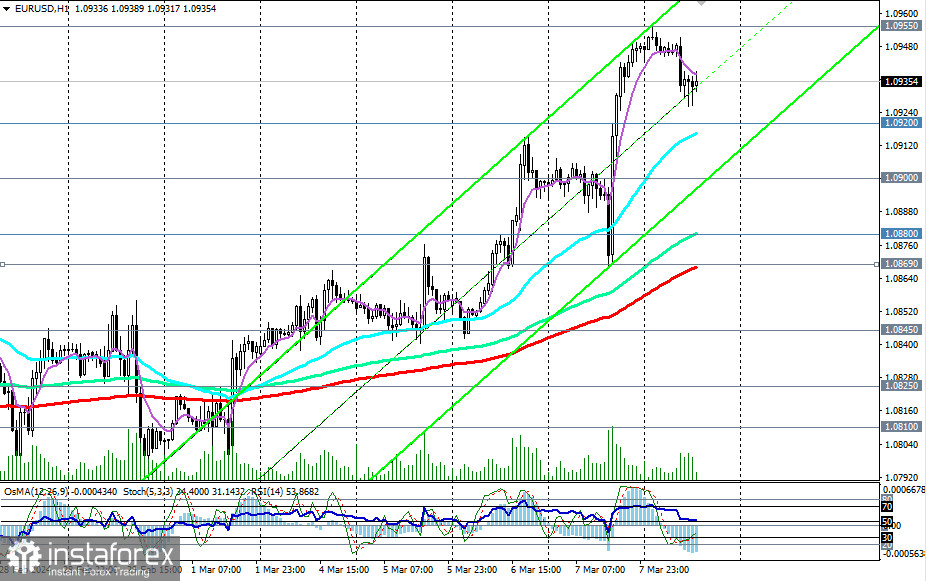

The dollar continued to weaken since the opening of today's trading day. However, EUR/USD is also on a downward trend.

After reaching a new high during the Asian trading session at 1.0955, the pair later declined, dropping to 1.0935.

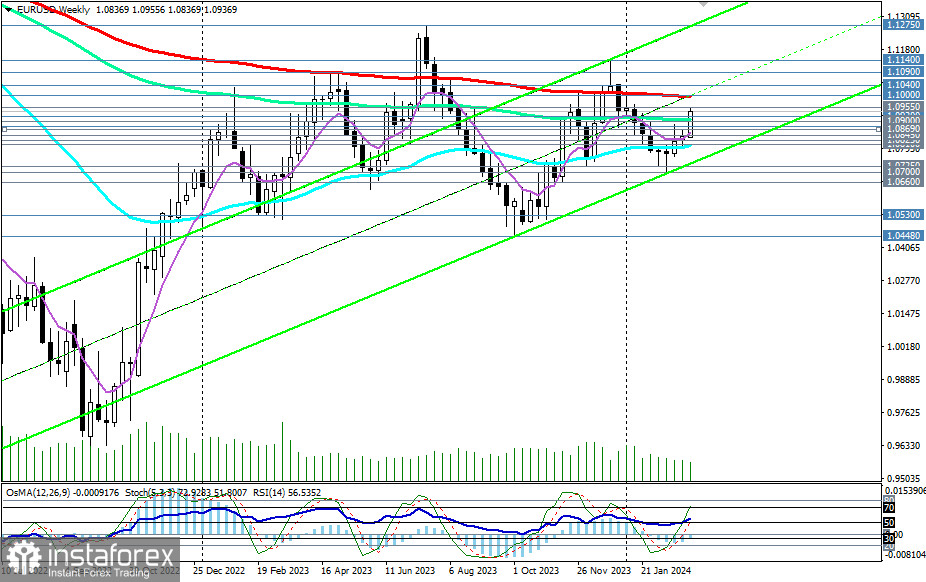

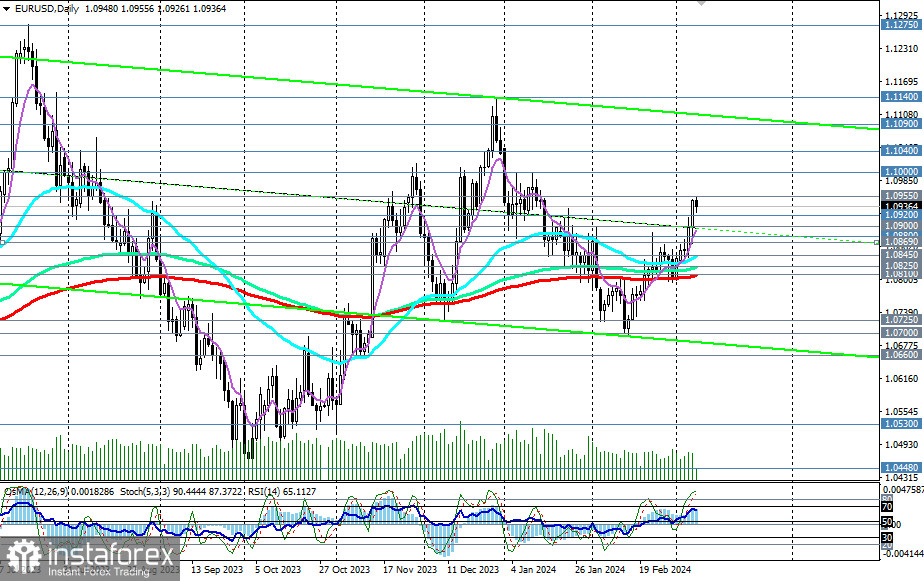

Since the middle of last month, EUR/USD has been continuing an upward correction, moving in the zone of the medium-term bullish market—above the key support level of 1.0810 (200 EMA on the daily chart).

Technical indicators RSI, OsMA, and Stochastic on the daily and weekly charts are on the buyers' side.

Therefore, a breakout of today's high (1.0955) may signal new long positions. Further growth could take EUR/USD into the zone of the long-term bullish market, above key resistance levels of 1.1000 (200 EMA on the daily chart), 1.1040 (50 EMA on the monthly chart), making medium-term and long-term long positions preferable.

In an alternative scenario, after breaking the important support level of 1.0900 (144 EMA on the weekly chart), EUR/USD may resume its decline towards key support levels at 1.0845, 1.0825, 1.0810. A breakout of the 1.0800 level will return EUR/USD to the zone of the medium-term bearish market, making medium-term short positions preferable again. In the long term, below resistance levels of 1.1000 and 1.1040, short positions remain preferable.

The earliest signal to start implementing this scenario could be a breakout of the local support level of 1.0920.

Support levels: 1.0920, 1.0900, 1.0880, 1.0869, 1.0845, 1.0825, 1.0810, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Resistance levels: 1.0955, 1.1000, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

Trading Scenarios

Alternative scenario: Sell Stop 1.0910. Stop-Loss 1.0960. Targets 1.0900, 1.0880, 1.0869, 1.0845, 1.0825, 1.0810, 1.0800, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Main scenario: Buy Stop 1.0960. Stop-Loss 1.0910. Targets 1.1000, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but they can serve as a guide in planning and placing your trading positions.