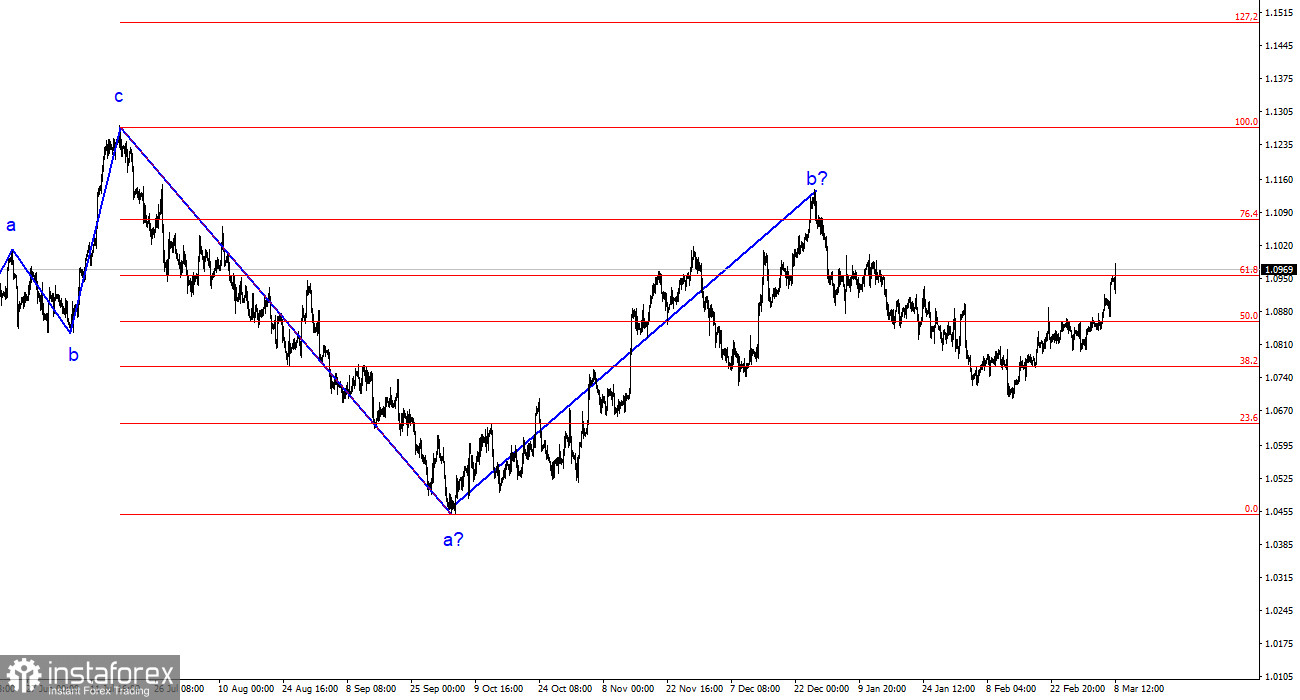

The wave analysis of the 4-hour chart for the EUR/USD pair remains unchanged. Over the past year, we have seen only three large-scale wave structures that constantly alternate with each other. Currently, the construction of another three-wave structure is ongoing – a downtrend that began on July 18th of last year. The presumed wave 1 is complete; wave 2 or b has become more complex three or four times but is currently also complete.

The upward segment of the trend may still resume, but its internal structure would be absolutely unreadable in this case. I remind you that I strive to identify clear and unambiguous wave structures that do not tolerate dual interpretations. If the current wave analysis is correct, the market has moved on to form wave 3 or c. Currently, the presumed wave 2 in 3 or c is being constructed. If this is indeed the case, the construction of this wave may be completed in the near future, as it has already taken on a distinctly three-wave form. In any case, this decline in the pair's quotes should not end here. News background + the market's reluctance to buy the dollar = a new rise in the EUR/USD pair.

The hit parade of reports in the USA has ended.

The EUR/USD exchange rate rose by 50 basis points on Thursday and another 20 today. And the day is not yet over. Considering the nature of the news background from America, demand for the American currency may well continue to decline, although this contradicts the wave analysis. I remind you that yesterday's and the day before yesterday's decline in the dollar raised many questions since the news background did not anticipate such a movement. Christine Lagarde did not change her rhetoric to a more "hawkish" one, and Jerome Powell's tone did not become more "dovish." However, today's nonfarm payroll reports and unemployment in the USA did put pressure on the US currency. Absolutely logically. However, from my point of view, the market did not consider other options besides buying. There were many other days before today when there was no sign of trouble for the dollar, yet it found itself in trouble time and time again.

The report on US payrolls exceeded market expectations. It would seem that demand for the US currency should have increased, not decreased, if not for one "but." The value of the previous month was revised from 335 thousand to 229 thousand. One can only ask the US Bureau of Labor Statistics: How is this possible? The miss in January was more than 100,000 jobs. How could such an error occur? And if this is not a mistake, what is the point of statistical publications if any value can be revised post facto? However, the reduction in the January value was more significant than the market's expectation of exceeding the February value. Today, demand for the US currency fell predictably.

General conclusions.

Based on the analysis of EUR/USD, I conclude that the construction of a downtrend wave set continues. Wave 2 or b has taken on a completed form, so I expect the continuation of the construction of an impulsive descending wave 3 or c with a significant decline in the pair in the near future. Currently, an internal corrective wave is being constructed, which could already be completed, but the news background has spoiled everything. I continue to consider only sales with targets near the calculated level of 1.0462, which corresponds to 127.2% Fibonacci, and await the completion of the corrective wave.

On a larger wave scale, it can be seen that the presumed wave 2 or b, which in length exceeded 61.8% Fibonacci from the first wave, may be complete. If this is indeed the case, the scenario with the construction of wave 3 or c and a decrease in the pair below the 1.4 figure has begun to unfold.

Key principles of my analysis:

- Wave structures should be simple and understandable. Complex structures are challenging to play with and often bring about changes.

- If there is no confidence in the market's direction, it's better not to enter it.

- There is never 100% certainty in the direction of movement. Don't forget about protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.