Wild market. Bitcoin not only soared to a record peak, but its volatility spiked to high levels since the bankruptcy of the largest crypto exchange FTX, and the pullback after the new all-time high within a day amounted to 14%. However, after shedding excess weight, the token quickly regained lost positions, and its future still looks bright.

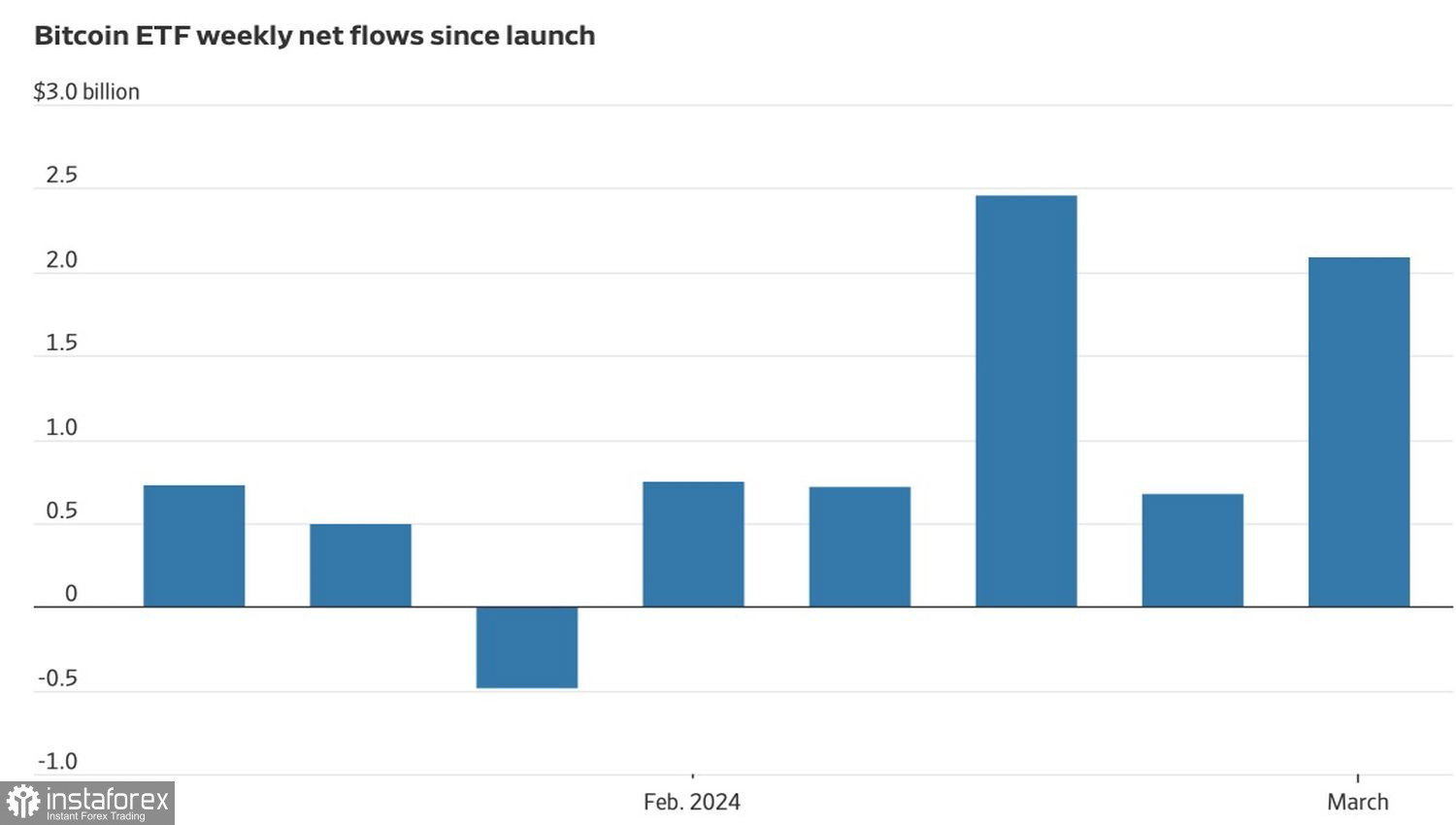

Ironically, Bitcoin owes its popularity to the Securities and Exchange Commission (SEC), which long resisted the launch of new ETFs with cryptocurrency as a spot asset. Since the approval and launch of specialized exchange-traded funds, a net capital inflow of $8.9 billion has been recorded, and assets have grown to over $50 billion. BlackRock's iShares Bitcoin Trust assets exceeded the $10 billion mark in the shortest time for all possible analogs.

Dynamics of capital inflows into Spot ETFs with Bitcoin

Investors now have the opportunity to invest their money in regulated financial institutions. This reduces the risks of investments previously directed to decentralized crypto exchanges, contributing to the rapid growth of BTC/USD. Since the beginning of the year, they have surged by 60%, significantly outperforming almost all financial market assets. The only competition to the token comes from shares of the technology giant NVIDIA, which have grown by 87%.

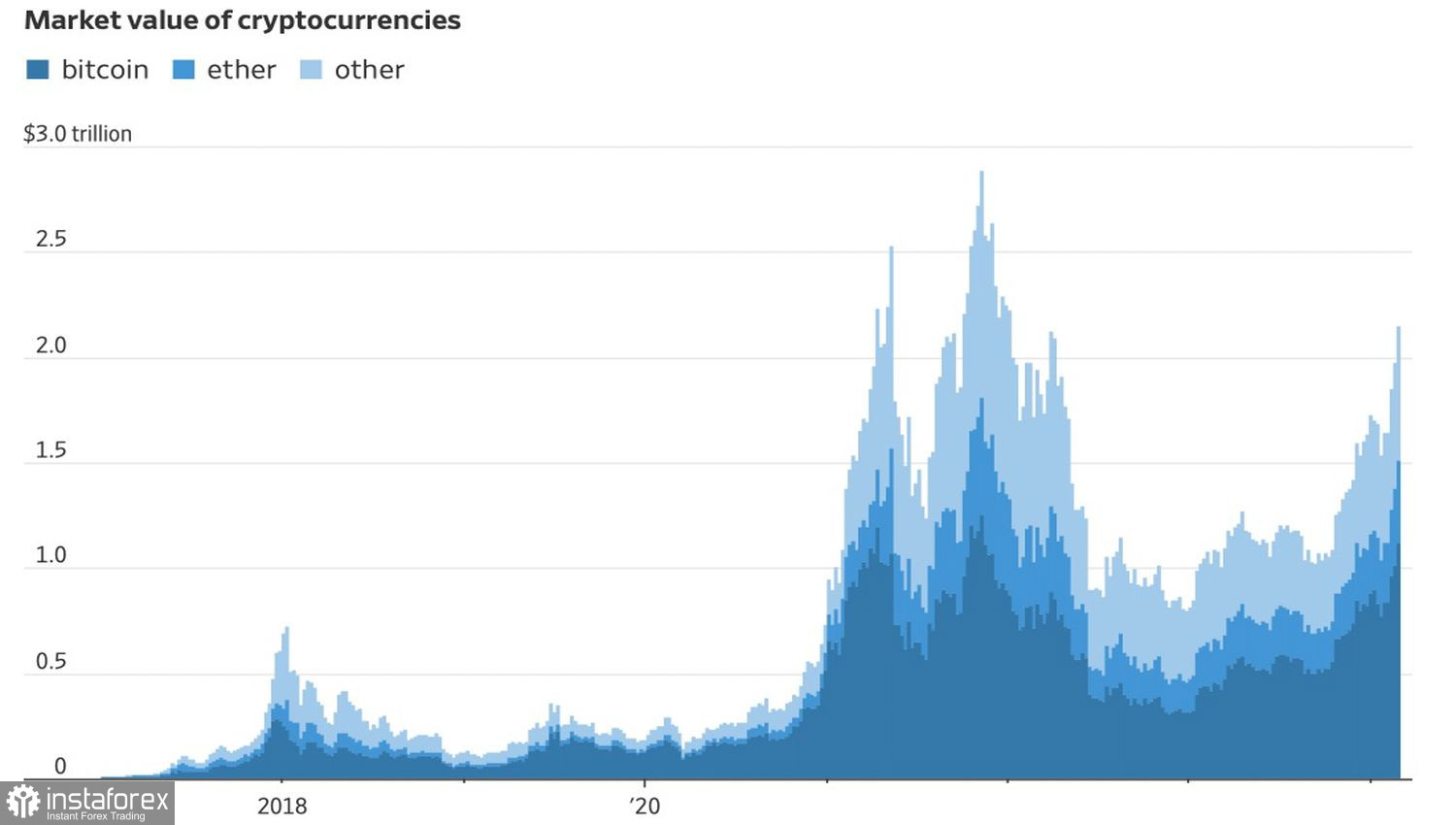

As a result, the cryptocurrency market capitalization jumped to $2.6 trillion, and this is far from the limit. DeFi Hashnote points out that after reaching previous historical peaks, Bitcoin prices increased 4-5 times over time. Currently, the talk is about doubling, allowing the company to predict the continuation of the upward move of BTC/USD towards 138,000.

Dynamics of the crypto market capitalization

Two other drivers of the cryptocurrency sector leader's rally are the expected halving in April, which will halve emissions, reducing supply and theoretically leading to price increases amid heightened demand; and strong global risk appetite.

At the beginning of 2024, investors bet on the Goldilocks scenario, where the U.S. economy slows down but continues to grow above trend, and inflation confidently moves towards the Fed's 2% target. However, strong macroeconomic statistics in the United States have led to speculation, not about a soft landing but a new takeoff.

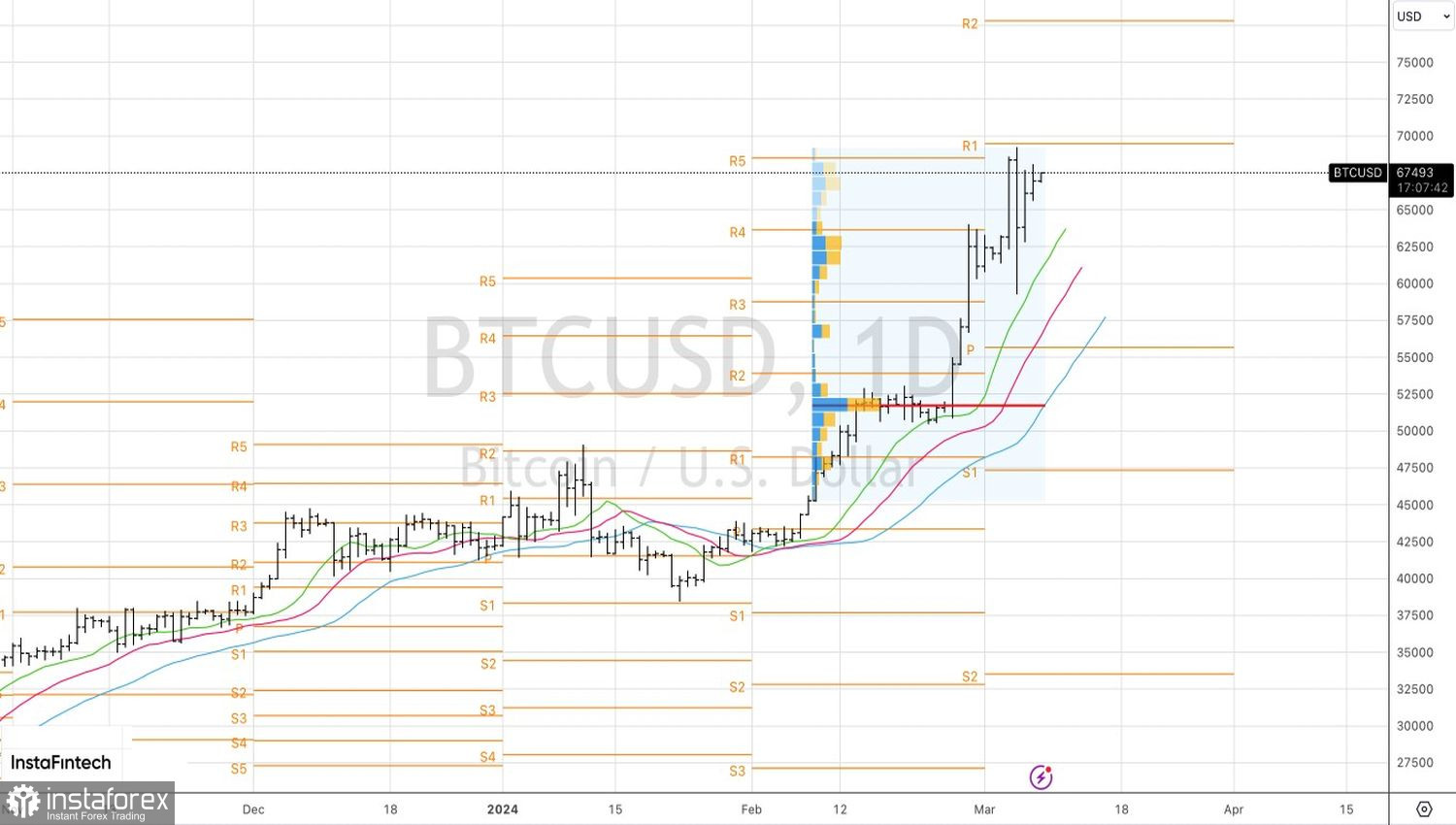

As a result, the S&P 500 has already marked its 16th record high since the beginning of the year, and the risk appetite is so great that Bitcoin's quick return to the historical peak does not surprise anyone. However, if U.S. stock indices start to fall, for example, due to the release of U.S. employment data, the token will also undergo a correction.

Technically, on the daily chart, BTC/USD bulls see an attempt to play the inside bar. If buyers consolidate above 67,740, the rally toward 69,480 and 77,770 will likely continue. In this scenario, it makes sense to increase longs formed from the 63,650 level. Otherwise, profit-taking on them is advisable.