Analysis of GBP/USD 5M

GBP/USD traded higher on Thursday. The volatility was low again, but the pair still covered a range of 70-80 pips. Take note that 80 pips for the British pound is not much, but at least it's not a flat market. At the end of the day, the pair found itself near the upper boundary of the sideways channel, where it has been trading for over three months. On the 24-hour timeframe, the pair once again tested the Fibonacci level of 61.8%. Logically, we should see a rebound from this level, but the market has been so bullish that it wouldn't be surprising if the pair overcomes this mark and even resumes the upward trend.

Do we still need to mention that the pound has shown illogical growth? The market has returned to its favorite activity by completely ignoring economic reports and the fundamental background. On Wednesday, Federal Reserve Chairman Jerome Powell gave no hint of an imminent shift to monetary easing, but the dollar still fell. On Thursday, there were no news releases for the British and U.S. currencies, and yet the dollar continued to fall. The greenback has been persistently falling for a month, which is quite a lot even for movement within a sideways channel. Again, there is no logic behind the movements; the market trades the way it wants to.

Speaking of trading signals, there were no signals throughout the day. Buyers could hold on to positions after overcoming the area of 1.2691-1.2701, as the pair has practically risen without retreating. The price doesn't even approach the critical line and it looks like it doesn't want to start a bearish correction, which once again proves the obvious fact: the market is simply buying the pound and it doesn't pay attention to the macroeconomics and fundamentals. Overcoming the level of 1.2786 could be an important task. In this way, the sideways channel may lose its relevance, and nothing can hold back the pound from rising further. In this case – it's buying.

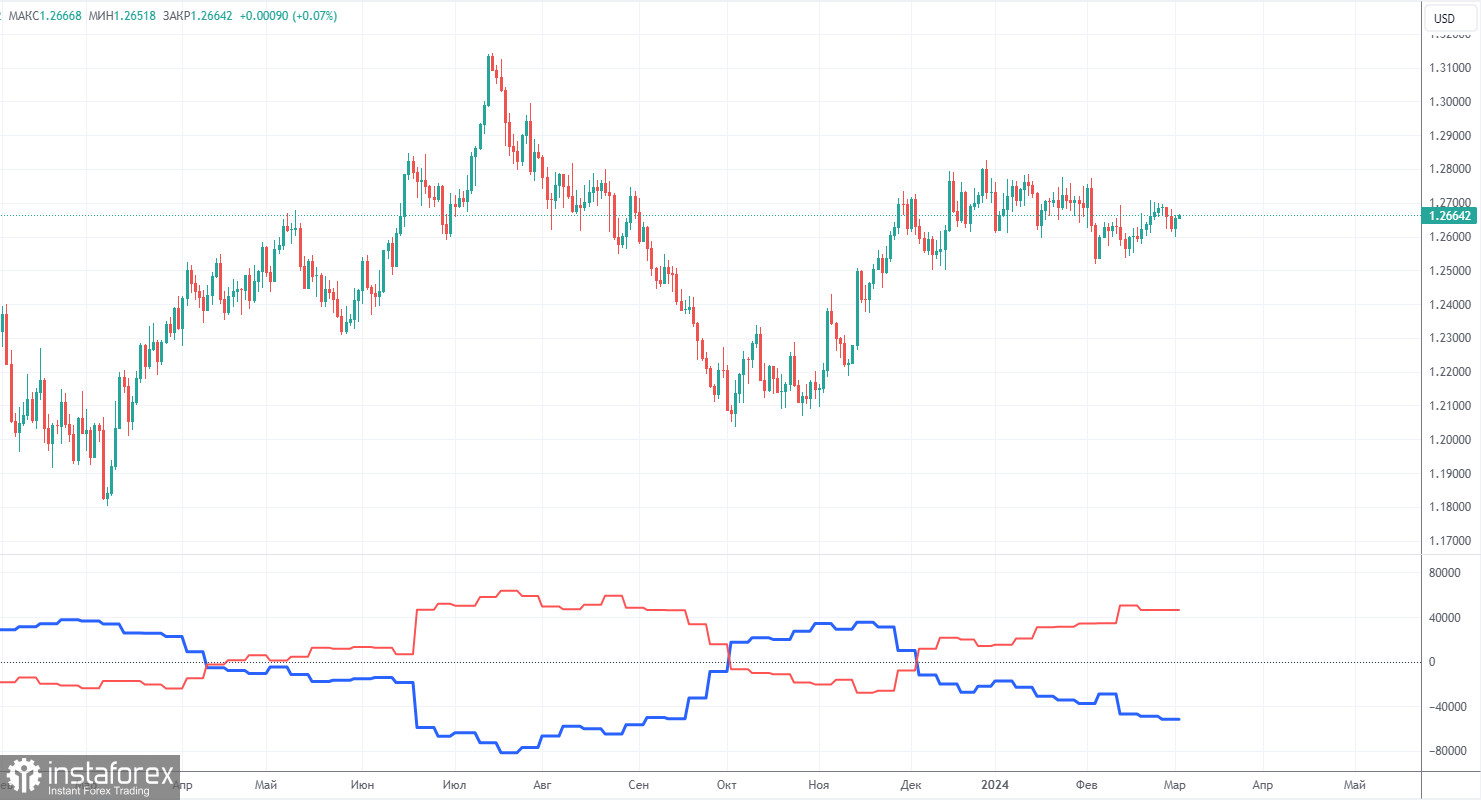

COT report:

COT reports on the British pound show that the sentiment of commercial traders has frequently changed in recent months. The red and blue lines, which represent the net positions of commercial and non-commercial traders, constantly intersect and, in most cases, remain close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 4,400 buy contracts and 4,300 short ones. As a result, the net position of non-commercial traders increased by 100 contracts in a week. Despite the fact that the net position of speculators is growing, the fundamental background still does not provide a basis for long-term purchases of the pound sterling.

The non-commercial group currently has a total of 92,000 buy contracts and 45,600 sell contracts. The bulls have a big advantage. However, in recent months, we have repeatedly encountered the same situation: the net position either increases or decreases, the bulls or the bears either have the advantage. Since the COT reports do not provide an accurate forecast of the market's behavior at the moment, we have to scrutinize the technical picture and economic reports. The technical analysis suggests that there's a possibility that the pound could show a pronounced downward movement. The economic reports have also been significantly stronger in the United States than in the United Kingdom, but this has not benefited the dollar.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD left the sideways channel of 1.2611-1.2787 but is now trading within another sideways channel of 1.2605-1.2701. And despite all that, the flat remains intact, and the pound has been rising for a month. The British pound is still a currency that tends to move sideways, but settling above the level of 1.2787 would indicate a good chance of reviving the uptrend. Macroeconomic reports and the fundamental background practically hold no importance for traders at the moment.

As of March 8, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691, 1.2786, 1.2863, 1.2981-1.2987. The Senkou Span B line (1.2643) and the Kijun-sen (1.2702) lines can also serve as sources of signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

On Friday, the UK economic calendar is empty, but this may not prevent the pound from rising further. After all, it doesn't need reasons to move upward. The U.S. will release two important reports on Non-Farms and unemployment, but this does not guarantee that the dollar will rise even if they exceed forecast values.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.