could pay attention to. Remember that Federal Reserve Chairman Jerome Powell spoke a day earlier, and his speech did not contain any dovish words or hints. However, over the past two days, the euro has jumped by 100 pips. It may seem like a small move, but it raises the question of the logic behind such a movement.

Speaking of trading signals, there were several yesterday. In the first half of the day, the pair was completely flat, but it managed to bounce from the level of 1.0889. Then, immediately after the meeting's results were announced, there was a sell signal near the same level, which also turned out to be a false signal. And finally, a buy signal was formed near the same level of 1.0889, which should not have been executed. As we can see, the problem isn't due to the false signals, but because the movements were illogical. However, during such important events as the ECB meeting, it is always advisable to trade with increased caution.

COT report:

The latest COT report is dated February 27. The net position of non-commercial traders has been persistently bullish for quite some time. Basically, the number of long positions in the market is higher than the number of short positions. However, at the same time, the net position of non-commercial traders has been decreasing in recent months, while that of commercial traders has been increasing. This shows that market sentiment is turning bearish, as speculators are increasing the volume of short positions on the euro. We don't see any fundamental factors that can support the euro's growth in the long term, while technical analysis also points to the formation of a downtrend.

We have already drawn your attention to the fact that the red and blue lines have significantly diverged, often preceding the end of a trend. Currently, these lines are moving towards each other (indicating a trend change). Therefore, we believe that the euro will fall further. During the last reporting week, the number of long positions for the non-commercial group decreased by 7,900, while the number of short positions decreased by 2,800. Accordingly, the net position decreased by 5,100. The number of buy contracts is still higher than the number of sell contracts among non-commercial traders by 63,000 (previously 68,000). Thus, commercial traders continue to sell the euro.

Analysis of EUR/USD 1H

On the 1-hour chart, the uptrend remains intact, and EUR/USD has left the sideways channel of 1.0792-1.0889. In our opinion, all the factors currently suggest that the dollar will strengthen, but the market is still buying the euro for no apparent reason. Therefore, we expect the price to consolidate below the Senkou Span B line and the euro to resume the downward movement, but at the moment, there are no sell signals. The euro will continue to correct higher.

On March 8, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0823, 1.0889, 1.0935, 1.1006, 1.1092, as well as the Senkou Span B line (1.0840) and the Kijun-sen (1.0870). The Ichimoku indicator lines can move during the day, so this should be taken into account when identifying trading signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

On Friday, the revision of the Eurozone GDP Growth Rate will be due later in the day, which is unlikely to fuel market volatility unless the value turns out to be resonant. The NonFarm Payrolls and the unemployment rate coming from the US are the most important data release. Considering that the euro gained for no logical reason, we are not confident that even strong reports from the US can provoke a significant rise in the dollar.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.